Core Banking Dashboards

Core Banking facilitates user interaction with a series of in-built dashboards. According to their specific destination, they aid the bank employees in their daily tasks, displaying important, up-to-date information on the statuses of different contracts, events, limits, needed approval tasks, generating reports or offering easy navigation through a button to record creation pages.

These dashboards can be accessed from the FintechOS Portal's Home page in accordance with each user's specific access rights.

The following dashboards come along with your Core Banking package:

-

Contract - displays a list of the contract along with a pie-chart specifying the number of contracts in each business status, a list of contract approval requests and a button to access the Add Contract page.

-

Customer Limits - displays a list of the existing customer limit records, a list of the customer limit approval requests and a button for adding new customer limits.

-

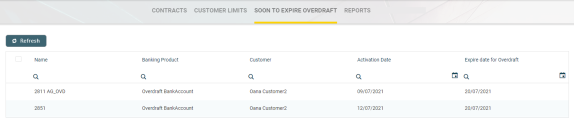

Soon to Expire Overdrafts - displays a list of contracts based on

current accounts with overdraftbanking products whose overdraft functionality is about to expire. -

Credit Facility - displays a list of the credit facility records along with a pie-chart specifying the number of credit facilities in each business status, separate lists of credit facility approval requests, utilizations and utilizations approval requests, and a button to access the Create Credit Facility page.

-

Reports - contains links to a series of reports such as repayment notifications past due, collaterals in default, limits, future installments or past due installments.

-

Records To Be Purged - displays the list of records in

Draftstatus that are scheduled to be deleted at the current day's end, grouped on tabs specific for each transaction type: disbursement, early repayments, top-ups, early termination for deposits, loan contracts, payment holidays, reschedule overdue, withdraws, transfers, returned amount or goods, or agreements. Also displays tabs with agreement records inDraftstatus that are scheduled to be purged. -

Third Party Agreements - displays a list of the third-party agreements created in the system along with a pie-chart specifying the number of agreements in each business status, and a button to access the Creating Agreements For Third-Parties page.

The Contract dashboard displays a list of the contracts created in the system and a list of contract approval requests. The lists can be filtered on every column. Access records from the lists by double-clicking them.

The Add Contract button facilitates your access to the Create Contract page, where you can create new contracts.

The dashboard also shows a visual of the contracts within the system, displaying a pie-chart that specifies the number of contracts in each status: Contract Draft, Contract Closed, Contract Approved , Contract Pending and Contract Canceled.

This dashboard can be accessed by users with the following predefined security roles, but note that some actions may be limited according to the role setup:

-

Loan Admin Officer

-

Supervisor Corporate Officer

-

Supervisor Retail Loans Officer

-

Corporate Credit Officer

-

Retail Credit Officer

-

Supervisor Risk Officer

-

Risk Officer.

The Customer Limits dashboard displays a list of the customer limit records created in the system and a list of customer limit approval requests. The lists can be filtered on every column. Access records from the lists by double-clicking them.

The Add New Customer Limit button helps you add new customer limits.

This dashboard can be accessed by users with the following predefined security roles, but note that some actions may be limited according to the role setup:

-

Loan Admin Officer

-

Supervisor Corporate Officer

-

Corporate Credit Officer

-

Supervisor Risk Officer

-

Risk Officer.

The Soon to Expire Overdrafts dashboard displays a list of the contracts created in the system based on current account with overdraft banking products whose overdraft functionality is about to expire. The Core Banking system parameter CurrentAccount_WithOverdraft_DaysBeforeExpire determines the number of days before overdraft expiration when the contract can be displayed in this dashboard.

The lists can be filtered on every column. Access records from the lists by double-clicking them.

This dashboard can be accessed by users with the following predefined security roles, but note that some actions may be limited according to the role setup:

-

Loan Admin Officer

-

Supervisor Corporate Officer

-

Supervisor Retail Loans Officer

-

Corporate Credit Officer

-

Retail Credit Officer

-

Supervisor Risk Officer

-

Risk Officer.

The Credit Facility dashboard displays a list of the credit facility records created in the system. It also displays separate lists of credit facility approval requests, utilizations and utilizations approval requests. The lists can be filtered on every column. Access records from the lists by double-clicking them.

The Add Credit Facility button facilitates your access to the Create Credit Facility page, where you can create new credit facilities.

The dashboard also shows a visual of the credit facilities within the system, displaying a pie-chart that specifies the number of records in each status: Credit Facility Draft, Credit Facility Closed, and Credit Facility Approved.

This dashboard can be accessed by users with the following predefined security roles, but note that some actions may be limited according to the role setup:

-

Loan Admin Officer

-

Supervisor Corporate Officer

-

Corporate Credit Officer

-

Supervisor Risk Officer

-

Risk Officer.

The Reports dashboard contains links to a series of reports:

-

Report Days Past Due - Click this link to display the report of repayment notifications past due date.

-

Collaterals in Default - Click this link to display the report of collateral records in default.

-

Limit Report - Click this link to display the report of limits records in Core Banking. The report displays different sections for expired limits, limits with available amount lower than 0, limits about to expire and limits to be reviewed, the latest two with the option to select the desired interval of dates. The reports are run automatically with a default value defined in the

DefaultIntervalLimitsReportCore Banking system parameter, but you can change the intervals according to your needs directly from the report.

-

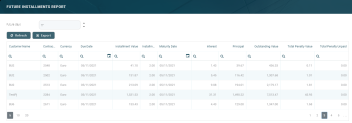

Future Installments - Click this link to display the list of installments that are due in the following X number of days from the current date. X represents a default value taken from the

DaysFutureInstallmentsReportCore Banking system parameter. You can generate the report for a different number of days simply by changing the value of the Future days field within the Future Installments Report page. The report displays the following information about the future installments: customer name, contract number, currency, due date, installment value, installment number, maturity date, interest, principal, outstanding value, total penalty value and total penalty unpaid.

-

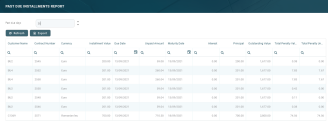

Past Due Installments - Click this link to display the list of installments that were due but not have been fully paid, no matter their origin - normal installments, penalties, transaction fees, etc, - in the last Y number of days from the current date. Y represents a default value taken from the

DaysPastDueInstallmentsReportCore Banking system parameter. You can generate the report for a different number of days simply by changing the value of the Past due days field within the Past Due Installments Report page. The report displays the following information about the past due installments: customer name, contract number, currency, installment total value, due date, unpaid amount, maturity date, interest, principal, outstanding value, total penalty value and total penalty unpaid.

The lists can be filtered on every column. Access records from the lists by double-clicking them.

The charts can be downloaded by clicking the Chart context menu in the top right corner of each chart and selecting the desired format: PNG or JPEG image, PDF document or SVG vector image.

The reports can be accessed by users with the following predefined security roles, but note that some actions may be limited according to the role setup:

-

Loan Admin Officer

-

Supervisor Corporate Officer

-

Corporate Credit Officer

-

Supervisor Risk Officer

-

Risk Officer.

The Future Installments and the Past Due Installments reports can also be accessed by users with Supervisor Retail Officer and Retail Credit Officer roles.

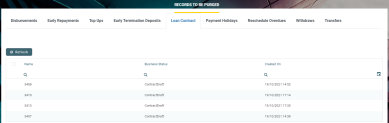

The Records To Be Purged dashboard displays the records in Draft status that are due be purged on the current day and have their transaction type's To Be Purged field marked as True.

In order to be purged on the current day, the record's Created On date + the value of the Purge Number of Days parameter at transaction type level must be equal with the current date. If the Purge Number of Days parameter at transaction type is

null, then the value of the DaysBeforePurge system parameter is considered instead. The job performing the deletion is Delete Purged Entries and it should be scheduled at the bank's level. The lists can be filtered on every column. You can select to display only the records created on a specific day from the calendar button next to the Created On column.

The following tabs are available to display the records to be purged, based on their transaction type:

-

Disbursements - displays all the disbursement type transactions in

Draftstatus which are due to be purged on the current system date; -

Early Repayment - displays all the early repayments type transactions in

Draftstatus which are due to be purged on the current system date; -

Top-Ups - displays all the top-up account type transactions in

Draftstatus which are due to be purged on the current system date; -

Early Termination Deposit - displays all the early termination deposits type transactions in

Draftstatus which are due to be purged on the current system date; -

Loan Contract - displays all the contracts in

Draftstatus created based on Term Loan banking products which are due to be purged on the current system date; -

Payment Holidays - displays all the payment holidays type transactions in

Draftstatus which are due to be purged on the current system date; -

Reschedule Overdues - displays all the reschedule overdues type transactions in

Draftstatus which are due to be purged on the current system date; -

Withdraws - displays all the withdraw type transactions in

Draftstatus which are due to be purged on the current system date; -

Transfers - displays all the transfer type transactions in

Draftstatus which are due to be purged on the current system date. -

Return Fees - displays all the Returned Amount of Goods type transactions in

Draftstatus which are due to be purged on the current system date. -

Agreements - displays all the Agreement type transactions in

Draftstatus which are due to be purged on the current system date.

For each transaction type that can be purged (marked with Yes in the Predefined Transaction Types table's Can Be Purged column), Core Banking displays a tab in the Records To Be Purged dashboard only if their To Be Purged field is marked as

True.For each record, the following information is displayed: name, business status, creation date and transaction type.

The example below shows the Loan Contract tab, which displays all the contracts in Draft status created based on Term Loan banking products and which are due to be purged on the current system date.

This dashboard can be accessed by users with the Loan Admin Officer predefined security role.

The Third-Party Agreements dashboard displays a list of the third-party agreements created in the system. The list can be filtered on every column. Access records from the lists by double-clicking them.

The Add Agreement button facilitates your access to the Creating Agreements for Third-Parties page, where you can create new agreements.

The dashboard also shows a visual of the agreements within the system, displaying a pie-chart that specifies the number of agreements in each status: Draft, Closed, Approved , and Canceled.

Users with the associated role of Loan Admin Officer or Retail Credit Officer can view, insert, update, or delete third-party agreement records. Users with the other associated Core Banking security roles can only view such records.