Creating Credit Facilities

A credit facility is a grouping of multiple credit products that a customer has arranged with a financial institution under a single credit limit.

Before creating a credit facility, make sure that:

-

the customer is recorded in Core Banking,

-

a settlement account (a current account contract for the same customer) is set up for the desired currency,

-

and the limits are configured according to Core Banking's setup.

To create a new credit facility:

-

Open the Credit Facility page as described in the Managing Credit Facilities section.

-

Click the Insert button to display the Add Credit Facility page.

The Credit Facility tab requires the basic elements for the creation of a credit facility such as customer, facility amount and currency, period, attached customer limit. Other important details such as participants, products, plans, fees, and contract covenants are captured in specialized sections of the same tab. -

Fill in the following fields, also available for completion when updating a record in Draft status:

-

Customer - Select from the list the name of the customer with whom the financial institution agreed upon the credit facility.

Changing the selected customer at a later point of the record creation process leads to emptying theCurrent AccountandCustomer Limitfields, if these were already selected. -

Currency - Select from the list the currency of the credit facility. If the banking products attached to the credit facility are defined in different currencies, then their values are converted in this currency when calculating the facility's available amount.

Changing the selected currency at a later point of the record creation process leads to emptying theCurrent Accountfield, if this was already selected. -

Facility Amount - Enter the amount agreed upon to grant within the credit facility, expressed in the currency selected above.

The facility amount cannot exceed the selected customer limit's value.

-

Facility Date - Select the date when the facility becomes active.

The maturity date is automatically calculated following the formula:Facility Date+ (Period*Period Type). -

Period Type - Select from the list the period type for the facility's validity.

-

Period - Enter the number of periods during which the facility is valid.

-

Customer Limit - Select a customer limit from the list of limits approved for the chosen customer. The list is already filtered to display only the selected customer's already approved Total Exposure type limits that have

Is Revolving = Trueat the limit level.NOTE

The previously entered facility amount cannot exceed the selected customer limit's value. -

Current Account - Select the customer's bank account where the credit facility amount can be disbursed. The list is already filtered to display only the selected customer's bank accounts in the currency selected before for the credit facility.

-

-

Optionally, view or fill in the following fields:

-

Approval Date - This is the date when the credit facility record is approved by a user with credit facility approval competencies. This date is automatically displayed when the record's status changes to Approved.

-

Review Date - Enter the date when the credit facility's amount should be reviewed for possible adjustments.

-

Maturity Date - This is the automatically calculated maturity date of the credit facility. You can modify this date from the attached calendar, if needed.

-

Is Revolving - Select this checkbox to mark the credit facility as revolving. This means that the customer can borrow money repeatedly up to the entered facility amount while repaying a portion of the current balance due in regular installments. Each payment, minus the interest and fees charged, replenishes the available amount.

-

Interest - Select from the list the interest applicable for the credit facility amount. The list is already filtered to display only the interests defined in the selected currency.

-

Margin - Enter a margin for the credit facility amount.

-

Max Utilization Date - Select from the calendar the maximum date when the credit facility's available amount can be disbursed through utilizations.

-

Available Amount - This is the amount still available in the credit facility after disbursing the amounts specified in the approved utilizations, expressed in the facility's currency.

At creation time,Available Amount=Facility Amount.

-

-

Click the Save and Reload button.

When creating a credit facility, fill in all the mandatory fields. After saving the credit facility, all the other sections of the Credit Facility page become visible and can be completed.

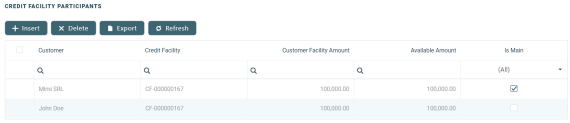

You can insert, delete, or export customers who can participate in this credit facility within the Credit Facility Participants section. After the first save operation, Core Banking adds the customer as the main facility participant. If the customer is a group, then all the group members are also added.

To add a participant, follow these steps:

-

Click the Insert button to display the Credit Facility Participant page.

-

Fill in, modify or view the following fields:

-

Customer - Select from the list the name of the customer who can participate to the selected credit facility.

-

Customer Facility Amount - This is automatically filled with the facility amount. You can modify the amount that this specific participant can use within the credit facility. The entered amount cannot exceed the available amount of the facility.

-

Available Amount - This read-only field displays the available amount of the facility.

-

-

Click the Save and Close button.

For information purposes, the Credit Facility Participant page also displays the Facility Utilizations section, containing a list with all the credit facility utilizations corresponding to the selected customer. You cannot perform any action on the records within this list.

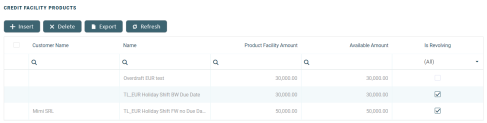

You can insert, delete or export banking products which can be utilized through this credit facility in the Credit Facility Products section.

To add a banking product, follow these steps:

-

Click the Insert button to display the Credit Facility Products page.

-

Fill in, modify or view the following fields:

-

Product Facility Amount - This is automatically filled with the facility amount. You can modify the amount that can be disbursed through the use of this product within the credit facility's utilizations. The entered amount cannot exceed the facility amount.

-

Available Amount - This read-only field displays the available amount of the facility.

-

Allowed Customer - Select from the list the customers who is allowed to use this banking product through credit facility utilizations, if the use of this banking product has to be restricted to certain customers. The list is already filtered to display only the customers defined as participants in this credit facility record.

-

Banking Product - Select from the list the banking product that can be used through credit facility utilizations.

-

Is revolving - Select this checkbox to mark the banking product used through the credit facility utilizations as revolving. This means that the customer can borrow money repeatedly up to the entered product facility amount while repaying a portion of the current balance due in regular installments. Each payment, minus the interest and fees charged, replenishes the available amount.

-

-

Click the Save and Close button.

For information purposes, the Credit Facility Products page also displays the Facility Utilizations section, containing a list with all the credit facility utilizations already created for the selected banking product. You cannot perform any action on the records within this list.

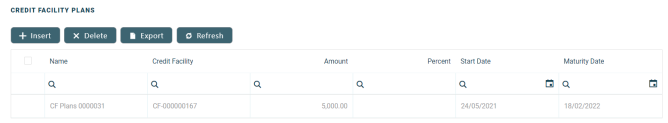

You can insert, delete or export plans for the increase or decrease of the facility amount during the credit facility's duration in the Credit Facility Plans section.

To add a plan, follow these steps:

-

Click the Insert button to display the Credit Facility Plans page.

-

Fill in, modify or view the following fields:

-

Amount - Enter the amount which affects the credit facility plan. Use negative values if you wish to decrease the facility amount. Positive values increase the facility amount. This field is mandatory only if

Percentis not filled in, otherwise, it can't be completed. -

Periodicity Type - Select from the list the periodicity type applicable for the facility plan. The possible values are

Semestrial, Weekly, Monthly, Annual, Bimonthly, Trimestrial, Once, 4 Weeks. -

No Times - Enter the number of times the plan should increase or decrease of the facility amount, until the credit facility's maturity date.

-

Percent - Enter the percent of facility amount which affects the credit facility plan. Use negative percent values if you wish to decrease the facility amount. Positive percent values increase the facility amount. Mandatory only if

Amountis not filled in, otherwise, it can't be completed. -

Start Date - Select from the calendar the first date when the plan should be executed. Depending on the periodicity type and number of times already completed for plan execution, the maturity date of the plan is calculated. The plan's maturity date cannot exceed the credit facility's maturity date.

-

Maturity Date - This read-only field displays the plan's maturity date based on the start date, periodicity type and number of times already completed for plan execution.

-

-

Click the Save and Close button.

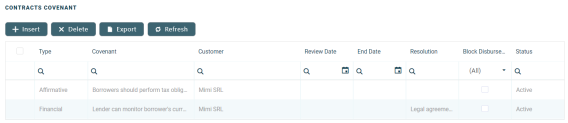

You can insert, delete or export covenants, certain conventions that customers must abide by after getting the facility in the Contract Covenants section.

To add a covenant, follow these steps:

-

Click the Insert button to display the Contracts Covenant page.

-

Fill in, modify or view the following fields:

-

Covenant - Select from 3 possible covenants:

- Borrowers should perform tax obligations - the lenders expect the borrowers to perform their tax obligations to both the business and towards their employees. This covenant is of affirmative type.

- Lender can monitor borrower's current ratio - the lender may continuously monitor the borrower's current ratio to ensure it stays relatively attractive and promising. This covenant is of financial type.

- Lender posses the right to prevent merges or acquisitions - a clear stipulation that the lender possesses the right to prevent merges of acquisitions without proper notification or full knowledge of the process. This covenant is of negative type.

-

Value - Enter the value for the covenant.

-

Covenant Type - This field displays the type of the selected covenant. You can edit it, selecting one the possible values:

Financial, Affirmative, orNegative. -

Review Frequency (Months) - Enter the number of months applicable for the covenant review frequency.

-

Review Date - Enter the date when the covenant should be reviewed.

-

Customer - Select the customer who must abide by the covenant's terms. The list is already filtered to display only the customers defined as participants in this credit facility record.

-

-

Click the Save and Reload button.

Core Banking displays a series of fields after the save operation. -

Fill in the following fields:

-

Grace Period (Months) - Enter the number of months acting as grace period for this covenant's resolution, if applicable.

-

Resolution - Select from the list the resolution of this covenant, if applicable.

-

Resolve Date - Enter the date when the covenant is achieved, if applicable.

-

End Date - Enter the last day when this covenant is applicable.

-

Start Early Termination - If you select this checkbox, then the credit facility agreement is terminated before its maturity date.

-

Block Disbursement - If you select this checkbox, then Core Banking blocks any further disbursements if the covenant is not achieved after end date.

-

-

Activate the covenant by changing its status to Active.

-

Click the Save and Close button.

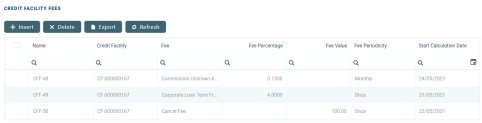

You can insert, delete or export fees or commissions that are added to this credit facility in the Credit Facility Fees section.

To add a fee, follow these steps:

-

Click the Insert button to display the Credit Facility Fees page.

-

Fill in, modify or view the following fields:

-

Credit Facility - This read-only field displays the id of the selected credit facility record.

-

Start Calculation Date - Enter the start date for fee calculation.

-

Fee - Select a fee to apply to the credit facility from the list of defined fees & commissions.

-

Fee Value, Fee Percentage, and Fee Periodicity - These read-only fields display the value, the percentage, and the periodicity of the selected fee, as defined in Core Banking.

-

Use specific day for aggregation - Enter a day of the month when the fee accrual should be aggregated.

-

Use End Of Month for Aggregation - Select the checkbox to mark the last day of the month as aggregation day for the fee accrual. Mandatory only if the

Use specific day for aggregationfield is not completed.

-

-

Click the Save and Reload button.

A new list, Credit Facility Fee Values, is displayed for viewing after the save operation, containing the calculated fee values for the saved fee. The list displays the fee name, date, value and currency.

After filling in all the mandatory details in the Credit Facility tab, the record is still in Draft status. Change its status to Send to Approved to send it for approval.

You can add utilizations only for credit facility records with Approved status.