Conveyancing

The bank needs a solicitor to send the conveyancing document, i.e., the transfer of legal title of real property from one person to another to validate the loan. After this step, the signing of the mortgage contract is done.

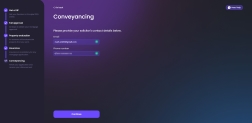

From My Mortgage Hub, click Continue to Conveyancing.

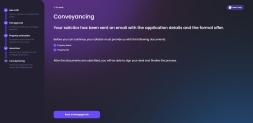

A confirmation message is displayed. Click Continue. The page reloads asking you to insert the solicitor's contact information. Insert the email address and the phone number of the solicitor that has the property deeds and the property title.

In the form driven flow > step SolicitorContactDetails > After Section Save, the scripts FTOS_BARET_MortgageGenerateContract and FTOS_BARET_ChangeApplicationStatusMortgage are called.

After inserting those details, click Continue. An email is sent to the solicitor's address with a link where to insert the documents.

Click Back to Mortgage Hub.

Solicitor's Flow

As a solicitor, follow these steps:

- Access your email address.

- Open the email sent to you.

- Click Upload documents.

-

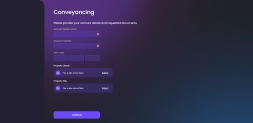

Fill in the following mandatory fields:

- Account holder name: Insert the account holder name.

- Account number: Insert the account number.

- Sort code: Insert three characters in each box.

- Property deeds: Upload the property deeds file.

- Property title: Upload the property title file.

-

Click Continue. An email is sent to the underwriter to be notified that you finished the process.

The underwriter must access to the documents submitted by the solicitor and change the business status depending on the result of the assessment. For details, see Back-Office Dashboard.

Applicant's Flow

You can view the status of the conveyancing flow by clicking the View Details link.

Conveyancing Passed

If the solicitor managed to upload the files and the underwriter to approve the documents uploaded (for details, see Changing the Business Status of a Customer), then this success screen is displayed.

Click Continue with Mortgage Signing.

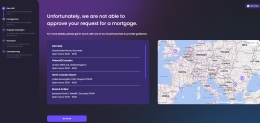

Conveyancing Failed

If the solicitor managed to upload the files and the underwriter to fail the application (for details, see Changing the Business Status of a Customer), then this reject screen is displayed.

This screen has a list with the available branches where you can go to seek professional help with your mortgage application and the map where they are located. Click Go Home to access the Welcome page.