Managing Automatic Invoice Payments

Core Banking identifies the invoices that are not paid on the day of payment specified in the agreement, using the Charge Not Paid Invoices service within the TPM Invoices (TPM) scheduled job. The system can automatically generate and process the payments for the invoices. The method of operating these payments depends on the setting of the ThirdPartyPaymentIsNet system parameter. The value of the parameter specifies whether Core Banking should generate one or two bank account transactions and payments for a third-party agreement invoice when the invoice's status is changed from Approved to Unpaid.

Depending on the

Third Party Invoice transaction type's Real Time Process field's value, the transactions made on bank accounts are processed in real-time, when the transaction is approved, or at a later time, after being placed in a queue and taken for processing by a specialized scheduled job.If ThirdPartyPaymentIsNet =False, when the invoice's status is changed from Approved to Unpaid, Core Banking generates one or two bank account transactions with the corresponding payments, as follows:

-

If

Total Amount To Recover > 0, one bank account transaction is generated, with source account =Settlement Accountand destination account =Reconciliation Accountwith the value ofTotal Amount To Recover, and with statusApproved. A payment is generated. -

If

Total Amount To Pay > 0, another bank account transaction with source account =Reconciliation Accountand destination account =Settlement Accountwith the value ofTotal Amount To Pay, and with statusApproved. A second payment is generated.

When

Total Amount To Pay > 0 , Total Amount To Recover > 0 , and both payments' statuses become Allocated, the invoice's status becomes Paid.If ThirdPartyPaymentIsNet =True, when the invoice's status is changed from Approved to Unpaid, Core Banking calculates the difference between Total Amount To Recover and Total Amount To Pay. Only one bank account transaction is generated and only one payment, representing the non-zero value between the Total Amount To Recover and the Total Amount To Pay, as follows:

-

If

Total Amount To Recover - Total Amount To Pay > 0, a new bank account transaction is generated with source account =Settlement Accountand destination account =Reconciliation Account, and a payment is generated for the invoice. -

If

Total Amount To Recover - Total Amount To Pay = 0, a bank account transaction is generated, and the transaction's status changes to Paid. -

If

Total Amount To Recover - Total Amount To Pay < 0, a new bank account transaction is generated with source account =Reconciliation Accountand destination account =Settlement Account, and a payment is generated for the invoice.

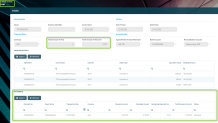

After automatically creating the payment records, Core Banking displays them for each invoice in the Invoice page's Payments section:

Each payment record in the list displays information about the payment number, payer's bank account name, transaction date, currency, payment amount, allocated amount, remaining payment amount, total payment amount, and status.

In the Payments section, you can search and open for viewing existing payment records, or delete payments in Draft status.

You can't edit any of the fields of a payment.

Any payment with a status different than Draft cannot be deleted

To view a third-party invoice payment record, follow these steps:

-

On the Invoice page's Payments section, double-click the desired payment. The Payment page is displayed.

-

View the following information about the selected payment:

-

Payment No - The number of the payment.

-

Customer - The name of the third-party entity associated with the payment.

-

Payer Name - The number of the payer bank account.

-

IBAN - The IBAN of the account where the money is being paid.

-

Transaction Date - The date of the payment transaction.

-

Currency - The currency of the payment.

-

Bank Reference - The bank reference for the payment.

-

Bank Charge - The amount charged by the bank for performing this transaction.

-

Total Payment Amount - The sum of the payment amount and the bank charge value.

-

Payment Amount - The amount of the payment.

-

Allocated Amount - The amount that was already allocated as a contract's repayment for a notification for the selected customer.

-

Unallocated Amount - The amount that remains to be allocated as a contract's repayment for a notification for the selected customer.

-

Comments - Any comments referring to the payment.

-