Policies

The insurance policy is a contract in which the policyholder pays an insurance company for financial protection or loss indemnity resulting from a covered event. The insurance policy contains the insured object, what coverages apply, how long the insurance is effective, and how much the policyholder agrees to pay in premiums.

The policy issuance process represents the main Policy Administration functionality through which the insurance contracts are generated within the core system, laying the basis for other Policy Administration flows. This functionality involves an end-to-end process that starts from the generation of an initial Policy through a specific endpoint, is updated through an update endpoint, and then reaches the InForce status, according to the period of validity.

The policy issuance endpoint creates a connection between the core system and various external systems - such as websites, apps and other digital channels that you use in order to reach out to customers. Once the integration with another system that sends in customer data is obtained, Policy Administration generates a policy according to the received information.

Within this endpoint, a policy generation object is structured to collect the necessary policy related information through the integration with an external system. Following the request made, the response body issues into the system the new data specific to the policy, in addition to those obtained during the data collection from a given external system.

When generating a policy, this cannot have the Start Date less than the Issue Date; in this case, the API displays the following error message: ”The contract cannot start before it’s issuance date”. However, when generating policies under a master policy, you can add them with a Start Date earlier than the Issue Date or the Start Date of the master policy.

Follow the steps below to access the repository and view the registered policies:

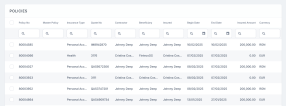

- In FintechOS Portal, go to Main Menu > Policy Admin > Policies. The list of all existing policies records is displayed.

-

Double-click any record to inspect a policy. The policy form opens, displaying the first tab, Policy, with the following sections:

-

The Policy section. The details in this grid are read-only:

-

Insurance Type: The type of insurance;

-

Insurance Product: The insurance product;

-

Policy No: The unique identifier of the policy;

-

Issued Date: The date when the policy has been issued;

-

Master Policy No.: The unique number of the master policy it belongs to, if it belongs to a master policy;

-

Begin Date: The date when the policy becomes effective;

-

End Date: The last effective date of the policy;

-

Policy Validity: The number of months, days or years when the policy is valid;

-

Validity Type: The type of validity expressed in months, days or years;

-

Agency Code: The unique identifier of the agency;

-

Agent: The full name of the insurance agent;

-

Quote ID: The unique identifier of the quote;

-

Renewed Policy: States if the policy has been renewed or not;

-

Renewed By: This field holds the account name of the user that renewed the policy;

-

Renew Type: This field holds the type of renewal that the policy went through;

-

Effective Date: The effective date of the policy.

-

-

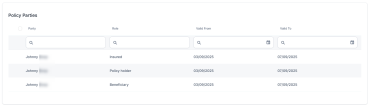

The Policy Parties section, contains valid policy parties and their roles, the valid from and valid to columns which represent the effective date and policy end date:

Double click each entry to view details about that policy party.

-

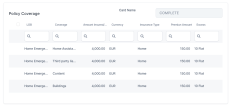

The Policy Coverage section, listing the insured objects along with their insured amounts, premium amounts and excess.

Double-click a policy in the list to view details for each coverage, such as sum insured, available indemnity limit, excess, availability:

Double-click an item in the Modules section to open sub-coverages and display details such as sum insured, indemnity limit, waiting period, and covered risks:

-

The Policy premium amount section, with the following read-only details:

-

Currency: The currency used for payment;

-

Final Premium: The premium calculated taking into account the total premium and the commercial discount;

-

Total Premium: The sum of the premium amounts of all the insured objects;

-

Commercial Discount: The commercial discount amount;

-

Payment Frequency: The frequency of the payment, which can be monthly, quarterly,

-

Payment Period Grace(days): The payment grace period, expressed in days;

-

No of Installments: The number of installments.

-

-

The Payment Type History section holds valid payment types, together with the valid from and valid to which represent the effective date and policy end date:

-

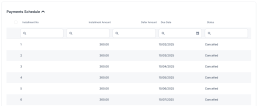

The Payments Schedule section, listing the past installments, the upcoming installment, and their statuses:

-

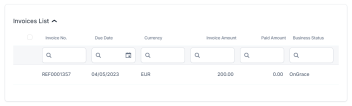

The Invoices List section, displaying the records for all invoices related to the policy:

-

The Policy Mentions section, displaying further details about the policy:

-

-

Go to the second tab, Insured Object, which displays the insured objects, together with the valid from and valid to which represent the effective date and policy end date:

Double-click to view details about the insured object.

-

Go to the third tab, Claims Data. This tab holds all the details of the registered claims for this policy. To learn more about claim data, go to the Manage Policy Claim Data page.

-

Go to the History tab. This tab has the following sections:

-

History: shows the policy versions, status, date, and the user who performed the changes;

-

Pending Versions: shows policy clones with alterations;

-

Alterations: shows alterations and their business status;

-

Reinstatements: shows policy reinstatements together with their status;

-

Cancellations: displays policy cancellations.

-