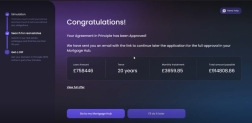

Congratulations!

This step informs you whether you qualify for the mortgage you applied. It marks the success of your request and displays the offer available.

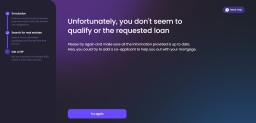

Rejection Screens

If you fail the financial calculations, there are two rejection screens for two scenarios:

- for the applications that have only one applicant, you are invited to add a co-applicant to boost the income and apply again for the decision in principle

- for the applications that already have two applicants, then the system invites you to a branch to discuss options for funding.

Additionally, an email is sent containing:

- a document with the DIP proposal

- the schedule for the offer

- a link to continue the journey at a later time.

The offer is depicted wit the loan amount, the tenor, monthly instalment![]() The value of one of a number of successive payments in settlement of a debt., the total amount payable

The value of one of a number of successive payments in settlement of a debt., the total amount payable![]() It represents the sum of all scheduled or projected payments of funds that the recipient agrees to pay to the provider..

It represents the sum of all scheduled or projected payments of funds that the recipient agrees to pay to the provider..

Click the button View full offer to open additional details about the loan:

- Product category

- Product name

- Nr of applicants

- Monthly instalment

The value of one of a number of successive payments in settlement of a debt. (for the first instalment)

The value of one of a number of successive payments in settlement of a debt. (for the first instalment) - Interest rate

The interest rate is the amount a lender charges a borrower and is a percentage of the principal, i.e., the amount loaned. for the fixed period

The interest rate is the amount a lender charges a borrower and is a percentage of the principal, i.e., the amount loaned. for the fixed period - APR

The annual percentage rate is an annualized representation of the interest rate.

The annual percentage rate is an annualized representation of the interest rate.

- End date of the fixed rate

- Follow-on payments (monthly repayments after the fixed interest rate period)

- Interest rate after the fixed period

- Product fee (from Banking Product Factory)

- Total of monthly payments

- Early repayment charges (from Banking Product Factory).

There are two buttons available: Go to My Mortgage Hub or I'll do it later to postpone the process. An email is sent with a button Continue Application that triggers the Resume Application and Log In page.