Define Product Portfolio

The banking products associated with the customer, such as credit lines, personal loans, credit cards, and others are displayed in the Product Portfolio tab.

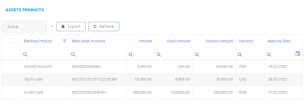

View Assets Products

The Asset Products section contains the contract types below. By default, active records are displayed, but inactive ones can also be viewed by changing the status filter to Inactive. To view additional information, double-click a record. Depending on the selected banking product, certain tabs are displayed.

A term loan is a banking product which defines a loan for a specific amount that has a specified repayment schedule and either a fixed or floating interest rate. For more details see the Term Loans page.

The Overview tab displays further elements such as the product type, account details, or contract details.

For the General Data section, the following data is displayed:

-

Banking Product: The customer's banking product name. For example: Current Account.

-

Amount: The term loan amount.

-

Main Bank Account: The main bank account number.

-

Used amount: The used amount.

-

Contract Number: The contract number.

-

Unused amount: The unused amount.

-

Activation Date: The activation date of the term loan.

-

Currency: The term loan currency.

-

Reimbursement Account: The current account used for collecting the installments.

-

Disbursement Account: The account where the disbursements are performed.

-

Close Date: The close date of the term loan.

For the Product Interest Rate section, the following data is displayed:

-

Product Interest: The interest rate applied to the banking product.

-

Margin: The margin.

-

Total Interest Rate: The total value of the interest rate.

-

Reference Rate: The reference rate of the overdraft valid at the reference date rate.

-

Reference Rate Date: The reference rate date.

For the Repayment Overview section, the following data is displayed:

-

Contract period: The contract period.

-

Contract Period Type: The contract period type for example: months years, and so on.

-

Maturity Date: The contract maturity date.

-

Due Date: The installment repayment date.

-

Number of Installments: The number of installments.

-

Periodicity Type: The time interval for the repayment schedule, for example: once, days, years, months, weeks.

-

Schedule Type: The schedule type, for example, equal installments, equal principal.

For the Grace Period section, the following data is displayed:

-

Principal Grace Period (Months): The value in months for the grace period for principal repayment of a contract.

-

Interest Grace Period (Months): The value in months for the grace period for interest repayment of a contract.

For the Contract Participants section, the following data is displayed:

-

Status No: The status of the participant: active or inactive.

-

Participant: The participant's name.

-

Role: The role of the participant in the contract.

-

Start Date: The start date of the contract.

-

End Date: The end date of the contract.

For the Contract Tranche section, the following data is displayed:

-

Status: The status of the contract tranche: active or inactive.

-

Tranche Date: The date of the disbursement tranche.

-

Tranche Percent: The percentage from the contract value (amount) that has to be disbursed with a tranche.

-

Amount: The amount from the contract value that has to be disbursed with this tranche.

-

Unusage Commission Percent: The commission percent applicable for the unused loan amount from a tranche

-

Interest Percent: The interest percent applicable for a tranche, if it is different from the interest rate applicable for the entire contract.

-

Created On: The record creation date.

-

External ID: The record external ID.

For the Contract Covenants section, the following data is displayed:

-

Covenant: The covenant, for example, the borrower should perform tax obligations, the lender can monitor the borrower's current ratio, the lender posses the right to prevent merges or acquisitions.

-

Value: The covenant value.

-

Covenant Type: The covenant type, for example: financial, affirmative, negative. For additional information see the Configure Availability section of the Current Accounts with Overdraft page.

-

Review Date: The date when the covenant has to be reviewed.

-

Review Frequency (Months): The number of months after which the covenant has to be reviewed.

-

Created On: The record creation date.

-

External ID: The record external ID.

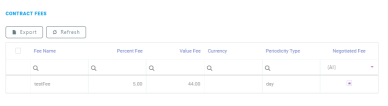

For the Contract Fees section, the following data is displayed:

-

Fee Name: The name of the fee.

-

Currency: The currency of the fee.

-

Periodicity Type: The type of periodicity. For example, monthly, quarterly, or annual.

-

Percent Fee: The commission percentage applicable, if the commission is defined as a percentage.

-

Negotiated Fee: If true, the fee is negotiated.

-

Value Fee: The commission value applicable, if the commission was defined as a value

-

Created On: The record creation date.

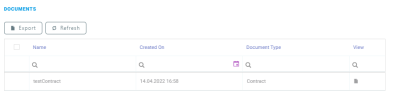

For the Documents section, the following data is displayed:

-

Account: The customer's account.

-

Contract: The contract number.

-

Document Type: Set Select the contract type from the following options: Agreement, Contract, Application, External Report, Statement, Other Documents.

-

Entity Id: The entity ID.

-

Entity: The entity name.

-

External ID: The external ID.

-

File: Select the document to attach it to the customer's account.

-

Name: The document name.

A credit card is a banking product that allows the customer to make purchases without bringing out any amount of cash. Instead, the customer borrows funds from the issuing bank, to make purchases. For more details see the Credit Cards page.

The Overview tab displays further elements such as the product type, account details, or contract details.

For the General Data section, the following data is displayed:

-

Banking Product: The customer's banking product name. For example: Current Account.

-

Amount: The term loan amount.

-

Main Bank Account: The main bank account number.

-

Used amount: The used amount.

-

Contract Number: The contract number.

-

Unused amount: The unused amount.

-

Activation Date: The activation date of the credit card.

-

Currency: The term loan currency.

-

Bank Account IBAN: The customer's IBAN number.

-

Close Date: The close date of the credit card.

For the Product Interest Rate section, the following data is displayed:

-

Product Interest: The interest rate applied to the banking product.

-

Margin: The margin.

-

Total Interest Rate: The total value of the interest rate.

-

Reference Rate: The reference rate of the overdraft valid at the reference date rate.

-

Reference Rate Date: The reference rate date.

For the Repayment Overview section, the following data is displayed:

-

Contract period: The contract period.

-

Contract Period Type: The contract period type for example: months years, and so on.

-

Maturity Date: The contract maturity date.

-

Due Date: The installment repayment date.

-

Minimum Payment amount: The minimum payment amount.

For the Grace Period section, the following data is displayed:

-

Credit Card Grace Period: The grace period for the credit card.

For the Contract Participants section, the following data is displayed:

-

Status: The status of the participant: active or inactive.

-

Participant: The participant's name.

-

Role: The role of the participant in the contract.

-

Start Date: The start date of the contract.

-

End Date: The end date of the contract.

For the Contract Covenants section, the following data is displayed:

-

Covenant: The covenant, for example, the borrower should perform tax obligations, the lender can monitor the borrower's current ratio, the lender posses the right to prevent merges or acquisitions.

-

Value: The covenant value.

-

Covenant Type: The covenant type, for example: financial, affirmative, negative. For additional information see the Availability section of the Current Accounts with Overdraft page.

-

Review Date: The date when the covenant has to be reviewed.

-

Review Frequency (Months): The number of months after which the covenant has to be reviewed.

-

Review Frequency (Months): The number of months after which the covenant has to be reviewed.

-

Review Frequency (Months): The number of months after which the covenant has to be reviewed.

-

Created On: The record creation date.

-

External ID: The record external ID.

For the Contract Fees section, the following data is displayed:

-

Fee Name: The name of the fee.

-

Currency: The currency of the fee.

-

Periodicity Type: The type of periodicity. For example, monthly, quarterly, or annual.

-

Percent Fee: The commission percentage applicable, if the commission is defined as a percentage.

-

Negotiated Fee: If true, the fee is negotiated.

-

Value Fee: The commission value applicable, if the commission was defined as a value

-

Created On: The record creation date.

For the Documents section, the following data is displayed:

Account: The customer's account.

Contract: The contract number.

Document Type: Select the contract type from the following options: Agreement, Contract, Application, External Report, Statement, Other Documents.

Entity Id: The entity ID.

Entity No: The entity name.

External ID: The external ID.

File: Select the document to attach it to the customer's account.

Name: The document name.

An Overdraft (Current Account with Overdraft) is an extension of the credit from a lending institution that is granted when an account reaches zero. For more details see the Overdrafts and the Current Accounts with Overdraft pages.

The Overview tab displays further elements such as the product type, account details, or contract details.

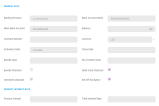

For the General Data section, the following data is displayed:

-

Banking Product: The customer's banking product name. For example: Current Account.

-

Bank Account IBAN: The customer's IBAN number.

-

Main Bank Account: The main bank account number.

-

Balance: The account's balance.

-

Contract Number: The contract number.

-

Currency: The account's currency.

-

Activation Date: The date the account was activated.

-

Close Date: The date account was closed.

-

Bundle Type: The bundle type.

-

No of Debit Cards: The number of debit cards associated with the account.

-

Bundle Attached: If true, the contract is part of a bundle.

-

Debit Card Attached: If true, the contract has a debit card attached.

-

Overdraft Attached: If true, the contract has an overdraft attached to the account.

-

Set Off Exception: If true, an exception is set.

For the Product Interest Rate section, the following data is displayed:

-

Product Interest: The interest rate applied to the banking product.

-

Total Interest Rate: The total value of the interest rate.

This section is displayed only for Current Accounts with Overdraft baking products.

For the General Data section, the following data is displayed:

-

Overdraft Contract Number: The contract number of the overdraft.

-

Amount: The amount of the overdraft.

-

Overdraft Activation Date: The overdraft activation date.

-

Used Amount: The used amount from the Amount field value.

-

Overdraft Close Date: The overdraft close date.

-

Unused Amount: The unused amount from the Amount field value.

For the Product Interest Rate section, the following data is displayed:

-

Overdraft Interest: The interest rate of the overdraft. For example: EURIBOR 3M, ROBOR 6M.

-

Overdraft Margin: The overdraft margin.

-

Overdraft Total Interest Rate: The total interest rate of the overdraft which is the sum of the overdraft margin + the overdraft reference rate.

-

Overdraft Reference Rate: The reference rate of the overdraft valid at the reference date rate.

-

Date for Review Overdraft Interest Rate: The review date of the overdraft interest rate.

-

Overdraft Reference Rate Date: The overdraft reference rate date.

For the Repayment Overview section, the following data is displayed:

-

Contract Period: The contract period.

-

Contract Period Type: The contract period type.

-

Maturity Date: The date of the final payment for the overdraft repayment.

For the Contract Participants section, the following data is displayed:

-

Status: The status of the participant: active or inactive.

-

Participant: The participant's name.

-

Role: The role of the participant in the contract.

-

Start Date: The start date of the contract.

-

End Date: The end date of the contract.

For the Contract Covenants section, the following data is displayed:

-

Covenant: The covenant, for example, the borrower should perform tax obligations, the lender can monitor the borrower's current ratio, the lender posses the right to prevent merges or acquisitions.

-

Value: The covenant value.

-

Covenant Type: The covenant type, for example: financial, affirmative, negative. For additional information see the Availability section of the Current Accounts with Overdraft page.

-

Review Date: The date when the covenant has to be reviewed.

-

Review Frequency (Months): The number of months after which the covenant has to be reviewed.

-

Created On: The record creation date.

For the Contract Fees section, the following data is displayed:

-

Fee Name: The name of the fee.

-

Currency: The currency of the fee.

-

Periodicity Type: The type of periodicity. For example, monthly, quarterly, or annual.

-

Percent Fee: The commission percentage applicable, if the commission is defined as a percentage.

-

Negotiated Fee: If true, the fee is negotiated.

-

Value Fee: The commission value applicable, if the commission was defined as a value

-

Created On: The record creation date.

For the Documents section, the following data is displayed:

-

Account: The customer's account.

-

Contract: The contract number.

-

Document Type: Select the contract type from the following options: Agreement, Contract, Application, External Report, Statement, Other Documents.

-

Entity Id: The entity ID.

-

Entity: The entity name.

-

External ID: The external ID.

-

File: Select the document to attach it to the customer's account.

-

Name: The document name.