Term Loans

A term loan is a banking product which defines a loan for a specific amount that has a specified repayment schedule and either a fixed or floating interest rate.

To manage banking products:

- Log into Innovation Studio in Developer mode.

- Click the main menu icon at the top left corner.

- In the main menu, click Product Factory.

- Click Banking Products to open the Banking Products List page.

In the Banking Products List page, you can:

- Add a new banking product by clicking the Insert button at the top right corner.

- Edit an existing banking product from the list by double clicking it.

- Delete a banking product by selecting it and clicking the Delete button at the top right corner.

For banking products in

Active status, you can't change any of their related entities (such as features, discounts, product guarantee, interest or commission item, formula, test scenario, product covenant, product disbursement, product availability item filter). To change any of the product's related entities, create a new version of the banking product record.Creating Term Loans

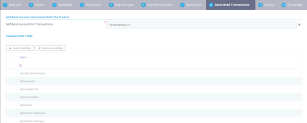

To create a new banking product, click the Insert button on the top right side of the page. A new page opens, with a series of tabs that assist you in configuring the banking product:

- Main Info - The first tab requires the basic elements for the creation of a product such as product type, name, code, hierarchy and features.

- Details - This tab requires further elements that build on the first tab such as interest, payment type, top-ups, withdrawals and associated products.

- Availability - This tab determines the monetary range and the time frame when the product is available for customers.

- Dimensions - This tab displays the interests, commissions, insurances, discounts and questions valid for a product.

- Risk Formulas - In this tab, you can attach a formula that triggers calculations to determinate the eligibility of a customer, for example.

- Test Risk Formulas - Use this tab to test the formula attached above before displaying it in a digital journey.

- Documents - This tab contains all the attached documents available for a product.

- Associated Transactions - Transactions that are done to and from a banking product are found in this tab.

- History - This tab displays the versions of the product, along with workflow status and the user who modified the product.

- GL Settings - This tab contains the accounts to be used by Operational Ledger for transactions performed on contracts based on this banking product.

The Main Info tab requires the basic elements for the creation of a product such as name, code, image and features.

The following fields are available:

| Field | Required | Data Type | Details |

|---|---|---|---|

| Product Type | Yes | Option Set | Choose one for the following:

NOTE Your product type selection greatly influences the next steps. It is important to choose the right type of product to build. |

| External Code | No | Text | The code of the product imported from an external system, if applicable. It can have 10 characters and it is not used in the contract. |

| Banking Product Code | Yes | Text | The code of the product. It can have 10 characters and it is used in the contract. It uses a sequencer and the code of the product type. |

| Name | Yes | Text | The name of the product. |

| Class | No | Option set | This field is used to place the product in a hierarchy. For more information, see Product Hierarchy |

| Subclass | No | Option set | This field is used to place the product in a hierarchy. For more information, see Product Hierarchy |

| Category | No | Option set | This field is used to place the product in a hierarchy. For more information, see Product Hierarchy |

| Subcategory | No | Option set | This field is used to place the product in a hierarchy. For more information, see Product Hierarchy |

| Start Date | Yes | Date | The date when the product becomes available. |

| End Date | Yes | Date | The last date from when the product is available. From that date forward, the product is no longer available. |

| Benefits | No | Text area | Insert the advantages of owning the banking product. You can format the text in the text editor window. |

| Description | No | Text area | Write any description or additional text here. |

| Product Image | No | File | Insert an image representative for the product. |

| Document | No | File | Insert the document representative for the product. |

| Display Conditions | No | Text area | Insert the conditions for the applicant, e.g. age limit, annual turnover, education level, income, registration documents. |

Click the Save and Reload button at the top right corner of the page.

In the Product Features section, you can insert, delete or export features. To add a feature, click Insert and fill in the following fields:

| Field | Required | Data Type | Details |

|---|---|---|---|

| Banking Product | No | Option set | Choose the name of the product. |

| Is main feature | No | Bool | Select the checkbox if it is the major feature. |

| Feature | No | Text | The name of the feature. |

Click the Save and Reload button at the top right corner of the page.

In the Product Classifications section, you can insert or remove existing product classification items. To add a product classification item, click Insert Existing and select an already existing item, or create a new one by clicking Insert and filling in the following fields:

| Field | Required | Data Type | Details |

|---|---|---|---|

| Classification Type | Yes | Option set | Choose the classification type of the item. Possible values: Regulatory, Restructuring. |

| Name | Yes | Text | Enter the name of the classification item. |

| Code | Yes | Text | Enter the unique code of the classification item. |

| Is Default | Yes | Boolean | Select the checkbox if this classification item is default. |

| Valid From | Yes | Invariant Date | Select the date from which the product classification item is valid. |

| Valid To | Yes | Invariant Date | Select the date until when the product classification item is valid. |

The Banking Products Classification Section is displayed after saving the classification item record and allows you to insert existing banking products. The following information is displayed here:

| Field | Details |

|---|---|

| Code | The code of the banking product added to the product classification item. |

| Name | The name of the banking product. |

| Class | The class of the banking product. |

| SubClass | The subclass of the banking product. |

| Category | The category of the banking product. |

| SubCategory | The subcategory of the banking product. |

| Status | The status of the banking product record. |

The Contract Classifications Section is displayed after saving the classification item record and allows you to insert existing contracts. The following information is displayed here:

| Field | Details |

|---|---|

| Contract | The number of the contract using this classification. |

| Code | The code of the classification item. |

| Name | The name of the classification item. |

| Classification Type | The type of the classification. |

| Valid From | The date from which the classification item is valid. |

| Valid To | The date until which the classification item is valid. |

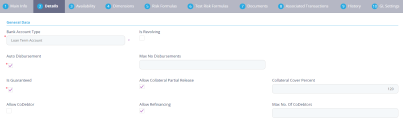

The Details tab requires further elements such as interest, payment type, top-ups and withdrawals.

For the General Data section, the following fields are available:

| Field | Required | Data Type | Details |

|---|---|---|---|

| Bank Account Type | Yes | Option set | Choose one from the following:

|

| Is Revolving | No | Bool |

Allows a business to borrow money as needed for funding working capital needs and continuing operations such as meeting payroll and playable. NOTE

If a term loan is revolving, its attached limit must also be revolving, meaning that the Available Amount of the limit is replenished either on each repayment of the principal or on loan contract closure. |

| Auto Disbursement | Yes | Bool | Specifies if the disbursement is automatically performed when the contract is approved. |

| Max No Disbursements | No | Whole number | The maximum number of disbursements that can be configured for this product. |

| Is Guaranteed | Yes | Bool | This checkbox marks the product as secured or unsecured. NOTE The Collateral Cover Percent field appears when you select this checkbox. |

| Activation Tranches On Document Submission | No | Bool | Tranches to be granted after certain documents are submitted. |

| Allow Collateral Partial Release | No | Bool | A partial release is a mortgage provision that allows some of the collateral to be released from a mortgage after the borrower pays a certain amount of the loan. |

| Collateral Cover Percent | No | Whole number | The percent that the collateral person on the contract pays. It usually is over 100%. |

| Allow CoDebtor | No | Bool | Select if another debtor exists for this product. |

| Allow Refinancing | No | Bool | Select if the account can be refinanced for this product. |

| Number of CoDebtors | No | Text | Set the maximum number of debtors possible for this product. |

In the Payment Schedule Types section, the following fields are available:

| Field | Required | Data Type | Details |

|---|---|---|---|

| Periodicity Type | Yes | Option set | Select the regularity of payments. Select one from the following:

NOTE If the measurement unit of the selected Periodicity Type = Days, then Holiday Shift For Repayment Installments = False and it cannot be changed. |

| Repayment Allocation Method | Yes | Option set | The repayment allocation method represents the recovery order of amounts from repayment notifications. You can specify if charges should be recovered with priority or maybe interest or principal. You can also split order by number of days overdue. Select a repayment allocation method from the list. |

| Holiday Shift For Repayment Installments | Yes | Bool | This checkbox marks if the holidays are considered for the calculation of the maturity schedule. NOTE The Country Calendars section appears if you select this checkbox. |

| Holiday Shift Method | No | Option set | Select from the list the method to be used when calculating the due date if that date falls to a holiday. The due date can be shifted before or after the holiday. Possible values:

Forward. |

| Defer Due Date | Yes | Bool | If you select the checkbox, the payment schedule calculates the next payment amount as if the due date has not changed even when the due date falls on a holiday. This checkbox is selected by default. |

| Grace Type | No | Option set | Select whether the product grace should apply to the principal, the interest, or both. Select an option from the list:

|

| Product Grace | No | Option set | Select an option from the list. This is the amount of time that the bank can offer to a customer at the beginning of the contract without repayments of principal or principal + interest (however, most probably the bank capitalizes the interest for that period of time). |

| Grace Days for Repayment | No | Whole number | Insert the number of days for which the bank expects a payment without calculating penalty. |

|

Penalty for grace period |

No | Bool | If you select the checkbox, the penalty interest is applied on the loan contract without taking into consideration the grace period defined at contract level, being calculated for the difference between system date - due date, if the grace period passed and the customer didn't pay the due amounts. If you leave this checkbox unselected, the penalty interest is applied on the loan contract taking into consideration the grace period defined at contract level, being calculated for system date - due date + grace days for repayment. |

In the Payment Schedule Types section, you can associate/ delete payment schedule types to/ from the banking product. To associate a payment schedule type to the banking product, click Insert Existing and select one of the already defined types. Go to Payment Schedule Types to read more about this.

When creating a new Term Loan, Mortgage, or Overdraft banking product, you must select at least one payment schedule type, otherwise you can't approve the product. If the Payment Schedule Types section has no records, an error message is displayed upon transitioning the product into the Approved status: “At least one Payment schedule type definition must be selected for approval!”

In the Country calendars section, you can insert or delete calendars. You can work with multiple calendars as well. Click the Insert Existing button and add the country's name. If the maturity date coincides with a holiday, it is allocated automatically on the next business day.

In the Product Guarantees section, presented if the Is Guaranteed checkbox was selected earlier, you can insert or delete guarantees. To insert a guarantee, click the Insert Existing button and select one of the following:

- Cash collateral

- Real estate.

To insert a new guarantee, click Insert and fill in the name, code and select the guarantee type.

The Product Destination Types section allows for insertion or removal of existing destinations. Click Insert existing and select one of the existing destination types, or insert a new one. To create a new destination type, insert a name and specify if it is default. For this case, the following have been configured:

- Loan Collateral

- Loan disbursements

- Personal

- Repayments.

The Associated Products section allows for insertion or removal of existing products. It is especially useful when you wish to create a link between two products. You can insert or remove a product from the list or create a new one.

Click the Save and Reload button at the top right corner of the page.

In the Disbursement Matrix section, create or insert existing disbursement tranches, configured to fit the product. Usually used for corporate loans, such dividend payments or cash outflows are not done in equal amounts and usually trigger a recalculation in terms of interest. Add multiple such disbursements by clicking the Insert button. You can add:

-

Name.

-

Tranche Percent (%): the percentage of the final amount that goes towards the disbursement.

-

Start Month From Activation: the start month for the disbursement. It can be any month in the loan availability period.

-

Interest Percent (%): the interest percent for that particular disbursement.

-

Unusage Commission Percent (%): a commission paid for the loan amount unused.

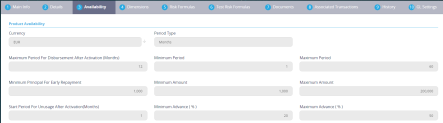

The Availability tab determines the monetary range and the time frame when the product is available for customers.

The following fields are available:

| Field | Required | Data Type | Details |

|---|---|---|---|

| Currency | Yes | Option set | Choose the currency for this banking product. |

| Period Type | No | Option set | Choose one:

NOTE The period type must be the same as the measurement unit of the Periodicity Type selected in the Details tab. |

| Maximum Period For Disbursement After Activation (Months) | No | Whole Number | The maximum period of disbursement after the this option is set. The number of months during which the disbursement must be made. |

| Minimum Period | No | Whole Number | The minimum duration of the product mentioned in the contract. |

| Maximum Period | No | Whole Number | The maximum duration of the product mentioned in the contract. |

| Minimum Principal For Early Repayment | No | Whole Number | The minimum principal for when early repayments are made. |

| Minimum Amount | No | Whole Number | The minimum amount of the product for which the bank opens a contract. |

| Maximum Amount | No | Whole Number | The maximum amount of the product for which the bank opens a contract. |

| Start Period For Unusage After Activation (Months) | No | Whole Number | The start period for unused amount after the activation. |

| Minimum Advance (%) | No | Numeric | The minimum advance percentage from the contract's financed value applicable at the contract level. |

| Maximum Advance (%) | No | Numeric | The maximum advance percentage from the contract's financed value applicable at the contract level. |

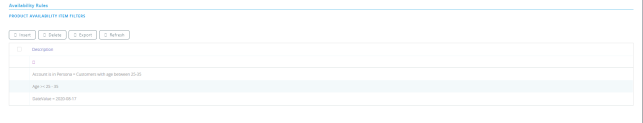

In the Availability Rules section you can select the item filters for the banking product. For more details, see Product Filter.

Click the Save and Reload button at the top right corner of the page.

In the Product Covenants section you can set certain conventions that applicants must abide by after getting the loan. This is usually applicable for corporate clients that must meet certain requirements in order to continue to receive disbursements. Click the Insert button to add a covenant to the product. You can select from 3 possible covenants:

-

Borrowers should perform tax obligations: the lenders expect the borrowers to perform their tax obligations to both the business and towards their employees. This covenant is of type affirmative.

-

Lender can monitor borrower's current ratio: the lender may continuously monitor the borrower's current ratio to ensure it stays relatively attractive and promising. This covenant is of type financial.

-

Lender posses the right to prevent merges or acquisitions: a clear stipulation that the lender possesses the right to prevent merges of acquisitions without proper notification or full knowledge of the process. This covenant is of type negative.

Each covenant can be attributed a value, an availability period, and a review frequency in months.

After all configurations are done, click the Save and Reload button.

For example, this is how it displays within a Digital Journey in the FintechOS Portal:

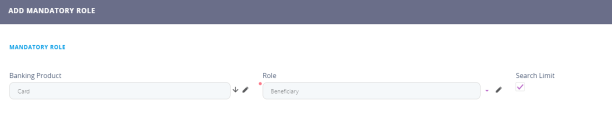

The Mandatory Roles section allows you to add the roles of the participants that are mandatory to exist at the contract level for contracts based on this banking product. In other words, when creating contracts based on banking products with Merchant role in this section, you must add a customer with the same Merchant role as contract participant, otherwise, the contract cannot be approved. When Search Limit is selected for a role on a banking product, Core Banking checks if the contract participant with this role has an attached limit configured with a limit type associated to the same role, in this case Merchant Exposure.

In the Mandatory Roles section, click Insert and fill in the following fields:

| Field | Required | Data Type | Details |

|---|---|---|---|

| Banking Product | Yes | Lookup | The banking product for which you define mandatory roles. This is automatically completed with the current banking product. |

| Role | Yes | Option set | Select the beginning value/ date for the filter. |

| Search Limit | Yes | Boolean | When Search Limit is selected for a role on a banking product, Core Banking checks if the contract participant with this role has an attached limit configured with a limit type associated to the same role. |

Click the Save and Reload button at the top right corner of the page.

The Dimensions tab displays the interests, commissions, insurances, discount and questions valid for a product.

You can insert, delete or export interest, commissions, insurances, discounts or questions. To add a new one, click Insert and fill-in the fields detailed in the sections below.

To configure the interest and commissions separately, navigate to Main > Banking Product Factory for Enterprise > Banking Product Dimensions menu which contains several other embedded menus.

Interest & Commissions

Click Insert. In the Interest & Commission Item page, fill in the following fields:

| Field | Required | Data Type | Details |

|---|---|---|---|

| Banking Product | Yes | Option set | Select the banking product. |

| Code | No | Text | Enter a code for this particular interest/ commission. |

| Item Name | Yes | Text | Enter a name. |

| Start Date | No | Date | The start date when the interest/ commission becomes effective. |

| End Date | No | Date | The end date for the interest/ commission. |

| Interest List | No | Option set | Select from which list the interest is a part of. |

| Commissions List | No | Option set | Select from which list the commission is a part of. |

| Minimum Interest Rate (%) | No | Numeric | Enter the percent applicable as a minimum interest rate at the contract level. |

| Is Negotiable | No | Bool | Select the checkbox to specify that every interest, commission or margin field at the contract level is negotiable and can be edited. |

Click the Save and Reload button at the top right corner of the page.

In the Interest & Commission Item Filters section, click Insert and fill in the following fields:

| Field | Required | Data Type | Details |

|---|---|---|---|

| Filter | Yes | Option set | Select a filter created earlier in the Product Filter. |

| Value/ Date | No | Text/Date | Select the beginning value/ date for the filter. |

| Until Value/ Until Date | No | Text/Date | Select the maximum value/ date for the filter. |

| Description | No | Text area | This field is automatically filled in after clicking the Save and Reload button. The values/ dates inserted above are turned into an expression. |

| For Lookup attributes | |||

| Filter | Yes | Option set | Select a filter created earlier in the Product Filter. |

| Option Set | No | Option set | It is automatically filled in with the option set name created for the attribute. |

| Description | No | Text area | It is left blank. Add a description if needed. |

| Grid of Options | No | Grid | This field is automatically filled in after clicking the Save and Reload button. The values of the option set are displayed. Select the bool for the values you wish to include in the filter. |

Click the Save and Reload button at the top right corner of the page.

Insurance

For any banking product, you can select a pre-existing insurance or create a new one. To add a new one, fill in the following fields:

| Field | Required | Data Type | Details |

|---|---|---|---|

| Banking Product | Yes | Option set | Select the banking product. |

| Code | No | Text | Insert a code for this particular insurance. |

| Item Name | Yes | Text | Insert a name. |

| Start Date | No | Date | It is the start date when the insurance becomes effective. |

| End Date | No | Date | It is the end date for the insurance. |

| Details | No | Text area | It is left blank. Add a description if needed. |

| Insurance List | No | Option set | Select from which list the insurance is a part of. |

Click the Save and Reload button at the top right corner of the page.

In the Insurance Item Filters section, click Insert and fill in the following fields:

| Field | Required | Data type | Description |

|---|---|---|---|

| Filter | Yes | Option set | The name inserted earlier. |

| Value | Yes | Text | The starting value for the attribute. |

| Until Value | Yes | Text | The ending value of the interval. |

| Description | No | Text area | Insert the proper description for the availability filter. |

Click the Save and Close button at the top right corner of the page.

Discounts

For any banking product, you can add discounts of any nature. You can select a pre-existing discount or create a new one.

Click the Insert button. In the Details page, fill in the following fields:

| Field | Required | Data Type | Details |

|---|---|---|---|

| Name | Yes | Text | Insert the appropriate name for the discount. |

| Discount | No | Option set | Choose one of the pre-configured types of discounts or create a new one. According to the selected type, new fields appear on the page requiring to be filled in. |

| Value discount | No | Numeric | Insert the value of the discount to be applied, e.g. 15. |

| Start date | Yes | Date | It is the start date when the discount becomes effective. |

| End date | Yes | Date | It is the end date for the discount. |

| Applied to dimension | No | Option set | Specifies for which product dimension this discount is applicable (interest, commission or insurance). This is autocompleted by the selected discount's dimension. |

| Commission type | No | Lookup | This field appears if the selected discount = Commission discount or Management Fee Discount. Specifies for which commission type this discount is applicable. This is autocompleted by the selected discount's default commission type. |

| Commission | No | Lookup | This field appears if the selected discount = Commission discount or Management Fee Discount. Specifies for which commission this discount is applicable. This is autocompleted by the selected discount's default commission. |

| Insurance class | No | Lookup | This field appears if the selected discount = Discount Life Insurance or Interest Discount. Specifies for which insurance class this discount is applicable (credit, home, life or other insurance class). This is autocompleted by the selected discount's insurance class. |

| Insurance | No | Lookup | This field appears if the selected discount = Discount Life Insurance. Specifies for which insurance this discount is applicable. This is autocompleted by the selected discount's insurance. |

| Interest type | No | Lookup | This field appears if the selected discount = Interest discount. Specifies for which interest type this discount is applicable. |

| Use Banking Formula | No | Bool | If you select this checkbox, the discount is calculated using the Banking Formula engine. |

| Is optional discount? | No | Bool | Selecting this checkbox results in the discount being applied only if the customer agrees to the discount. |

| Is percentage | No | Bool | If you select this checkbox, the discount is calculated as a percentage from the contract's amount. |

| Destination entity | No | Option set | Select the entity where to register the discount. This field opens when the Is optional discount? checkbox is selected. |

| Destination entity attribute | No | Option set | Select the attribute where to register the discount. This field opens when the Is optional discount? checkbox is selected. |

Click the Save and Reload button at the top right corner of the page.

In the Product Discount Item Filter section, click Insert and fill in the fields as specified in the Product Filter page. The fields displayed depend on the selected filter.

Click the Save and Reload button at the top right corner of the page.

Questions

Choose one or more questions to add to the banking product, or insert a new one.

To insert a new question, click Insert existing, then click Insert. In the Add Banking Product Question page, fill in the following fields:

| Field | Required | Data type | Description |

|---|---|---|---|

| Question | No | Text | Enter the appropriate name. |

| Answer Type | No | Option set |

Select the type of answer the customer has to give:

|

| Answer Entity | No | Option set | Select the entity where the answer is stored. |

| Answer Field | No | Option set | Select the attribute where the answer is stored. |

Click the Save and Reload button at the top right corner of the page.

The Banking Products List shows where the question is used.

The question has to be activated in order for it to be added to the banking product.

Click the Save and Close button at the top right corner of the page.

For example, this is how a question is displayed in a digital journey in the FintechOS Portal:

The Risk Formulas tab keeps formulas built with Formula Engine for the banking product. Such formulas can be used to determine the eligibility of a customer.

In the Banking Product Formula section, choose an already defined formula or click Insert to configure a new one, for example a formula for eligibility or scoring purposes. For information on how to build a formula, see Define Formula Inputs.

In the Add Banking Product Formula page, fill in the following fields:

| Field | Required | Data type | Description |

|---|---|---|---|

| Name | No | Text | Enter an appropriate name. |

| Banking Product | No | Option set | The name of the banking product is inserted automatically. |

| Formula Type | Yes | Option set | Select the type of formula configured before, e.g. scoring /eligibility. |

| Formula | Yes | Option set |

Select the previously configured formula. IMPORTANT!

The formula must be activated before attaching it to a product. |

After selecting the desired formula, click Save and reload, then click Map Data.

In the Formula Mapping page, click Input and configure the input data for the formula.

Click Output and configure the output for the formula.

Click the Save and Close button at the top right corner of the page.

Such formulas can be used in digital journey steps, for example when the customer inserts their financial data.

A good practice is to test the formula before displaying it in a digital journey. You can do that in the Test Risk Formulas tab.

Insert Test Scenario Type from the option set. The keys and the values are shown. Click the Save and Reload button at the top right corner of the page.

Click the Calculate button. The outputs are displayed in the Test Scenario Outputs section. These outputs can be saved by selecting the Save Output Data checkbox next to Calculate.

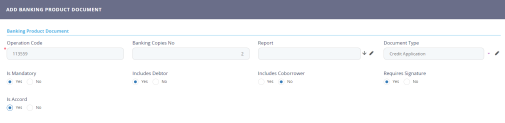

The Documents tab contains all the attached documents available for a product. The previously associated documents are displayed in the Banking Product Documents section.

To attach a new document to the banking product, click Insert and fill in the following fields:

| Field | Data Type | Description |

|---|---|---|

| Operation Code | Whole number | Enter a code for the document. |

| Banking Copies No | Whole number | Insert the number of copies made. |

| Report | Lookup | Select a document from the list. |

| Document Type | Option set | Select a document type from the list. |

| Is Mandatory | Bool | Select if the document is mandatory. |

| Includes Debtor | Bool | Select if the document includes the debtor. |

| Includes Coborrower | Bool | Select if the document includes the co-borrower. |

| Requires Signature | Bool | Select if the document requires to be signed. |

| Is accord | Bool | Select if the document represents the accord. |

Click the Save and Close button at the top right corner of the page.

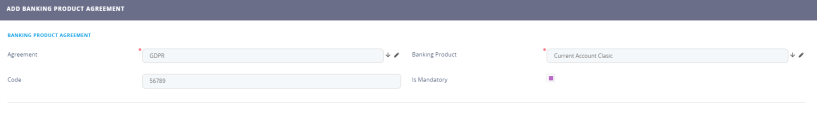

The agreements that a customer needs to go through are displayed in the Banking Products Agreement section. To attach a new agreement to the banking product, click Insert and fill in the following fields:

| Field | Required | Data Type | Description |

|---|---|---|---|

| Agreements | Yes | Option set | Select an agreement from the list. |

| Banking Product | Yes | Option set | It is automatically filled in. |

| Code | No | Whole number | Insert the corresponding code. |

| Is Mandatory | No | Bool | Select if the agreement is mandatory for the product. |

Click the Save and Close button at the top right corner of the page.

For more information on how to configure a contract or an agreement, see the Digital Document Processor.

The following transaction types are typically used for term loans:

-

Accruals and Provisions- System transaction. If added at banking product level, the accruals and provisions for contracts can be calculated on a daily basis.

This transaction type is not added automatically. Make sure you insert it in the Associated Transactions tab. -

Disbursement- If added at banking product level, the requested funds are transferred into the customer's account.

This transaction type is not added automatically. Make sure you insert it in the Associated Transactions tab. -

Early repayment- If added at banking product level, the customer can make a payment earlier than the stated maturity date of the contract.

This transaction type is not added automatically. Make sure you insert it in the Associated Transactions tab. -

Payment Holiday- If added at banking product level, the official bank holidays are considered when calculating a payment schedule.

This transaction type is not added automatically. Make sure you insert it in the Associated Transactions tab. -

Repayment- If added at banking product level, the customer can make a payment to cover the scheduled repayment amount.

This transaction type is not added automatically. Make sure you insert it in the Associated Transactions tab. -

Repayment Notification- If added at banking product level, the system generates and displays in the contract a repayment notification after each disbursement, containing the total amount to be paid off.

This transaction type is not added automatically. Make sure you insert it in the Associated Transactions tab. -

Reschedule Overdues- If added at banking product level, the system extends or adds extra time to an existing contract.

This transaction type is not added automatically. Make sure you insert it in the Associated Transactions tab. -

Reschedule Debt- If added at banking product level, the system recalculates the entire payment schedule by extending the time period for loan repayment.

This transaction type is not added automatically. Make sure you insert it in the Associated Transactions tab. -

Revert Disbursement- If added at banking product level, disbursements performed at contract level can be reverted after being performed.

This transaction type is not added automatically. Make sure you insert it in the Associated Transactions tab. -

Revert Transfer between my bank accounts- System transaction. If added at banking product level, transfers between the same customer's bank account can be reverted after being performed.

This transaction type is not added automatically. Make sure you insert it in the Associated Transactions tab. -

Transfer between my bank accounts- If added at banking product level, the customer is allowed to move funds between their accounts at the contract level.

This transaction type is automatically added in the Associated Transactions tab ifAllow Withdrawalswas selected in the Details tab.

Transactions types that are performed to and from a banking product are displayed in the Associated Transactions tab.

For each banking product, you must select a bank account to be used for transactions. Next to the Self Bank Account For Transactions field, select a value from the list to be the current account from which or to which the money is wired from or to.

This account must have the same currency as the product, because the translations are performed from and into this account.

In the Transaction Types section, you can associate possible transaction types with the selected banking product. Click Insert existing and select the desired transaction types.

Double-click a selected transaction type to edit it. In the Edit Transaction Type section, fill in the following fields:

| Field | Required | Data Type | Details |

|---|---|---|---|

| Transactions Operations Type | Yes | Option set | This field makes the connection with the transaction motor of bank accounts. Select one of the methods defined within the system. NOTE There is no integration at this point with a payment gateway. |

| Is Automatic Transaction | Yes | Bool | This checkbox marks the transaction as automatic. If selected here, then you cannot select it within the contract operations. |

| Is System Transactions | No | Bool | This checkbox marks the transaction as being neither a credit of the account, nor an allocation of funds, but a transaction that does not influence other transactions within the account. System transactions are meant to be used only for accounting. |

| Name | Yes | Text | Name of the transaction type. |

| Transaction Code | Yes | Text | The code of the transaction type. |

| Generates Accounting Entry | Yes | Bool | This checkbox allows you to create an entry in the general ledger. It generates records in the Accounting Entry entity. |

| Source Entity ID | Yes | Option set | The ID of the entity referenced by the accounting systems. |

| Generate New Contract Version | No | Bool | This checkbox allows you to specify if a new contract version should be generated by this transaction type. |

| Commission Type | No | Lookup | The transaction type for which this transaction type is applicable. |

You can also edit the information in the Transaction Value Types, Transaction Item Accounting Configurations and Transaction Accounting Models sections. Read more details about Transaction Types in the Operational Ledger User Guide.

Click the Save and Close button at the top right corner of the page.

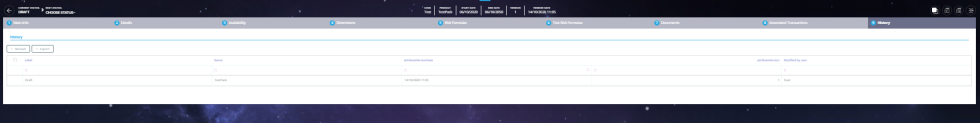

The History tab displays the versions of the banking product, their workflow status and the user who modified the product.

Here you can track the product's life cycle and review older versions that are no longer active (for details, see Banking Products' Life Cycle).

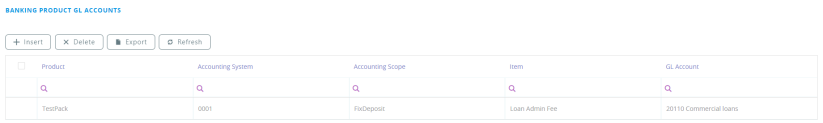

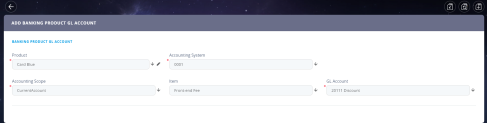

In the Banking Product GL Accounts section, you can set specific accounts to be used by the Operational Ledger system for transactions performed on contracts based on this banking product. Thus, you can overwrite the generic settings of the Operational Ledger, instructing it to use the accounts specified at banking product level.

To add specific accounts to be used by Operational Ledger, click Insert and fill in the following fields in the displayed Add Banking Product GL Account page:

| Field |

Required |

Data Type | Description |

|---|---|---|---|

| Product | Yes | Option set | Select from the list the banking product. Automatically completed with the banking product you are currently editing. |

| Accounting System | Yes | Option set | Select from the list the desired accounting system. The list contains the records created in the FTOS_GL_AccountingSystem entity. |

| Accounting Scope | Yes | Option set | Select from the list the corresponding accounting scope. The list contains the records created in the FTOS_GL_AccountingScope entity. |

| Item | No | Option set | Select from the list the corresponding transaction item. The list contains the records created in the FTOS_GL_TransactionItemAccountingConfig entity. |

| GL Account | Yes | Option set | Select from the list the corresponding GL account. The list is filtered based on the previously selected accounting system. It contains the accounts defined in the FTOS_GL_AccountingChart entity that were added to the chosen accounting system record. |

Click the Save and Reload button at the top right corner of the page.