Interest Definition Best Practices

This page presents a series of recommendations about defining interests to be used in conjunction with banking products and contracts based on these banking products. For step by step instructions on how to add interests and how to fill in each field on the page, please read the dedicated Interests section.

General Notes

-

The validity period of an interest (the period between the values entered in the

Valid fromandValid tofields) is the taken into consideration when searching for the values of each interest. -

The system performs validations to ensure that the time intervals for interest validity do not overlap. It also ensures that the interest has a valid value at any given time of a contract's life cycle.

-

Penalty calculations are applied to overdue payment amounts in contracts, while interests are applied to remaining payment amounts.

You can specify that an interest is penalty if you select theIs Penaltycheckbox in the Interest page:

We advise against defining collection interests for penalties. Instead, create interests for penalties using Business Formulas.

The following sections display examples of each interest type's typical definition:

The base type interest is used for calculating the variable type, i.e. EURIBOR or IRCC. The EURIBOR base type interest is updated on a daily bases by the European Central Bank.

Define base type interests by selecting Interest Type = Base Type and entering values for determined intervals of time. The following picture shows how the value of a base type interest differs depending on its validity period:

The variable interest is an interest rate formed from a Base Type interest + a variable percent, e.g. EURIBOR + 4%.

Define variable interests by selecting Interest Type = Variable, selecting a predefined base interest from the list, then entering values for the variable percents for determined intervals of time. The following picture shows how the value of a variable interest differs depending on its validity period:

The collection interest is a combination of previously defined fixed and/ or variable interest rates. It can be used for fixed to float interest contracts. The validation of each composing interest is performed on intervals. For example, for a term loan contract, the bank may apply a fixed interest for the first 12 months of the contract, then for the second and third year another fixed interest, and then for the remaining period a variable interest rate.

Define collection interests by selecting Interest Type = Collection, then selecting predefined interests as elements of the collection that are applicable on specific time intervals and depending on the contract's number of installment. The system performs validations to ensure that the time intervals and the installment intervals do not overlap and no time or installment interval is left undefined.

The following picture shows how the value of a collection interest differs depending on the contract's number of the installments:

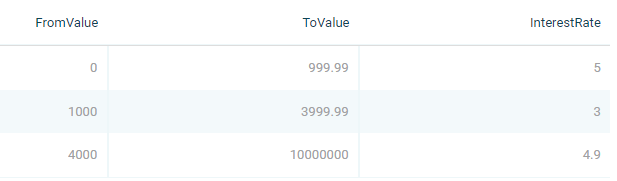

The banded interest, applicable for contracts based on current account with overdraft banking products, can be defined as a collection of values that is applied depending on the amount. For example, the bank wants to apply an interest rate of 5% for borrowed amount between 1 and 999.99, an interest rate of 3 % for the amounts between 1000 and 3999.99, and an interest rate of 4.9% for amounts surpassing 4000.

Example of a banded interest:

Define several banded interests by selecting Interest Type = Fixed or Interest Type = Variable and entering values for determined intervals of time. Later, create a Collection interest type, select the Is For Overdraft checkbox, and use the previously defined banded interests to define the values applicable for overdraft amount intervals.

The following picture shows how three banded interests are used within a collection type interest to define bands of different value to be applied for different amounts of overdraft contracts:

Banded interest can be used only for Current Account with Overdraft banking products.

You can define penalty interests of any interest type, including Banking Formula interest type.

Here's an example of a penalty interest of Banking Formula type, with the Banking Formula Type = PenaltyFormula:

Make sure you mark the Is Penalty checkbox, then decide whether the penalty should be applied to all operation items that are overdue or not and mark the Is General checkbox accordingly.

You can't define values for the interest rates calculated based on banking formulas within the Edit Interest page.

To use such penalty interest rate at a banking product level, in the banking product level's Dimension tab, first attach an interest & commission item with an interest list containing the penalty interest defined earlier, with the same banking formula type (in this case PenaltyFormula), as in the example below:

Next, in the banking product's Product Formula Engine's tab, insert the actual banking formula, using the same formula type PenaltyFormula, selecting a pre-built formula and a formula mapping.

You can attach only one banking formula of a specific type to a banking product within the Product Formula Engine's tab. For example, you can't attach two formulas of the same

PenaltyFormula type to a product.For contracts based on such approved banking products, the applicable penalty rate is automatically updated by Loan Management during contract creation according to the definition set at the Banking Product Factory level.