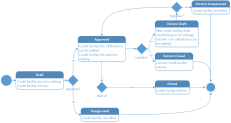

Credit Facility Life Cycle and States

Credit facilities are complex agreements between a bank and its customers. Therefore the four-eyes principle is applicable here, meaning that a record should be approved by a second bank employee, with higher authorization rights.

A credit facility record has the following business workflow statuses:

-

Draft - the status of a newly created credit facility record that was not yet sent for approval. While in this status, you can edit the fields from the record's Credit Facility tab, but you can't add utilizations to it. Send the record to approval after editing all the necessary details.

-

Pending - a system status applied to credit facilities sent for approval, but not yet approved. You can't perform any updates in this system status.

-

Approved - the status of a credit facility record after being authorized by a user with credit facility approval competencies. While in this status, you can't edit the record's details, but you can add utilizations to it within the Credit Facility Utilizations tab. If you need to alter the credit facility's details, create a new version based on the current credit facility.

NOTE

Each facility utilization must also be approved by a user with credit facility utilization approval competencies, otherwise, the disbursement of the utilization is performed by Core Banking. -

Unapproved - the last status of a credit facility, after manually canceling it directly from Draft status. You can't perform any updates on the record.

-

Closed - the last status of a credit facility, after manually closing it or after creating a new version based on the current version. You can't perform any updates on the record.

In order to use the credit facility, it must be in the Approved status.

Credit Facility Versioning

Core Banking allows you to create new versions for an existing credit facility if you need to modify an existing approved one.

A credit facility version can have the following statuses:

-

Version Draft - the status of a newly created credit facility version record that was not yet sent for approval. While in this status, you can edit some fields, but you can't add utilizations to it. Send the record to approval after editing all the necessary details.

-

Approved - the status of a credit facility version record after being authorized by a user with credit facility approval competencies. While in this status, you cannot edit the record's details, but you can add utilizations to it.

-

Version Closed - the last status of a credit facility version, after manually closing it or after creating another new version based on the current version. You can't perform any updates on the record.

Credit Facility Life Cycle

First, an agreement is made between a financial institution and a customer - usually, a legal entity, for the customer to have easy access to funds whenever in whichever banking product they need it. The amount cannot exceed the customer's approved Total Exposure type limit.

This agreement is recorded in the financial institution's system by a clerk, in the form of a credit facility. All details of the agreement are captured while creating the credit facility record: who are the participants with access to funding, what's the usable amount in the chosen currency, what products can be used within this agreement, when is the agreement applicable, under which conditions, whether the facility's amount increases or decreases over time, and so on. The clerk fills in all the mandatory details, saves the record still in Draft status, and then sends it for approval.

Another employee of the financial institution, with higher authorization rights and with credit facility competencies, consults the record and approves or rejects the credit facility, depending on the details entered before by the creator of the record. If rejected, the credit facility's status becomes Closed.

If approved, the credit facility, now in Approved status, can be used by the customer to access funds. Its details cannot be altered anymore, but the clerk can add utilizations to it up until the credit facility's maturity date, in the form of contracts for banking products listed in the credit facility.

These utilizations, being in fact banking contracts, after creation are still in Draft status, and thus have to be further approved by a second employee of the bank, with corresponding contract approval rights. After being approved, a utilization disburses its amount in the customer's account. This amount is taken from the credit facility, thus the available amount is lowered with the sum of the approved utilization.

The total amount of approved utilizations, in any of the banking products' currencies, cannot exceed the amount approved in the credit facility, calculated in the facility's currency based on the exchange rate valid on each day.

Fee values and accruals are calculated for the approved utilizations and displayed in the Credit Facility Utilizations tab, along with any repayment notifications.

You can manually close credit facilities if needed. Records in Closed status cannot be altered in any way.

If you have to update the details of an approved credit facility, then you must create a new version of the record. The new version of the record is created in Draft status, thus restarting the life cycle.

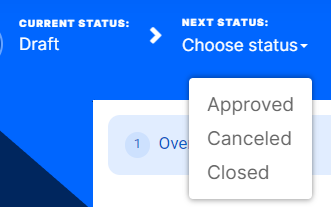

Changing Credit Facility Statuses

You can manage a credit facility's life cycle by changing its status from the top right corner of the screen.

The credit facility status transitions are illustrated below:

Note that:

- Once a record is live, its settings can no longer be modified.

- If you want to update the details of a live credit facility, you must create a new credit facility version.

- When you create a new credit facility version, the current version is retired; no updates are allowed on the retired version.

- Every credit facility version starts in a draft state and must go through an approval process before going live.

- Only one version of a credit facility can be live at one time.

As a best practice, new records or new versions of existing records created on a specific day should be approved on the same day.