First Time Buyer

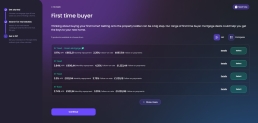

Based on what you selected in the previous screen, the system calculates the most likely products. It enlists possible offerings to compare. The heading is dynamic and depicts the mortgage selected in the Let’s Choose the Right Mortgage for You. However, the development only includes the type First time buyer.

For the products defined here, see Configuring the Banking Product Factory.

The list view is the default option. In the List viewing mode, the first four results for product offering based on the product ranking. Additionally, click Show more to display additional products, if the list exceeds the page. Additionally, the screen depicts the total number of products.

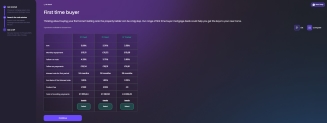

You can compare the products by clicking the Compare viewing mode.

Based on what you selected in the previous screen, the system can return with no products. In this case, configure a different loan.

The system displays additional details regarding a banking product for you to make an informed decision: product name, APR![]() The annual percentage rate is an annualized representation of the interest rate., monthly repayment (displays the value for the first month payment only), follow-on rate

The annual percentage rate is an annualized representation of the interest rate., monthly repayment (displays the value for the first month payment only), follow-on rate![]() It is the lender's standard variable rate (SVR), and this is the default interest rate that you are charged if you don't remortgage., follow-on payments (monthly repayments after the first period expires).

It is the lender's standard variable rate (SVR), and this is the default interest rate that you are charged if you don't remortgage., follow-on payments (monthly repayments after the first period expires).

The second view features a more detailed list of products and display them in a vertical way: product name, APR, monthly repayment, follow-on rate, follow-on payments, interest rate![]() The interest rate is the amount a lender charges a borrower and is a percentage of the principal, i.e., the amount loaned. for the first period, end date of the first period, product fee, total of monthly payments.

The interest rate is the amount a lender charges a borrower and is a percentage of the principal, i.e., the amount loaned. for the first period, end date of the first period, product fee, total of monthly payments.

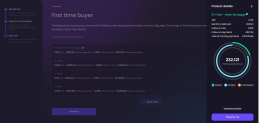

Select a product to view a graphical representation of product details: monthly repayment (the value for the first payment), APR![]() The annual percentage rate is an annualized representation of the interest rate., follow-on rate, follow-on payments (monthly repayments after the fixed interest rate period), total repayable amount

The annual percentage rate is an annualized representation of the interest rate., follow-on rate, follow-on payments (monthly repayments after the fixed interest rate period), total repayable amount![]() It represents the sum of all scheduled or projected payments of funds that the recipient agrees to pay to the provider..

It represents the sum of all scheduled or projected payments of funds that the recipient agrees to pay to the provider..

The products were configured using Banking Product Factory. The system only displays the relevant products and a minimum of one product.

For each product from the list, click Details to expand the right-hand side panel with a graphical representation is displayed with the distinction of the property financing solution with the following elements:

- Total commissions

The value of the total amount of commissions paid for the entire loan duration. (using the yellow color)

The value of the total amount of commissions paid for the entire loan duration. (using the yellow color) - Total interest

It is the total amount paid for the entire loan duration as interest. (using the green color)

It is the total amount paid for the entire loan duration as interest. (using the green color) - Total principal

It is the total amount paid for the entire loan duration. (using the light blue color).

It is the total amount paid for the entire loan duration. (using the light blue color).

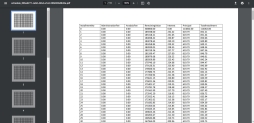

Additionally, there is a button to download the schedule![]() A loan amortization schedule is a complete table of periodic loan payments, showing the amount of principal and the amount of interest that comprise each payment until the loan is paid off at the end of its term.. Click it to trigger the download locally.

A loan amortization schedule is a complete table of periodic loan payments, showing the amount of principal and the amount of interest that comprise each payment until the loan is paid off at the end of its term.. Click it to trigger the download locally.

For the side panel, click the This is for me button to select the product and continue to the next step, if it is to your linking or to close the panel click the X symbol at the top of the panel.

Select a product from the list by click Select on the row of a product and then click Continue.

To calculate the offers for the filtered products that are displayed in this screen, the system determines the:

- The value for the first monthly instalment fetched from the payment schedule

A loan amortization schedule is a complete table of periodic loan payments, showing the amount of principal and the amount of interest that comprise each payment until the loan is paid off at the end of its term.

A loan amortization schedule is a complete table of periodic loan payments, showing the amount of principal and the amount of interest that comprise each payment until the loan is paid off at the end of its term. - Interest rate for the fixed period fetched from Banking Product Factory

- APR

The annual percentage rate is an annualized representation of the interest rate.

The annual percentage rate is an annualized representation of the interest rate.

- End date of the fixed rate: calculated as the last payment for the first prancing rate on the product.

- Follow-on payments: monthly repayments after the fixed interest rate period, it is fetched from the scheduler the first instalment after the initial period

- Interest rate after the fixed period fetched from Banking Product Factory

- Product fee fetched from Banking Product Factory

- Total of monthly payments calculated by adding all the monthly payments for the loan in the schedule

- Early repayment charges fetched from Banking Product Factory.