Groups

Core Banking allows users to define not only customers, but groups of customers as well. A corporate group or group of companies is a collection of parent and subsidiary corporations that function as a single economic entity through a common source of control. Both legal entity and individual customers can be added to groups, or you can create groups of individual customer. This can be helpful if you need to monitor group exposure for a household or a company and its shareholders together.

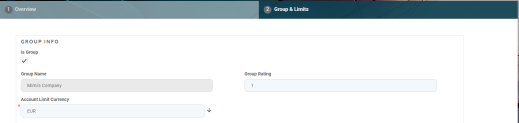

To define a group, select the checkbox Is Group from the Group&Limits tab of the Customer page, accessible through the Core Banking Operational > Customer Core menu. After the field is checked, the group name is automatically populated with the customer’s name and you can insert a rating and a limit currency for that group.

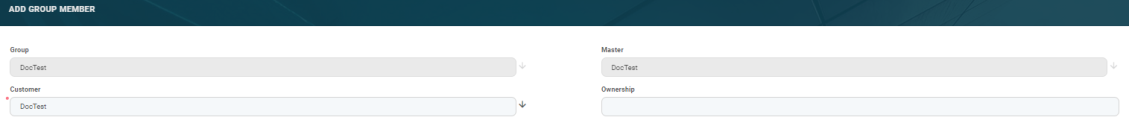

New members of the group are added by clicking the Insert button from the Group Members section. If a member has other members associated with it, they are all displayed in the same section. For a more clear picture of the group, you can insert an ownership percent, determined by dividing the number of shares they own by the number of outstanding shares.

Companies that also have subsidiary companies (sometimes referred to as child companies) can add them by clicking the Insert button from the Group Members tab. Therefore, a customer’s child company is displayed in the Group Members tab.

For a more clear picture of parent companies, there is one more section available, called Holding Companies. Thus, a customer’s parent companies is displayed in the Holding Companies section.

If a customer is a child company for more than one company that are part of different groups, it impacts the available limit amount of the group to which it was first added.