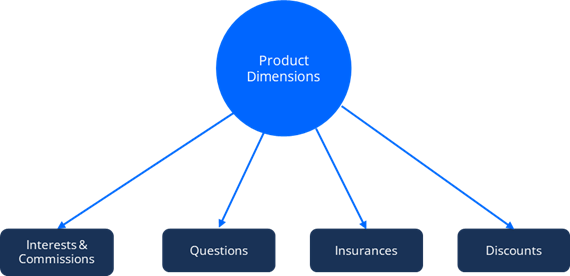

Product Dimensions

Since inflation affects the interest, it is mandatory to keep track of the changes, to register any new values for the rates and apply them to customers. Commissions are equally important, they represent the fees the bank has for offering a product or service. Fees keep the business going, being a steady flow of money to the bank's revenue. To stay competitive, financial institutions apply discounts to the two mentioned above. For contracting a loan, for example, a customer takes on an insurance. This insurance is part of the product dimensions. Lastly, to determine important details about a customer when they are applying for a product, it is important to have questions for the "Know Your Customer" process to determine their eligibility.

The Product Dimensions group together the notions of interest and commissions and helps you manage the variety of interest rates and the multitude of commissions used for your banking products: commissions and commissions list, interest and interest list, insurance and insurance list, discounts and questions.

There are two possible options for building the product dimensions:

- Expand the Banking Product Dimensions menu and configure each of the items enumerated above with its respective menu in the Innovation Studio.

- Another option is to start building the banking product and configure the dimensions in the banking product's page > Dimensions tab.