Contract Events

Contract events are transactions/ changes performed at the contract level. Such events are disbursements, early repayments, transfers of funds between the customer's accounts, and so on.

In a contract based on a specific banking product, you can only add events with the transaction types predefined at that banking product level. Other changes may be performed by versioning the contract. This page covers those changes enabled via events, created via the Insert button above the Transactions section in the Contract > Payments tab.

Only contracts with Approved status allow you to perform transactions.

The transactions must be previously defined and associated with the banking product in the Banking Product page > Associated Transactions tab.

Only events with Approved status operate changes at the contract level.

Event Statuses

An event record has the following statuses, visible in the top left corner of the Event page:

-

Draft - the status of a newly created event record that was not yet sent for approval. The event value is not applied to the contract while the event is still in this status. While in this status, you can edit some fields. Approve after editing all the necessary details.

-

Approved - the status of an event record after being authorized. The event value is applied to the contract and you cannot edit any of the event's details. There is no further transition from this status.

-

Canceled - the status of an event record after being canceled. The event value is not applied to the contract and you cannot edit any of the event's details. There is no further transition from this status.

As a best practice, new records or new versions of existing records created on a specific day should be approved on the same day.

Adding Events To Approved Contracts

In order to add events to a contract, follow these steps:

-

In FintechOS Portal, on the Contracts List page, select a contract with Approved status.

-

Double-click the contract to open it for editing.

-

Navigate to the contract's Payments tab.

-

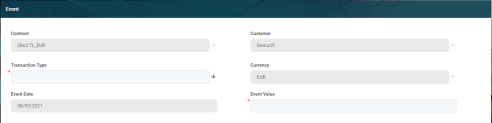

Click the Insert button above the Transactions section. The Event page is displayed.

-

Fill in the following fields, noting that the fields that are not mandatory, are read-only:

-

If you've already selected the transaction type, the other value fields are automatically calculated and their values are displayed.

-

For some transaction types, the event value is calculated and displayed after saving the record, based on the information filled in a series of other fields.

Both- take a break from paying the principal and interest amounts of the installments.Principal- take a break from paying the principal amount of the installments.Activity suspended

Major force

Financial restructuring.

-

Click the Save and Reload button at the top right corner of the page.

If the event value meets the business requirements defined within Core Banking, the event is saved in Draft status and a transaction number is automatically generated for it. Otherwise, an error message appears. Change the values as instructed in the message and try saving the event again.While the event is in Draft status, all the event's fields except Transaction Type can be modified. The event value is not applied to the contract while the event is still in this status.

-

Approve the event by changing its status to Approved in the upper left corner of the Event page.

| Field | Mandatory | Data Type | Details |

|---|---|---|---|

| Contract | No | Lookup | Automatically completed with the selected contract's number. You cannot edit this field. |

| Customer | No | Lookup | Automatically completed with the selected contract's customer. You cannot edit this field. |

| Currency | No | Lookup | Automatically completed with the selected contract's currency. You cannot edit this field. |

| Event Date | No | Invariant Date | Automatically completed with the Core Banking system's current date. You cannot edit this field. |

| Event Value | Yes | Numeric |

Enter the value of the transaction. |

| Transaction Type | Yes | Lookup |

Select from the list the transaction type. Only the transaction types associated with the banking product which is at the base of the contract are displayed. NOTE

Depending on the selected transaction type, a series of new fields are displayed that require to be filled in. |

| Top-up Account transaction type | |||

| Source Bank Account Balance | Yes | Numeric | This field displays the available balance of the account associated with the contract. You cannot edit this field. |

| Source Account | Yes | Text | Insert the source of the respective amount. |

| Transfer between my bank accounts transaction type | |||

| Source Bank Account Balance | Yes | Numeric | This field displays the available balance of the account associated with the contract. You cannot edit this field. |

| Destination Account | Yes | Lookup | Select the destination account from the list of accounts that belong to the contract's customer. |

| Withdraw transaction type | |||

| Source Bank Account Balance | Yes | Numeric | This field displays the available balance of the account associated with the contract. You cannot edit this field. |

| Destination Account | Yes | Lookup | Select the destination account from the list of accounts that belong to the contract's customer. |

| Disbursement transaction type | |||

| Financed Amount | No | Numeric | This field displays the contract's financed amount. You cannot edit this field. |

| Available Value | No | Numeric | This field displays the amount still available within the contract. You cannot edit this field. |

| Repayment Due Day | No | Whole Number | This field displays the day of the month when the repayment is due if it was specified previously. You cannot edit this field. |

| Installment Method | Yes | Lookup | This field displays the contract's selected installment method. You cannot edit this field. |

| Tenor | No | Whole Number | This field displays the duration left in the contract. You cannot edit this field. |

| Principal Value | Yes | Numeric | This field displays the value affecting the principal of the contract. You can modify this value. |

| Installment Value | Yes | Numeric | This field displays the installment value calculated for the entered event value. You can modify this value. |

| Import Schedule | No | Bool | This field specifies whether you are importing a custom repayment plan (for the selected checkbox), or the schedule generated by the system (for the checkbox left unselected) is to be used further within the contract. The checkbox is unselected by default, meaning that the schedule generated automatically by the system is to be used after approving the event. Select the checkbox to display the Export Schedule Template and the Schedule File - Select File buttons, otherwise, these buttons are not displayed. Read more about importing a custom schedule file in the Import Repayment Plan section of the user guide. |

| Schedule File - Select File | No | File |

This field contains the imported custom repayment plan. New events don't contain the file. In order for a file to be displayed here, you should first select the desired file with your custom schedule. Click Select File and, in the newly displayed Explorer window, browse for the NOTE

Before selecting the file, make sure you fill in the custom schedule according to the schedule template exported from Core Banking (click the Export Schedule Template button to download an .xslx file with the approved schedule template). Save the event record in order to save the schedule file to Core Banking, then click Run Import Schedule to perform the import of the new custom schedule to the contract through the event. Remember to approve the event for the new repayment plan to be in effect on the contract. |

| Early Repayment transaction type Only for contracts that have an approved disbursement event. Note that when an approved early repayment event covers a contract's entire outstanding amount resulting in zero amounts on the contract, that contract is automatically closed by Core Banking. |

|||

| Charge Fee | No | Lookup | This field displays the transaction fee applicable for a repayment transaction. See Transaction Fees for more details. You cannot edit this field. |

| Repayment Fee Percent | No | Lookup | This field displays the repayment fee percentage applicable for the contract. Depending on the ManualRepaymentFee Core Banking system parameter's value, the system may allow you to change the percentage. See Transaction Fees for more details. |

| Fee For Repayment | No | Lookup | This field displays the repayment fee value applicable for the contract. Depending on the ManualRepaymentFee Core Banking system parameter's value, the system may allow you to change the value. See Transaction Fees for more details. |

| Remaining Principal At Date | Yes | Numeric | This field displays the remaining value of the principal at the current date. You can modify this value. |

| Keep Contract Period | Yes | Bool | This field displays whether the system should keep the period of the contract (if the checkbox is selected) or recalculate it. You can modify this value. |

| Repayment Principal Amount | Yes | Numeric | This field displays the principal amount to be repaid with this event. You can modify this value. |

| Interest Value | Yes | Numeric | This field displays the interest value applicable to the payment. You cannot edit this field. |

| Other Fees Total Value | Yes | Numeric | This field displays other fees and commissions applicable to the payment. You cannot edit this field. |

| Future Installments No | Yes | Whole Number | This field displays the number of installments to be paid in the future. You cannot edit this field. |

| Future Installment Value | Yes | Numeric | This field displays the future value of the installment as recalculated after this payment. You cannot edit this field. |

| Future Principal For Installment | Yes | Numeric | This field displays the future value of the principal as recalculated after this payment. You cannot edit this field. |

| Unpaid Amount On Contract | No | Numeric | This field is displayed after saving the record. It shows the value of the unpaid amount still on the contract. You cannot edit this field. |

| Unpaid Amount For Customer | No | Numeric | This field is displayed after saving the record. It shows the value of the unpaid amount for the customer. You cannot edit this field. |

| Collect accrued interest | No | Boolean | This field indicates the behavior of the accrued interest on the early repayment contract events, respectively if the payment schedule type calculation should collect the interest accrued up to date or not. If the checkbox is not selected, then Accrued Interest = the value of accrued interest until the event's date. If the checkbox is selected, then the Accrued Interest = 0.00.The payment schedule projection takes into consideration both the payment schedule type defined at the banking product level, and whether to collect the interest accrued on the contract until the date of an early repayment event, thus repaying the accrued interest, or not, thus adding the accrued interest to the next installment due after the early repayment event. |

| Accrued interest | No | Numeric | This field displays the interest accrued up until the event date for an early repayment contract event. You cannot edit this field. |

| Import Schedule | No | Bool | This field specifies whether you are importing a custom repayment plan (for the selected checkbox), or the schedule generated by the system (for the checkbox left unselected) is to be used further within the contract. The checkbox is unselected by default, meaning that the schedule generated automatically by the system is to be used after approving the event. Select the checkbox to display the Export Schedule Template and the Schedule File - Select File buttons, otherwise, these buttons are not displayed. Read more about importing a custom schedule file in the Import Repayment Plan section of the user guide. |

| Schedule File - Select File | No | File |

This field contains the imported custom repayment plan. New events don't contain the file. In order for a file to be displayed here, you should first select the desired file with your custom schedule. Click Select File and, in the newly displayed Explorer window, browse for the NOTE

Before selecting the file, make sure you fill in the custom schedule according to the schedule template exported from Core Banking (click the Export Schedule Template button to download an .xslx file with the approved schedule template). Save the event record in order to save the schedule file to Core Banking, then click Run Import Schedule to perform the import of the new custom schedule to the contract through the event. Remember to approve the event for the new repayment plan to be in effect on the contract. |

| Payment Holiday transaction type | |||

| Charge Fee | No | Lookup | This field displays the transaction fee applicable for this transaction type. See Transaction Fees for more details. You cannot edit this field. |

| Repayment Fee Percent | No | Lookup | This field displays the repayment fee percentage applicable for the contract. Depending on the ManualRepaymentFee Core Banking system parameter's value, the system may allow you to change the percentage. See Transaction Fees for more details. |

| Fee For Repayment | No | Lookup | This field displays the repayment fee value applicable for the contract. Depending on the ManualRepaymentFee Core Banking system parameter's value, the system may allow you to change the value. See Transaction Fees for more details. |

| Keep Contract Period | Yes | Bool | This field displays whether the system should keep the period of the contract (if the checkbox is selected) or recalculate it. You can modify this value. |

| Payment Holiday Period (Months) | Yes | Whole Number | Enter the number of months for which you request a break from the payments. |

| Payment Holiday Period Type | Yes | Option Set | Select the type of payment holiday to be applied for the contract. Possible values: |

| Reason | Yes | Option Set | Select the reason for requesting the event. Possible values: |

| Import Schedule | No | Bool | This field specifies whether you are importing a custom repayment plan (for the selected checkbox), or the schedule generated by the system (for the checkbox left unselected) is to be used further within the contract. The checkbox is unselected by default, meaning that the schedule generated automatically by the system is to be used after approving the event. Select the checkbox to display the Export Schedule Template and the Schedule File - Select File buttons, otherwise, these buttons are not displayed. Read more about importing a custom schedule file in the Import Repayment Plan section of the user guide. |

| Schedule File - Select File | No | File |

This field contains the imported custom repayment plan. New events don't contain the file. In order for a file to be displayed here, you should first select the desired file with your custom schedule. Click Select File and, in the newly displayed Explorer window, browse for the NOTE

Before selecting the file, make sure you fill in the custom schedule according to the schedule template exported from Core Banking (click the Export Schedule Template button to download an .xslx file with the approved schedule template). Save the event record in order to save the schedule file to Core Banking, then click Run Import Schedule to perform the import of the new custom schedule to the contract through the event. Remember to approve the event for the new repayment plan to be in effect on the contract. |

| Reschedule Overdues transaction type | |||

| Charge Fee | No | Lookup | This field displays the transaction fee applicable for this transaction type. See Transaction Fees for more details. You cannot edit this field. |

| Repayment Fee Percent | No | Lookup | This field displays the repayment fee percentage applicable for the contract. Depending on the ManualRepaymentFee Core Banking system parameter's value, the system may allow you to change the percentage. See Transaction Fees for more details. |

| Fee For Repayment | No | Lookup | This field displays the repayment fee value applicable for the contract. Depending on the ManualRepaymentFee Core Banking system parameter's value, the system may allow you to change the value. See Transaction Fees for more details. |

| Keep Contract Period | Yes | Bool | This field displays whether the system should keep the period of the contract (if the checkbox is selected) or recalculate it. You can modify this value. |

| Import Schedule | No | Bool | This field specifies whether you are importing a custom repayment plan (for the selected checkbox), or the schedule generated by the system (for the checkbox left unselected) is to be used further within the contract. The checkbox is unselected by default, meaning that the schedule generated automatically by the system is to be used after approving the event. Select the checkbox to display the Export Schedule Template and the Schedule File - Select File buttons, otherwise, these buttons are not displayed. Read more about importing a custom schedule file in the Import Repayment Plan section of the user guide. |

| Schedule File - Select File | No | File |

This field contains the imported custom repayment plan. New events don't contain the file. In order for a file to be displayed here, you should first select the desired file with your custom schedule. Click Select File and, in the newly displayed Explorer window, browse for the NOTE

Before selecting the file, make sure you fill in the custom schedule according to the schedule template exported from Core Banking (click the Export Schedule Template button to download an .xslx file with the approved schedule template). Save the event record in order to save the schedule file to Core Banking, then click Run Import Schedule to perform the import of the new custom schedule to the contract through the event. Remember to approve the event for the new repayment plan to be in effect on the contract. |

| Overdraft Payment transaction type | |||

| Remaining Principal At Date | Yes | Numeric | This field displays the remaining value of the principal at the current date. You can modify this value. |

| Overdraft Interest Rate | Yes | Numeric | This field displays the value of the interest rate applicable for overdraft payments for the contract. You can modify this value. |

| Repayment Principal Amount | Yes | Numeric | This field displays the principal amount to be repaid with this event. You can modify this value. |

| Interest Value | Yes | Numeric | This field displays the interest value applicable to the payment. You cannot edit this field. |

| Unpaid Amount On Contract | No | Numeric | This field is displayed after saving the record. It shows the value of the unpaid amount still on the contract. You cannot edit this field. |

| Unpaid Amount For Customer | No | Numeric | This field is displayed after saving the record. It shows the value of the unpaid amount for the customer. You cannot edit this field. |

| Deposit Liquidation transaction type | |||

| Interest to Recover | No | Numeric | This field displays the calculated interest to recover at the current date. You cannot edit this field. |

| Available Deposit Amount | No | Numeric | This field displays the available value in the deposit at the current date. You cannot edit this field. |

| Destination Account | Yes | Lookup | Select from the list the account where the available deposit amount has to be moved upon liquidation. The list contains the contract customer's current accounts. |

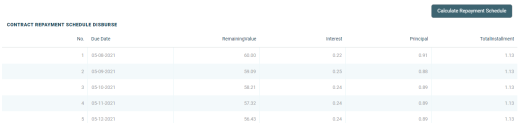

Depending on the selected transaction type, new sections are displayed at the bottom of the page, containing the contract repayment schedule for the event and any generated notifications.

Click the Calculate/ Simulate repayment schedule / Simulate reschedule overdues buttons (the displayed button depends on the selected transaction type) to view the details of each installment. If the Import Schedule checkbox is selected, the Calculate button is not displayed. If the Import Schedule checkbox is unselected, then the repayment schedule is recalculated using the standard Core Banking logic.

For Reschedule Overdue transaction type, select from the list the overdue payment notifications that you wish to reschedule.

-

Confirm the change of status in the Confirmation window, clicking Yes. The event is now in Approved status.

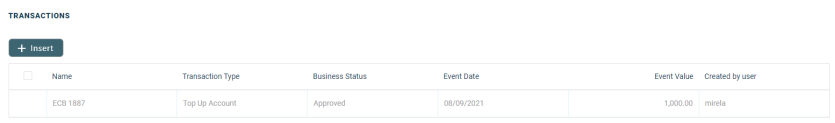

The event value is now applied and visible in the contract's Payments tab -> Transactions section.

All existing versions of the contract in Contract Version Draft status are automatically changed to Contract Version Closed when a payment event is approved for that contract.