Banking Product Type

The banking product types are the types of products that can be created using Banking Product Factory. Banking products inherit the behavior you set for banking product types, thus easing the banking product creation process. The values you set here are later inherited by banking products created based on this specific product type. You can view and change the inherited values at the product level, most of them within the Details tab.

You can create banking product types based on the banking product models used by financial institutions: bank account, card, deposit, mortgage, term loan, and so on. During product definition, it is important to choose the right type of product to build, because the displayed fields depend on this choice.

Banking Product Factory enables you to define the desired banking product types by managing the records in the Banking Product Type menu:

-

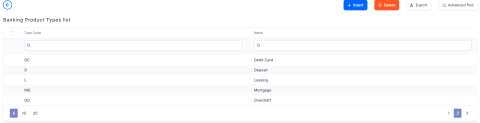

In the main menu, click Product Factory > Banking Product Dictionaries > Banking Product Type, and the Banking Product Type List page opens.

-

On the Banking Product Type List page, you can: create a new banking product type record, associate transaction types, interest scopes, country calendars, and payment schedule types, to a banking product type, edit an existing record (except its product type and its bank account type), delete, or search for a specific record.

NOTE

You can insert, update, or delete records if you have the associated role of Banking Product Admin.

The following preset banking product types come with the Banking Product Factory packages and are ready to be used as a basis for defining your banking products:

| Banking Product Type | Recommended to be used when creating the following types of Banking Products |

| BNPL | "buy now, pay later" type loans, term loans |

| Credit Card | credit cards |

| Current Account | bank accounts, current accounts |

| Current Account with Overdraft | current accounts with overdraft |

| Debit Card | debit cards |

| Deposit | deposits |

| Leasing | leasings |

| Mortgage | mortgage loans |

| Overdraft | overdrafts |

| Savings | savings accounts |

| Secured Loan | secured loans, term loans |

| Unsecured Loan | unsecured loans, term loans |

| Working Capital | revolving loans, term loans |

Creating Banking Product Type Records

Follow these steps to create new banking product type records:

-

Click the Insert button on the Banking Product Type List page. The Add Banking Product Type page is displayed. A series of fields from the Default Values section of the page are automatically filled in, to aid the product type definition process.

-

Fill in the following fields in the Main Information section:

-

Type Code: Enter the unique code of the banking product type.

-

Name: Enter the name of the new banking product type.

-

Product Type: Select from the drop-down the product type.

-

Bank Account Type: Select from the drop-down the new bank account type to be used with the new banking product type.

-

-

Fill in or modify the following fields in the Default Values section:

-

Allow Refinance - If you select this checkbox, the banking product type is marked as allowing refinancing for contracts. The checkbox is selected by default, but you can change its value.

-

Allow Restructuring - If you select this checkbox, the banking product type is marked as allowing restructuring for contracts. The checkbox is selected by default, but you can change its value.

-

Allow Codebtor - If you select this checkbox, the banking product type is marked as allowing codebtors for contracts. The checkbox is selected by default, but you can change its value..

-

Max No Codebtor - Enter the maximum number of codebtors allowed for contracts based on this banking product type.

-

Auto Disbursement - If you select this checkbox, the banking product type is marked for automatic disbursement of funds at the contract approval. The checkbox is selected by default, but you can change its value.

-

Max No Disbursement - Enter the maximum number of disbursements allowed for contracts based on this banking product type. Default value: null, for unlimited number.

-

Grace Type - Select the type of grace applicable for contracts based on this banking product type. You can choose between

none, for no grace,Interest, for the grace period applied for the interest of the contract,Principal, for the grace period applied for the principal amount of the contract, orBoth, for the grace period applied for the interest and the principal amount of the contract. -

Product Grace - This is mandatory if you selected a grace type. Select the product grace applicable to contracts based on this banking product type.

-

Period Type - Select the period type applicable to contracts based on this banking product type. Possible values: days, weeks, months, years, once, or none.

-

Holiday Shift - If you select this checkbox, the banking product type is marked to use the holiday shift method for schedule due day calculation for contracts. The checkbox is not selected by default, but you can change its value.

IfHoliday Shift = False, thenDefer Due Date = False,Holiday Shift Method = False, and you can't modify them. -

Defer Due Date - If you select this checkbox, the banking product type is marked for deferring the due date when it falls on a holiday in the used country calendar. The checkbox is not selected by default, but you can change its value.

-

Holiday Shift Method - Select the holiday shift method used for schedule due day calculation for contracts based on this banking product type. Possible values: forward, backward, or none.

-

-

Click the Save and Reload button. The new banking product type record is saved.

You can proceed to associate transaction types, interest scopes, country calendars, and payment schedule types, all in dedicated sections of the Edit Banking Product Type page, as follows:

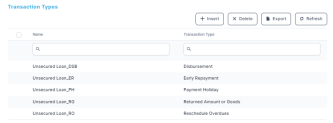

The transaction types associated to a banking product type are the ones available for that type of product. These transactions are automatically associated when creating a new banking product. However, you can remove the associated transactions that should not be available for a specific product at the banking product level's Lean Core tab.

Follow these steps to create association records between a transaction type and a banking product type:

-

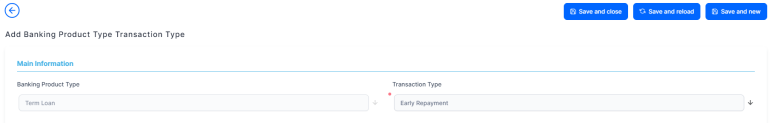

On the Edit Banking Product Type page, within the Transaction Types section, click the Insert button. The Add Banking Product Type Transaction Type page is displayed.

-

Fill in the following fields:

-

Banking Product Type: Automatically filled with the banking product type. It can't be edited.

-

Transaction Type: Select from the drop-down the transaction type to be associated with the new banking product type. There is a unique constraint for the association between a banking product type and a transaction type.

-

-

Click the Save and Reload button. The new association between the transaction type and banking product type is saved. The name of the record is automatically updated as

banking product name_transaction type code, for exampleTerm Loan_DSBfor the association betweenTerm Loanbanking product type andDisbursementtransaction type.

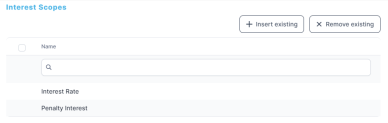

The interest scopes associated to a banking product type determine the scopes of the interests available for that type of product. These interest scopes are automatically associated when creating a new banking product.

Follow these steps to create association records between an interest scope and a banking product type:

-

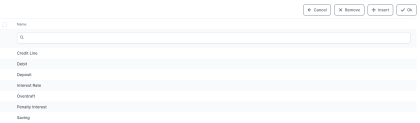

On the Edit Banking Product Type page, within the Transaction Types section, click the Insert existing button. A selection page is displayed, allowing you to choose the scope of the interest from the following values:

Credit Line, Debit, Deposit, Interest Rate, Overdraft, Penalty Interest, andSaving. -

Select the desired interest scope from the list and click Ok. The interest scope is associated to the banking product type.

-

You can delete an associated interest scope, if you need to, by selecting it from the list and clicking Delete.

-

Click the Save and Reload button. The new association between the interest scope and banking product type is saved.

The following associations of interest scopes to existing banking product types are already in place within Banking Product Factory:

| Banking Product Type | Pre-Associated Interest Scopes |

| BNPL | Interest Rate, Penalty Interest |

| Credit Card | - |

| Current Account | Interest Rate, Penalty Interest |

| Current Account with Overdraft | Interest Rate, Penalty Interest, Overdraft |

| Debit Card | Interest Rate, Penalty Interest |

| Deposit | Deposit |

| Leasing | - |

| Mortgage | Interest Rate, Penalty Interest |

| Overdraft | Interest Rate, Penalty Interest, Overdraft |

| Savings | - |

| Secured Loan | Interest Rate, Penalty Interest |

| Unsecured Loan | Interest Rate, Penalty Interest |

| Working Capital | Interest Rate, Penalty Interest |

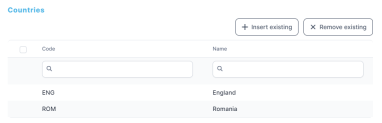

The country calendars associated to a banking product type are the ones available for that type of product. These country calendars are automatically associated when creating a new banking product. However, you can remove the associated country calendars that should not be available for a specific product at the banking product level's Details tab.

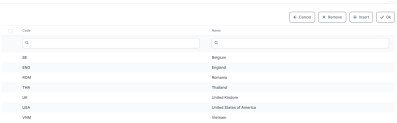

Follow these steps to create association records between a country calendar and a banking product type:

-

On the Edit Banking Product Type page, within the Countries section, click the Insert existing button. A selection page is displayed, allowing you to choose the country calendar from the already created records.

-

Select the desired country calendar from the list and click Ok. The country calendar is associated to the banking product type.

-

You can delete an associated country calendar, if you need to, by selecting it from the list and clicking Delete.

-

Click the Save and Reload button. The new association between the country calendar and banking product type is saved.

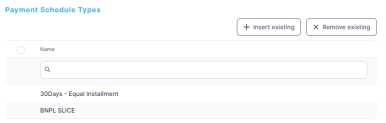

The payment schedule types associated to a banking product type are the ones available for that type of product. These payment schedule types are automatically associated when creating a new banking product. However, you can remove the associated payment schedule types that should not be available for a specific product at the banking product level's Details tab.

Follow these steps to create association records between a payment schedule type and a banking product type:

-

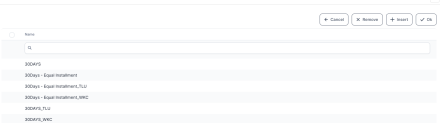

On the Edit Banking Product Type page, within the Payment Schedule Types section, click the Insert existing button. A selection page is displayed, allowing you to choose the payment schedule type from the already created records.

-

Select the desired payment schedule type from the list and click Ok. The payment schedule type is associated to the banking product type.

-

You can delete an associated payment schedule type, if you need to, by selecting it from the list and clicking Delete.

-

Click the Save and Reload button. The new association between the payment schedule type and banking product type is saved.