Main Info

The Main Info tab lets you add information about your product, and also indicate some of its underlying business conditions. The tab has two sections:

-

General Data - This section lets you introduce the product's main characteristics, those which are most visible to the final customer.

-

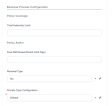

Business Process Configuration - This section lets you configure the policy coverage, policy administration, the scheduling of payments and billing, the management of claims, the tariff type, and more.

Filling in information in this first tab activates the next tabs and lets you move forward.

Additionally, what you configure in this tab has impact on what fields you see on some of the other tabs. However, after filling in information in the Main Info tab, it is not absolutely necessary to work on the other tabs in the order listed on your screen. For example, after the Main Info tab, you might want to go to the Documents tab, to upload the documents of your product, if you already have them. You can do that.

Understanding default vs specific settings, when configuring products:

A default setting uses the default values from the Insurance Parameter set up in your Portal > Settings > Insurance parameters. A specific setting uses values which differ from the default ones - values that you only configure for that specific field, section, or product.

Below, an example of the configuration fields available in the General Data Section - the red dots mark the mandatory fields:

In this section, generally describe your new product. The following fields are available:

| Field | Description |

|---|---|

| Insurance Product Type | Click the dropdown to select a Type of insurance for your insurance product - ex. Auto, Health, Home, Travel. See Insurance Types for details. |

| Insurance Product Code | Use this text area to fill in the code of the insurance product. |

| Name | Insert the name of your insurance product. |

| Currency | From the dropdown list, select a currency for your insurance product. |

| Start Date | Pick the date when your product becomes available. |

| End Date | Pick the date when the availability of your product ends. |

| Maximum Discount (%) | Set the maximum percentage of the commercial discount which can be offered in the sales process for your product. This field allows numeric values. |

| Maximum Commission (%) | Set the maximum percentage of the commission which can be offered to intermediary sellers. This field allows numeric values. |

| Description | Field for describing the insurance product (500 characters). |

| Commercial Text | Field for commercial text (300 characters). |

After inserting the required information, move to the next section of the tab.

Below, an example of the available configuration fields, with some details inserted, for a Draft product:

In this section, the following fields are available:

| Field | Description |

|---|---|

| Free Withdrawal Period Limit Days | Set the limit (expressed in days) for the free withdrawal period, if any. This value is necessary for the cancellation processes. |

| Renewal type | Choose the type of the insurance policy renewal. The option set values are: [none], No (default), Automatic renewal, and Renewal offers. If you choose Automatic renewal, the following option set fields become available: - Renewal Validity - where the options are: Yearly, Monthly, and SameValidity. - Renewing Policy - where the options are: [none], Same Policy and New Policy. - Renewal Tariff - where the options are: Same tariff and Actual tariff. - No of Days Before Renewal - Insert the number of days before policies reach maturity that the system can use to notify you about the coming renewal opportunity. |

| Prorata Type Configuration | Set the proportion rate type for premium payments. The option set values are: - Default if you allow the generic setting to be used. - Specific if you want to set a specific rate. When you choose this option, the Prorata Type option set becomes available and you can choose between the following specific values: Daily and Monthly. |

Below, an example of the available configuration fields:

*SGDAY translates to Statement Generation Day - This parameter stores the number of days in advance (before the payment due date), for automatically generating an invoice (statement) for a scheduled payment (installment) on a policy.

Click Save and reload.

The form shows the Main Payment Type insert form, as in the example below:

The available payment types are loaded into the grid and you must click next to the type that you choose as Main Payment Type. A message appears to let you know that the chosen Main Payment Type is saved.

The payment types already available as option set values are: OP (bank transfer), PayU, PayU-on time, brokerCollection, and directDebit. The default value is none. If necessary, the payment type grid allows you to add new payment type values into the grid, or delete those that don't fit your needs.

Below, an example of the available configuration fields:

| Field | Description |

|---|---|

| Claim Notification Period Limit (hours) | The period during which the claimant can notify the damage produced - in order to open a claim on a policy that contains this insurance product, expressed in hours. |

| Update Indemnity Limit | Check the box in order for the system to make automatic updates of the indemnity limit, after every claim payment. |

You can use two types of rating models:

1. Top down - where pricing and underwriting is made at product level.

Per product pricing means you add a generic formula on product level, no matter how many coverages, or riders it has. For example, for a health insurance product, the customer receives a policy (with a list of coverages and riders, that appear on the policy), but no matter of what is included in the policy, the customer will pay 50 Eur/ month if their age < 60 years and 60 Eur/ month if their age is >= 60. So, the premium is not calculated for each coverage, it's a general price, calculated on product level.

2. Bottom up - where pricing and underwriting can be set from peril (risk), or coverage level and, then, they can be aggregated at product level. Use this approach to attach individual formulas per each product item (coverage).

The available fields are as follows:

| Field | Description |

|---|---|

| Tariff Type | The tariff type options. The option set values are: Per Coverage and Per Product. |

| Underwriting Type | The underwriting type options. The option set values are: Per Coverage and Per Product. |

Below, an example of the available configuration fields:

After configuring all of the above, click Save and reload.

The other tabs become available and you can see them at the top of the screen.