Configure Alteration Types

The mid-term adjustment (MTA) functionality allows changes to active policies or master policies based on customer requests. This page describes the default alteration types and how to configure them to meet your business needs. The changes made here are applicable during the Policy Mid Term Adjustments and Master Policy Alterations processes.

View Default Alteration Types

In FintechOS Portal go to Main Menu > Settings > Alteration Types. The Policy Alteration Type List is displayed.

| Alteration | Display Name | Description | Product Type | Policy | Master Policy |

|---|---|---|---|---|---|

| Revoke Cancellation | Revoke Cancellation | Modify the effective date and/or due date for non-chronological mid term adjustments. It is valid for all types of product that have configured the non-chronological MTA. It reverts the effect of registered Cancellation on a policy/master policy, reinstated the version active before that cancellation. | Health, Home, Personal Accidents, Pet Insurance, Travel Insurance | ✔ | ✔ |

| Start Date | Change Start Date | Modify the start date of a policy or master policy, for backdating or future dating scenarios. It is applicable only for contracts that haven't started yet (Draft, Proposal, or Issued status). | Health, Home, Motor, Personal Accidents, Pet Insurance, Property, Travel Insurance | ✔ | ✔ |

| Coverage | Update Coverage | Change the coverages by modifying the insured sum, change the card, update insured amount or update/change excess value and type. | Health, Home, Personal Accidents, Pet Insurance, Travel Insurance | ✔ | |

| Due Date | Update Due Date | Change all on time installments to a specific collection day or change a specific due date. | Personal Accidents, Health, Home, Pet Insurance, SME Insurance | ✔ | ✔ |

| Payment Frequency | Change Payment Frequency | Change the frequency of the payments for the installments. The frequency can be any active value of the option set paymentFrequency. | Personal Accidents, Health, Home, Pet Insurance, SME Insurance | ✔ | ✔ |

| Payment Type | Change Payment Type | Change the payment type for the installments. | Personal Accidents, Health, Home, Pet Insurance, SME Insurance | ✔ | ✔ |

| Renewal Type | Change Renewal Type | Change the renewal type for the policy: automatic renewal, renewal offers or no renewals. | Personal Accidents, Health, Home, Pet Insurance, SME Insurance | ✔ | |

| Insured Object | Update Insured Object | Make alterations to the covered object in the policy. | Personal Accidents, Health, Home, Pet Insurance, SME Insurance | ✔ | |

| Mentions | Mentions | Update any mentions regarding the policy or master policy. | Home, Pet Insurance | ✔ | ✔ |

| Update Policy Party | Update Policy Party | Change the account on any role that is on the policy or master policy. | Personal Accidents, Health, Home, Pet Insurance, SME Insurance | ✔ | |

| Update Master Policy Party | Update Master Policy Party | Make changes to registered parties, such as the policy holder of a master policy. | Personal Accidents, Health, Home, Pet Insurance, SME Insurance | ✔ |

Use Cases

Chronological alterations allow changes in the exact order they occur over time. When a mid-term adjustment (MTA) is made, the system generates a cloned version of the policy, which stays in a Pending state until its effective date, at which point it transitions to In Force. These adjustments must be processed in chronological sequence. If a future adjustment has been scheduled but hasn't yet taken effect, it can still be cancelled. For instance, if there's an MTA scheduled to take effect on October 1st, but a change is required today, the process involves first cancelling the October 1st MTA, implementing the 2nd modification registered, and then reapplying the original MTA with its October effective date.

Non-chronological alterations allow changes to be applied based on operational necessity rather than strict time order. Mid-term adjustments (MTAs) under this structure are made directly on the active policy and take effect immediately. These adjustments cannot be reversed or cancelled once applied. However, a subsequent MTA can be used to counteract or override the previous change. If a cancellation is scheduled for a future date and needs to be undone, the Revoke Cancellation MTA must be used. This action nullifies the effects of the original cancellation and restores the prior version of the policy to InForce status.

The Revoke Cancellation mid-term adjustment type takes effect immediately and can't be cancelled, any changes must be made through a new alteration.

Alterations can be set with any effective date, provided it falls within the policy’s validity period and the chronology setting. If the policy renews as same policy, the MTA date must be on or after the original start date. Payment schedule updates only affect installments due on or after the alteration’s effective date.

The Change Start Date alteration type is applicable for both policies and master policies, and can be used for modifying the start date of a policy, particularly in backdating scenarios. Backdated insurance policies refer to insurance contracts that are issued with an effective date earlier than the actual date the policy is written or signed. In other words, the coverage is retroactively applied to a date in the past.

If the policy start date is in the past (before today's date, systemDate), and the payment schedule is set to apply the first installment to the start date, the system will overwrite this setting. It will then adjust the first payment to be due on the system date (today), instead of the past start date, ensuring the payment schedule is aligned with the current date.

Changes are also triggered for the payment schedule, this is generated based on the configured payment schedule type and any installments with a due date earlier than today's date will be updated to a new due date that’s equal to or later than today. The new due date will be adjusted monthly for monthly, quarterly, or annual payment frequencies, and weekly for weekly payments. The number of installments is kept, the due date is updated.

Use the Update Coverages alteration type to perform an alteration with an effective date that is earlier than existing alterations on the same policy. This option is available only for policies. After initializing the alteration, if the effective date is earlier than the system date (i.e., backdated), the system generates the clone from the currently enforced policy. This process bypasses all previous alterations that are still in In Progress status.

The following conditions must be met before registering the alteration:

-

No clones should exist in the system for the policy being changed;

-

All alterations with an effective date later than the system date must be cancelled;

-

A clone of the policy version is created, its status updated to Enforced, and the currently Enforced policy version is marked as Closed;

-

No changes are made on versions closed between effective date and system date;

-

The price is calculated based on the effective date, policy changes take effect from the system date. The payment schedule is regenerated for on time details affected by the change on the coverage start date;

-

A backdated alteration can be added on any type of product, if the chronology rule is met.

For backdated alterations on an insured object use the existing Update Insured Object alteration type. When backdating, the effective date is before the system date or another alteration’s effective date, and on or after the policy start date. Clicking Register creates a cloned policy version with status Enforced, which cannot be cancelled; further changes require a new alteration. Adding a new alteration is blocked if one is in progress and must be cancelled or finalized first. Clicking Validate recalculates the premium with the policy validity, then prorates the result depending on the selected effective date.

The following conditions must be met before registering the alteration:

-

No clones should exist in the system for the policy being changed;

-

All alterations with an effective date later than the system date must be cancelled;

-

A clone of the policy version is created, its status updated to Enforced, and the currently Enforced policy version is marked as Closed;

-

No changes are made on versions closed between effective date and system date;

-

The price is calculated on effective date, the changes on the policy are starting from the system date and the payment schedule is regenerated (only payment schedule details with the status OnTime are updated).

The Change Start Date alteration type is applicable for both policies and masterpolicies, and can be used for modifying the start date of a policy, in future dating scenarios. This means modifying the start date of a policy or masterpolicy to be greater than the system date. This is available for Proposal and Issued statuses, and not for InForce status.

For an independent policy, the end date is calculated as the new start date plus policy validity, with no amount updates, but updates are made to the policy’s coverage start date and payment schedule, regenerating if no invoice is issued or adjusting due dates for On Time payment statuses.

For a policy under a master policy, the new start date must be greater than or equal to the master policy’s start date, the end date remains unchanged (based on the master policy), the policy validity is recalculated, total premiums are adjusted based on new validity, and the coverage premium is updated, with final premiums reflecting any commercial discount; payment schedules are updated accordingly, and a new version of the master policy is created with the revised amounts and schedule.

For an alteration with effective date in the future, if an installment is invoiced between the clone generation and the effective date of that change, then the payment schedule attached to that clone is no longer valid and needs to be recalculated. The alterations that allow changing the effective date are: Update due date , Coverage, Insured Object, Mentions, Update Policy Party, Update Master Policy Party, Start Date , Payment Type, Payment Frequency, Renewal Type, Revoke Cancellation.

If you make a future-dated change to your policy, but an installment is already invoiced before the change becomes effective, then the payment plan must be recalculated to reflect the updated policy and premium.

A real life example of this would be if you have a home insurance policy with a $1,200 annual premium, paid in $100 monthly installments. On July 15, the customer asks to increase the coverage, starting August 1. You create a future version (clone) of your policy with higher premium, starting from that date. But on July 20, the August installment is invoiced—based on the old premium. The payment schedule in the cloned (future) policy is now outdated, because an installment was already issued before the change took effect. The payment schedule is recalculated to reflect the new premium from August onward.

This is done with the PolicyCloneBecomePolicyVersion, which calculates the premium due based on the current version of the policy, using the due date minus statement generation days (SGDays) to determine when to generate the bill.

Use the Update Coverage alteration type to update the content card on the policy. These cards represent the plans for insurance products and are generated when creating Offers. These may contain coverages with different insured sums, start or end date, effective dates, etc.

After picking a new card, the list of coverages is updated. The begin and end date are system driven. The begin date equals the sum of the alteration effective date and the waiting period. The end date equals the policy end date. You can only chose the effective date of the alteration.

When making changes, an update to the payment schedule is triggered. In case the policy is paid, a new payment schedule detail is generated with due date min(AlterationEffectiveDate+1, EndDate) and the amount resulted as difference. Otherwise, the on time installments are updated.

The system ensures that each policy coverage reflects its correct validity period (start and end dates) and associated premium amount. Policy coverages and sub-coverages are stored, with updates managed through MTAs. Historical values are only accessible in closed policy versions.

When a coverage or sub-coverage is removed, its end date is set to one day before the effective removal date. If re-added, a new record is created. Premiums for changes (additions, removals, or modifications) are prorated based on the coverage’s actual period of validity. This ensures that earned premium for the active period is included, even if the coverage is later removed, preventing discrepancies between total policy premium and the sum of individual coverage premiums.

Risks can be reported and linked to claims using the product Id tied to the policy’s product version.

Configure Alteration Types

-

In FintechOS Portal go to Main Menu > Settings > Alteration Types. The Policy Alteration Type List is displayed.

-

Click Insert to configure a new alteration type.

-

In the Alteration Type Form Logic tab, fill in the following fields in the Alteration Config section:

-

Enter Alteration Name: Input a unique name for the alteration type;

-

Display Name: Input a display name for the alteration type;

-

Category: Select MTA; Cancellation, Reinstatement.

-

Available Offers Validity: choose between Current and On policy issue date.

-

Product type: From the drop-down, select one or more product types to which you want the alteration to apply;

-

Product name: Select an insurance product from the drop-down, filtered by the insurance type chosen above. If you haven't selected a product type, all insurance products are displayed in this field.

-

-

In the second section, populate the following fields:

-

Logic: From the drop-down select either Policy Comparison or Specific Logic. The Policy Comparison logic is explained in the Register and Cancel an MTA Request section;

-

Allow Card Change: allow changes in offers.

-

Check Underwriting Rules: If you check this field, when the alterations occur, they are verified by the underwriting rules. If validated, this allows the alterations, or else the flow stops;

-

Calculate Premium: Check this field to trigger a premium recalculation;

-

-

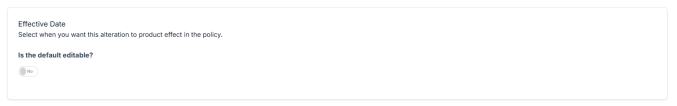

Configure the Effective Date of the alteration, and select when you want this alteration to product effect in the policy. If you check the Is the default editable? field, a new section unfolds where you can define the editable range for the effective date.

-

In the Approval Step section, check to define if the alteration needs an approval step. If you check the field, the Approval roles section is unfolded, where you can define who is doing the MTA approval.

-

In the next section, Where will alterations be triggered from?, define if you want the alterations to be triggered from the policy form or from the master policy form. In both cases, if the fields are checked, a new section is displayed where you can select in which policy or master policy status the alteration can be issued. Also, select an alteration form driven flow to apply in this case. You can choose an existing flow, or create a new one, and select it.

-

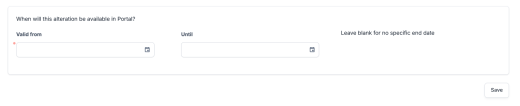

In the last section, When will this alteration be available in Portal?, define the validity time frame of the alteration. Choose a date for the Valid from and for the Until fields. You can leave the last field blank for no specific end date.

-

Click Save.

-

Go to the second tab, Technical Configuration, and populate the following fields:

-

Selection Server Side Lib Name: Enter the library that contains the method written in the

Selection Server Side Methodfield; -

Selection Server Side Method: Enter the method that is called when the alteration type is selected on the Alteration form;

-

Server Side Lib Name: Enter the library that contains the method written in the

Server Side Methodfield; -

Server Side Method: Enter the method that is called when the alteration type is validated on the Alteration form;

-

Summary Text: Enter the text to be displayed after validating an alteration type. It should contain tokens, for example:

Starting{effectiveDate} {identifier} {attributeDisplayName}is modified from{initialValueDisplayName}to{newValueDisplayName}The used tokens must be from the

PolicyAttributeChangeentity.

-

-

Go back to the first tab, Alteration Type Form Logic, and click Save. You can now find the configuration record in the Policy Alteration Type List, and you can use it for your policies.