Core Banking System Parameters

The system parameters used by Core Banking determine the behavior of all the contracts, transactions, limits, and other parts that make up your Core Banking system.

Do not confuse the Core Banking system parameters with the FintechOS system parameters, stored in the

systemparameter and systemParameterOnPortalProfile entities!Here's the list of system parameters used by Core Banking, along with their description:

It represents the analytic character used when displaying decimal numbers.

Module that uses the system parameter: Loan Admin

Parameter type: Text

Default value: .

It specifies if all accounting entries are generated real-time (for True value) or on demand (for False value).

Module that uses the system parameter: Loan Admin

Parameter type: Boolean

Default value: False

It specifies if the advance to be paid in a contract is displayed in a new repayment notification record (for False value) or included in the front-end fee repayment notification (for True value).

Module that uses the system parameter: Loan Admin

Parameter type: Boolean

Default value: False

When set to True, the approval of a contract only switches the change of business status of the contract to Approved, and the following approval processes, such as generating a main bank account, updating the contract with the main bank account number, if the Auto Disbursement = True then perform the disbursement event, generate a repayment schedule, generate and then process repayment notifications, are written to a queue and then are treated asynchronously by the Async Contract Approval (CB) scheduled jobFalse, the approval processes are all synchronous, at the moment when you trigger the approval.

Module that uses the system parameter: Loan Admin

Parameter type: Boolean

Default value: False

This parameter instructs the system how to process bank account transaction operations. Possible values:

Total- the system creates 4 operations – 2 for debit and 2 for credit for the transaction value and sum(fees)Individual- the system creates 2 * (1+NoFees) operations – debit and credit for the transaction value and each fee.

Module that uses the system parameter: Loan Admin

Parameter type: Text

Default value: Total

It specifies whether the accrual and provision should be calculated for early repayments with the event value equal to a part of contract's unpaid amount (partial early repayments) or only for full early repayments.

-

For

Truevalue, the accrual and provision is calculated for any early repayment event value. -

For

Falsevalue, the accrual and provision is calculated only for full early repayment event value.

For each early repayment event, the accrual and provision is calculated only if it was not calculated before for the current system date.

Module that uses the system parameter: Loan Admin

Parameter type: Boolean

Default value: Set it according to the bank's policy.

The maximum year in the calendar to be used when generating holidays for calendars. Format: YYYY.

Module that uses the system parameter: Loan Admin

Parameter type: Whole Number

Default value: 2100.

The minimum year in the calendar to be used when generating holidays for calendars. Format: YYYY

Module that uses the system parameter: Loan Admin

Parameter type: Whole Number

Default value: 2019.

It represents the default limit of credit facility records.

Module that uses the system parameter: Loan Admin

Parameter type: Whole Number

Default value: 30.

It represents the number of days before the overdraft feature's expiration date of a current account when the contract based on that banking product gets displayed in the Soon to Expire Ovedrafts dashboard.

Module that uses the system parameter: Loan Admin

Parameter type: Whole Number

Default value: 30.

It handles the change on a customer's contracts once the

Direct Debit Settlement Account attribute at the customer level is switched to true or false.

-

If

CustomerToContractDirectDebitSettlementAcc = False, the changes from the customer level for direct debit settlement do not impact existing contracts, and only the manual repayment notifications of the affected customer change their status accordigly. -

If

CustomerToContractDirectDebitSettlementAcc = True, the changes at the customer level for direct debit settlement impact current contracts. All the customer's existing contracts' Direct Debit Settlement Account settings are changed according to the setting at the customer level, and all the repayment notifications associated to the customer change their status accordingly.

Module that uses the system parameter: Loan Admin

Parameter type: Boolean

Default value: Set it according to the bank's policy.

It represents the default number of calendar days that a record will be kept in Draft status before it is purged. The records that are due to be purged on the current day and have their transaction type's To Be Purged field marked as True are displayed in the Records To Be Purged Dashboard, within the section specific to the record's transaction type. The job performing the deletion is Delete Purged Entries and it should be scheduled at the bank's level.

The custom job error records are also purged at the interval given by this parameter.

Module that uses the system parameter: Loan Admin

Parameter type: Whole Number

Default value: Set it according to the bank's policy.

It represents the default number of days before an installment's due date in order for that installment to be included in the Future Installments report within the Reports Dashboard.

Module that uses the system parameter: Loan Admin

Parameter type: Whole Number

Default value: 15.

It represents the default number of days after an unpaid installment's due date in order for that installment to be included in the Past Due Installments report within the Reports Dashboard.

Module that uses the system parameter: Loan Admin

Parameter type: Whole Number

Default value: 25.

It represents the default number of months considered when running the reports within the Limit Report dashboard.

Module that uses the system parameter: Loan Admin

Parameter type: Whole Number

Default value: 12

It represents the default sales channel for contracts defined via API integration.

Module that uses the system parameter: Loan Admin

Parameter type: Lookup. To entity SalesChannel

Default value: Set it according to the bank's policy.

It represents the default sales channel for contracts defined through the Core Banking user interface.

Module that uses the system parameter: Loan Admin

Parameter type: Lookup. To entity SalesChannel

Default value: Set it according to the bank's policy.

It represents the default number of delay days for blocking the approval of new loan contracts for customers who have overdue payments. New contract approval is blocked by Core Banking if the customer has overdue days >= the value of the DelayDaysForBlockNewContractApproval parameter.

Module that uses the system parameter: Collection

Parameter type: Whole Number

Default value: 0

It specifies if the deposit interest is split in two lines or displayed in one line.

- For

Falsevalue, the system splits the Deposit interest to recover in two lines (- paid interest -> recover all; sight interest to pay, pay all). - For

Truevalue, the system displays the Deposit interest to recover in one line with the aggregate value.

Module that uses the system parameter: Loan Admin

Parameter type: Boolean

Default value: False.

It specifies whether to generate a separate repayment notification for the early repayment fee of a contract (for True value) or include the fee into the repayment notification containing the actual early repayment amount (for False value).

Module that uses the system parameter: Loan Admin

Parameter type: Boolean

Default value: False.

It specifies the commission type used for automatic notification on contract approval (Inclusion)/ or notification daily process (Exclusion).

Module that uses the system parameter: Loan Admin

Parameter type: Lookup. To entity CommissionType

Default value: Front-end Fee.

It specifies whether Core Banking should calculate (for True value) or not (for False value) the provisions in the accruals and provisions processes.

Module that uses the system parameter: Loan Admin

Parameter type: Boolean

Default value: False.

It specifies the currency in which all the amounts are displayed within the Contracts Overview section of the Loan Admin Officer Dashboard.

Module that uses the system parameter: Loan Admin

Parameter type: Lookup. To entity: Currency

Default value: EUR

It represents the default number of days considered when running the reports within the Loan Admin Officer Dashboard.

Module that uses the system parameter: Loan Admin

Parameter type: Numeric

Default value: 365

It specifies whether Core Banking should use the latest available exchange rates for calculations or not.

Module that uses the system parameter: Loan Admin

Parameter type: Boolean

Default value: True.

It specifies whether Core Banking should include APRC (annual percentage rate of charge) for repayment schedule calculations or not.

Module that uses the system parameter: Loan Admin

Parameter type: Boolean

Default value: True.

It specifies whether Core Banking should validate the limits for individual customers or only validate them for legal entity customers.

- For

Falsevalue, Core Banking does not validate any limits for the individual customers. - For

Truevalue, Core Banking validates all the limits for the individual customers the same way it does for legal entity customers.

Module that uses the system parameter: Loan Admin

Parameter type: Boolean

Default value: True.

It specifies whether job errors should be logged (for True value) as custom job error records or not (for False value). The custom job error records are purged at the interval given by the DaysBeforePurge parameter.

Module that uses the system parameter: Loan Admin

Parameter type: Boolean

Default value: False.

The default allocation method used by Core Banking for manual repayment notifications that aren't linked to a contract.

Module that uses the system parameter: Collection

Parameter type: Lookup. To entity: AllocationMethod

Default value: CostOrder

The parameter is used to set up the maturity date on manual repayment notification, if the notification is not linked to a contract.

Module that uses the system parameter: Collection

Parameter type: Whole Number

Default value: Set it according to the bank's policy.

The parameter holds the penalty interest list used for penalty calculation for manual repayment notifications that are not linked to a contract.

Module that uses the system parameter: Banking Product

Parameter type: Lookup. To entity: InterestList

Default value: ManualPenaltyInterestList

It specifies whether a banking product can have only one Repayment Fee type commission on its Commission List or more. This parameter affects the Contract Event page.

- For

Falsevalue, the banking product has only one Repayment Fee commission type on its commission list. - For

Truevalue, the banking product's commission list displays all the commissions stored in theCommissionentity with type Repayment Fee.

Read more information about the effects of this parameter's value in the Transaction Fees section.

Module that uses the system parameter: Loan Admin

Parameter type: Boolean

Default value: True.

It specifies the number of days used to select the old data from the schedule job log to be purged.

Module that uses the system parameter: Loan Admin

Parameter type: Whole Number

Default value: 1.

Specifies how Core Banking treats situations when the funds of the reconciliation account associated with the banking product used in the contract would go below zero if a disbursement event would be approved.

- For

NoMessagevalue, there is no error or warning message displayed if the disbursement event that is being approved would result in a negative balance of the associated reconciliation account. The event can be approved and the balance can go below zero. - For

Warningvalue, there is a warning message displayed if the disbursement event that is being approved would result in a negative balance of the associated reconciliation account. The event can be approved and the balance can go below zero. - For

Errorvalue, there is an error message displayed if the disbursement event that is being approved would result in a negative balance of the associated reconciliation account. The event can't be approved and the balance can't go below zero.

This is a system-wide setting, applicable to events for contracts based on all banking products without a specified Negative balance treatment value. Core Banking also takes into consideration the settings used at the banking product level (the Negative balance treatment field's value next to Reconciliation Account). Thus, if the value is specified at the banking product level, then that value takes precedence over the system parameter's setting.

Module that uses the system parameter: Banking Product

Parameter type: Option Set. Values from option set: WarningErrorTreatment

Default value: Warning.

The commission type used for notification daily process (Exclusion).

Module that uses the system parameter: Loan Admin

Parameter type: Lookup. To entity: CommissionType

Default value: Repayment Fee

It specifies whether Core Banking should generate one or two bank account transactions and payments for a third-party agreement invoice when the invoice's status is changed from Approved to Unpaid.

For False value, two bank account transactions are generated with two payments:

- One transaction with source account =

Settlement Accountand destination account =Reconciliation Accountwith the value ofTotal Amount To Recover; - Another transaction with source account =

Reconciliation Accountand destination account =Settlement Accountwith the value ofTotal Amount To Pay.

For True value, Core Banking calculates the difference between Total Amount To Recover and Total Amount To Pay. Only one bank account transaction is generated and only one payment, representing the non-zero value between the Total Amount To Recover and the Total Amount To Pay, as follows:

- If

Total Amount To Recover - Total Amount To Pay > 0, a new bank account transaction is generated with source account =Settlement Accountand destination account =Reconciliation Account, and a payment is generated for the invoice. - If

Total Amount To Recover - Total Amount To Pay = 0, a bank account transaction is generated, and the transaction's status changes to Paid. - If

Total Amount To Recover - Total Amount To Pay < 0, a new bank account transaction is generated with source account =Reconciliation Accountand destination account =Settlement Account, and a payment is generated for the invoice.

When the payments are approved, the invoice's status becomes Paid.

Module that uses the system parameter: Loan Admin

Parameter type: Boolean

Default value: False

It contains the list of allowed roles to choose from in the third-party agreement form.

Module that uses the system parameter: Banking Product

Parameter type: Text

Default value: Merchant,Insurer,Broker,Agent

It specifies the commission for not using the funds. The commission type used for Credit Facility accrual daily process.

Module that uses the system parameter: Loan Admin

Parameter type: Lookup. To entity: CommissionType

Default value: False.

It specifies the commission for usage of funds. The commission type used for Credit Facility accrual daily process.

Module that uses the system parameter: Loan Admin

Parameter type: Lookup. To entity: CommissionType

Default value: Commission Usage Monthly

It specifies whether your installation uses the Credit Facility module for Core Banking Corporate or not.

- For

Truevalue, the Credit Facility module is used, the Credit Facility menu item is displayed within the Core Banking Operational menu, and the credit facility features are available in the Loan Admin Officer Dashboard. - For

Falsevalue, the Credit Facility module isn't used, the Credit Facility menu item is not displayed within the Core Banking Operational menu, and the credit facility features are not available in the Loan Admin Officer Dashboard.

Module that uses the system parameter: Loan Admin

Parameter type: Boolean

Default value: True

Loan classification works by risk contamination at the customer and the group levels. This means that if a loan contract belonging to a customer is classified as one of a higher risk due to delays in the repayment process, all the other loans of the customer and of the group where the customer is a member are further classified into that high-risk classification. Read more about loan classification in this dedicated page.

This parameter specifies whether Core Banking should use the risk contamination for loan classification or not.

- For

Truevalue, risk contamination is used for loan classification, thus one unpaid contract affecting all the loan contracts of that customer. - For

Falsevalue, risk contamination is not used for loan classification, thus unpaid contracts don't affect other loan contracts of the same customer.

The parameter affects only the EOD and SOD jobs.

Module that uses the system parameter: Loan Admin

Parameter type: Boolean

Default value: True

It specifies whether your installation uses the Operational Ledger module or not. The Operational Ledger module comes within a different digital asset than Core Banking, thus its use is optional.

- For

Truevalue, the GL module is used and the GL Settings tab is displayed at banking product level. - For

Falsevalue, the GL module is not used and the GL Settings tab does not display at banking product level.

Module that uses the system parameter: Loan Admin

Parameter type: Boolean

Default value: True

It specifies if the Third-Party Management package is installed on your system. If UseTPM = True, the system triggers the queueing of the transactions based on their contract and event ids. Also:

- For

Truevalue, the third-party management related features are available in the Loan Admin Officer Dashboard. - For

Falsevalue, the third-party management related features are not available in the Loan Admin Officer Dashboard.

Module that uses the system parameter: Loan Admin

Parameter type: Boolean

Default value: False. It is automatically updated to True when the TPM package is installed.

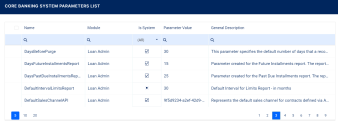

Managing Core Banking System Parameters

You must have the

system administrator user right to view and manage the Core Banking system parameters.In order to manage the system parameters used by your FintechOS Core Banking installation, follow these steps:

-

In FintechOS Portal, click the main menu icon and expand the Admin Configurations menu.

-

Click Core Banking System Parameter menu item to open the Core Banking System Parameters List page.

On the Core Banking System Parameters List page, you can add new system parameters or search, edit, and delete existing ones.

You can't delete parameters marked as Is System or edit anything else except their value.

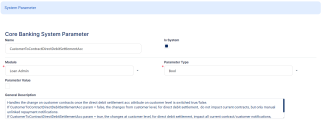

Follow these steps to create new system parameters to be used with Core Banking:

-

Click Insert button on the Core Banking System Parameters List page to display the System Parameter page.

-

Fill in the following fields:

-

Name - Enter a suggestive name for the parameter.

-

Is System - Select the checkbox to specify that the parameter cannot deleted or edited, except its value. Leave the checkbox empty if this parameter can be changed or deleted.

-

Module - Select the Core Banking module that uses the system parameter.

-

General Description - Enter a detailed description for the system parameter.

-

Parameter Type - Select the data type of the parameter. Possible values:

Text, Date, Date Time, Invariant Date, Whole Number, Numeric, Option SetandEntity.

-

-

Fill in the rest of the fields, depending on the selected data type:

-

Entity - For Lookup parameter type, select the entity from where you need to pick a record as parameter value.

-

Option Set - For Option Set parameter type, select the option set from where you need to pick a value as parameter value.

-

Parameter Value - Enter the value of the default parameter. Depending on the selected parameter type, you can either enter a value, select the checkbox or select record:

-

For

Text, Date, Date Time, Invariant Date, Whole Number, Numericparameter types, enter the desired value taking in consideration the data type's format. -

For

Booleanparameter types, select the checkbox to specify aTruevalue, or deselect for aFalsevalue. -

For

Lookupparameter type, select the desired record from the previously selected entity that acts as parameter value. -

For

Option Setparameter types, select the desired value from the previously selected option set that acts as parameter value.

-

-

-

Click the Save and Reload button.