Overview

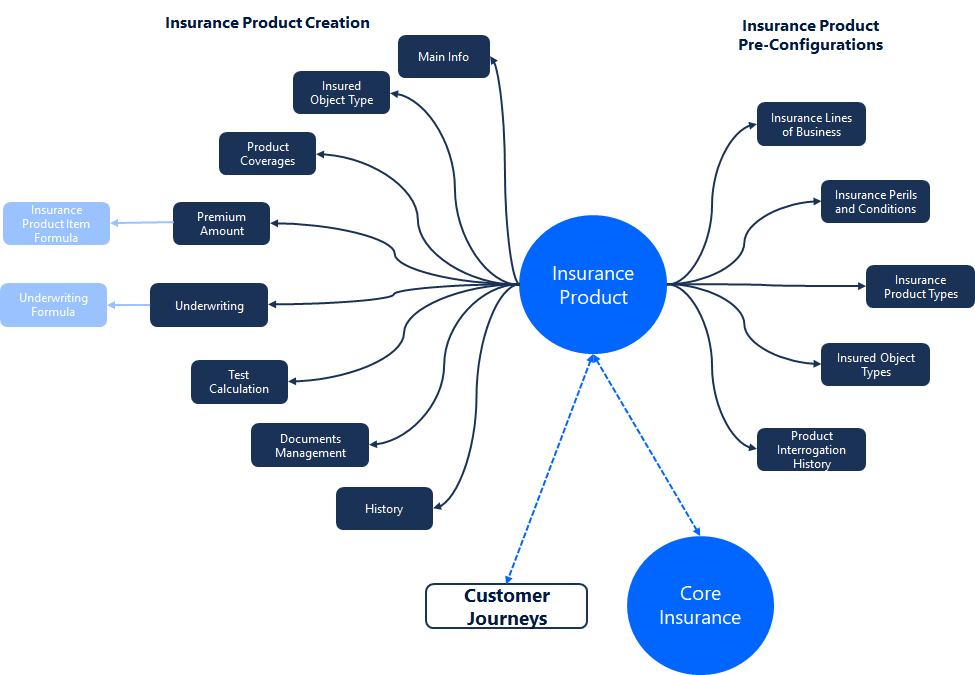

Insurance Product Factory is an end-to-end solution that helps you grow and manage your digital portfolio. It enables you to create new insurance products, modify, or retire insurance products. The solution enables you to keep your digital portfolio accessible and comprehensible, while handling the different life cycles of all your insurance products. In conjunction with other FintechOS capabilities, you can replicate your product data into the Insurance Product Factory solution. Once you finished the bulk importing of product data, you are free to use your product knowledge to decide the degree of similarity between the old and the new products, to maybe create hybrid products, and also you have tools in place to test your creations.

Insurance Product Factory helps you with shortening the time from formula to product design, since it provides access to your formulas and a testing functionality without leaving the context of your product.

The Insurance Product Factory is about creating insurance products, as well as managing the product portfolio. See details about these functionalities in the Creating New Insurance Product and Managing The Product Factory pages.

Integrations

Insurance Product Factory can be integrated with other insurance solutions or FintechOS automation blocks, allowing you to reap the resulting digital synergy. Few examples include:

-

Use Business Formulas to implement complex decision modeling for insurance peril rules and premium calculations, and apply them to different collections of insurance products, or product coverages.

-

Use the Proposal Configurator solution on top of the Insurance Product Factory, in order to deliver a fully digital Quote Configurator customer experience. Allow the eligible customers to review different insurance products, offers, or modules and configure their own insurance quote.

-

Use the Digital Journeys functionality to expose your products to your potential customers.

-

Use different insurance accelerators on top of the Insurance Product Factory solution, in order to speed up the product delivery for specific insurance verticals.

You can also use Insurance Product Factory with different automation processors, that help you build your operations around the needs of your customers, and have in-depth control over the product reach - such as Omnichannel Campaigns, or Hyper-Personalization Automation, and others.