Creating Credit Facilities for Legal Entities

Credit facility records are created in FintechOS Portal, on the Credit Facility page. To create a new credit facility, click the Insert button on the top right side of the page. A new page opens, with a series of tabs that assist you in configuring the credit facility:

-

Credit Facility tab - The first tab requires the basic elements for the creation of a credit facility such as customer, facility amount and currency, period, attached customer limit, participants, products, plans, fees, and contract covenants.

-

Credit Facility Utilizations tab - This tab contains all the details of the credit facility such as facility utilizations, fee values, accruals and repayment notifications.

-

History tab - The last tab displays the versions of the credit facility, along with workflow status and the user who modified the product.

The Credit Facility tab requires the basic elements for the creation of a credit facility such as customer, facility amount and currency, period, attached customer limit. Other important details such as participants, products, plans, fees, and contract covenants are captured in specialized sections of the same tab.

Credit Facility Details Section

The following fields are available for completion when creating or updating a record in Draft status:

| Field | Required | Data Type | Details |

|---|---|---|---|

| Customer | Yes | Lookup | Select from the list the name of the customer with whom the bank agreed upon the credit facility. Changing the selected customer at a later point of the record creation process leads to emptying the Current Account and Customer Limit fields, if these were already selected. |

| Currency | Yes | Lookup | Select from the list the currency of the credit facility. If the banking products attached to the credit facility are defined in different currencies, then their values will be converted in this currency when calculating the facility's available amount. Changing the selected currency at a later point of the record creation process leads to emptying the Current Account field, if this was already selected. |

| Facility Amount | Yes | Numeric | Enter the amount agreed upon to grant within the credit facility, expressed in the currency selected above. NOTE The facility amount cannot exceed the selected customer limit's value. |

| Facility Date | Yes | Invariant Date | Select the date when the facility becomes active. The maturity date is automatically calculated following the formula: Facility Date + (Period * Period Type). |

| Approval Date | No | Invariant Date | Read-only field. It displays the date when the credit facility record is approved by a user with credit facility approval competencies. This date is automatically displayed when the record's status changes to Approved. |

| Review Date | No | Invariant Date | Enter the date when the credit facility's amount will be reviewed for possible adjustments. |

| Period Type | Yes | Option Set | Select from the list the period type for the facility's validity. The maturity date is automatically calculated following the formula: Facility Date + (Period * Period Type). |

| Period | Yes | Whole Number | Enter the number of periods during which the facility is valid. The maturity date is automatically calculated after filling this field, following the formula: Facility Date + (Period * Period Type). |

| Maturity Date | No | Invariant Date | This field displays the automatically calculated maturity date of the credit facility. You can modify this date from the attached calendar, if needed. |

| Customer Limit | Yes | Lookup | Select a customer limit from the list of limits approved for the chosen customer. The list is already filtered to display only the selected customer's already approved Total Exposure type limits that have Is Revolving = True at the limit level.NOTE The previously entered facility amount cannot exceed the selected customer limit' value. |

| Current Account | No | Lookup | Select the customer's bank account where the credit facility amount can be disbursed. The list is already filtered to display only the selected customer's bank account in the currency selected before for the credit facility. |

| Is Revolving | No | Boolean | If the checkbox is selected, then the credit facility is marked as revolving. This means that the customer can borrow money repeatedly up to the entered facility amount while repaying a portion of the current balance due in regular installments. Each payment, minus the interest and fees charged, replenishes the available amount. |

| Interest | No | Lookup | Select from the list the interest applicable for the credit facility amount. The list is already filtered to display only the interests defined in the selected currency. |

| Margin | No | Numeric | Enter a margin for the credit facility amount. |

| Max Utilization Date | No | Invariant Date | Select from the calendar the maximum date when the credit facility's available amount can be disbursed through utilizations. |

| Available Amount | No | Numeric | Read-only field. It displays the amount still available in the credit facility after disbursing the amounts specified in the approved utilizations, expressed in the facility's currency. At creation time, Available Amount = Facility Amount. |

Click the Save and Reload button at the top right corner of the page.

When creating a credit facility, fill in all the mandatory fields. After saving the credit facility, all the other sections of the Credit Facility page become visible and can be completed.

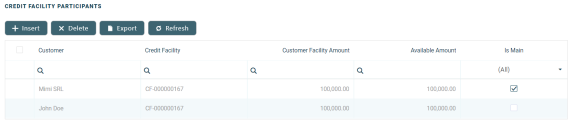

Credit Facility Participants Section

In the Credit Facility Participants section, you can insert, delete or export customers who can participate in this credit facility. After the first save operation, the customer is added as the main facility participant. If the customer is a group, then all the group members are also added.

To add a participant, click Insert and fill in the following fields:

| Field | Required | Data Type | Details |

|---|---|---|---|

| Customer | Yes | Lookup | Select from the list the name of the customer who can participate to the selected credit facility. |

| Customer Facility Amount | Yes | Numeric | Automatically filled with the facility amount. You can modify the amount that this specific participant can use within the credit facility. The entered amount cannot exceed the available amount of the facility. |

| Available Amount | No | Numeric | Read-only field. It displays the available amount of the facility. |

For information purposes, the Credit Facility Participant page also displays the Facility Utilizations section, containing a list with all the credit facility utilizations corresponding to the selected customer. You cannot perform any action on the records within this list.

Click the Save and Close button at the top right corner of the page.

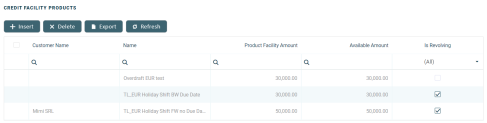

Credit Facility Products Section

In the Credit Facility Products section, you can insert, delete or export banking products which can be utilized through this credit facility.

To add a banking product, click Insert and fill in the following fields:

| Field | Required | Data Type | Details |

|---|---|---|---|

| Product Facility Amount | Yes | Numeric | Automatically filled with the facility amount. You can modify the amount that can be disbursed through the use of this product within the credit facility's utilizations. The entered amount cannot exceed the facility amount. |

| Available Amount | No | Numeric | Read-only field. It displays the available amount of the facility. |

| Allowed Customer | No | Lookup | Select from the list the customers who is allowed to use this banking product through credit facility utilizations, if the use of this banking product has to be restricted to certain customers. The list is already filtered to display only the customers defined as participants in this credit facility record. |

| Banking Product | Yes | Lookup | Select from the list the banking product that can be used through credit facility utilizations. |

| Is revolving | Yes | Boolean | If the checkbox is selected, then the banking product used through the credit facility utilizations is marked as revolving. This means that the customer can borrow money repeatedly up to the entered product facility amount while repaying a portion of the current balance due in regular installments. Each payment, minus the interest and fees charged, replenishes the available amount. |

For information purposes, the Credit Facility Products page also displays the Facility Utilizations section, containing a list with all the credit facility utilizations already created for the selected banking product. You cannot perform any action on the records within this list.

Click the Save and Close button at the top right corner of the page.

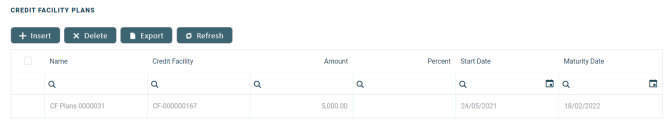

Credit Facility Plans Section

In the Credit Facility Plans section, you can insert, delete or export plans for the increase or decrease of the facility amount during the credit facility's duration.

To add a plan, click Insert and fill in the following fields:

| Field | Required | Data Type | Details |

|---|---|---|---|

| Amount | Yes | Numeric | Mandatory only if Percent is not filled in, otherwise it can't be completed. Enter the amount which affects the credit facility plan. Use negative values if you wish to decrease the facility amount. Positive values increase the facility amount. |

| Periodicity Type | Yes | Option set | Select from the list the periodicity type applicable for the facility plan. The possible values are:

|

| No Times | Yes | Whole Number | Enter the number of times the plan should increase or decrease of the facility amount, until the credit facility's maturity date. |

| Percent | Yes | Numeric | Mandatory only if Amount is not filled in, otherwise it can't be completed. Enter the percent of facility amount which affects the credit facility plan. Use negative percent values if you wish to decrease the facility amount. Positive percent values increase the facility amount. |

| Start Date | Yes | Invariant Date | Select from the calendar the first date when the plan should be executed. Depending on the periodicity type and number of times already completed for plan execution, the maturity date of the plan is calculated. The plan's maturity date cannot exceed the credit facility's maturity date. |

| Maturity Date | No | Invariant Date | Read-only field. It displays the plan's maturity date based on the start date, periodicity type and number of times already completed for plan execution. |

Click the Save and Close button at the top right corner of the page.

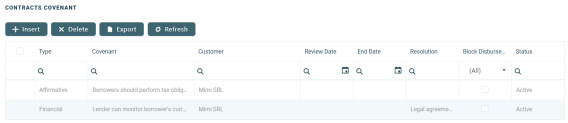

Contract Covenants Section

In the Contract Covenants section, you can insert, delete or export covenants, certain conventions that customers must abide by after getting the facility.

You can block any further disbursements of the facility utilizations if you select the

Block Disbursements checkbox next to a covenant in Active status within this section.To add a covenant, click Insert and fill in the following fields:

| Field | Required | Data Type | Details |

|---|---|---|---|

| Covenant | No | Lookup | Select from 3 possible covenants:

|

| Value | No | Numeric | Enter the value for the covenant. |

| Covenant Type | No | Option set | This field displays the type of the selected covenant. You can edit it, selecting one the possible values:

|

| Review Frequency (Months) | No | Whole Number | Enter the number of months applicable for the covenant review frequency. |

| Review Date | No | Invariant Date | Enter the date when the covenant should be reviewed. |

| Customer | Yes | Lookup | Select the customer who must abide by the covenant's terms. The list is already filtered to display only the customers defined as participants in this credit facility record. |

Click the Save and Reload button at the top right corner of the page.

A series of fields are displayed for completion after the save operation:

| Field | Required | Data Type | Details |

|---|---|---|---|

| Grace Period (Months) | No | Whole Number | Enter the number of months acting as grace period for this covenant's resolution, if applicable. |

| Resolution | No | Lookup | Select from the list the resolution of this covenant, if applicable. |

| Resolve Date | No | Invariant Date | Enter the date when the covenant is achieved, if applicable. |

| End Date | No | Invariant Date | Enter the last day when this covenant is applicable. |

| Start Early Termination | No | Boolean | If you select this checkbox, then the credit facility agreement is terminated before its maturity date. |

| Block Disbursement | No | Boolean | If you select this checkbox, then Core Banking blocks any further disbursements if the covenant is not achieved after end date. |

Remember to activate the covenant by changing its status to Active.

Click the Save and Close button at the top right corner of the page.

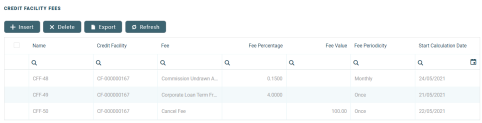

Credit Facility Fees Section

In the Credit Facility Fees section, you can insert, delete or export fees or commissions that are added to this credit facility.

To add a fee, click Insert and fill in the following fields:

| Field | Required | Data Type | Details |

|---|---|---|---|

| Credit Facility | No | Lookup | Read-only field. It displays the id of the selected credit facility record. |

| Start Calculation Date | Yes | Invariant Date | Enter the start date for fee calculation. |

| Fee | Yes | Lookup | Select a fee to apply to the credit facility from the list of defined fees & commissions. |

| Fee Value | No | Numeric | Read-only field. It displays the value of the selected fee, as defined in Core Banking. |

| Fee Percentage | No | Numeric | Read-only field. It displays the percentage of the selected fee, as defined in Core Banking. |

| Fee Periodicity | No | Option set | Read-only field. It displays the periodicity of the selected fee, as defined in Core Banking. |

| Use specific day for aggregation | No | Whole Number | Enter a day of the month when the fee accrual should be aggregated. |

| Use End Of Month for Aggregation | Yes | Boolean | Mandatory only if the Use specific day for aggregation field is not completed. Select the checkbox to mark the last day of the month as aggregation day for the fee accrual. |

Click the Save and Reload button at the top right corner of the page.

A new list, Credit Facility Fee Values, is displayed for viewing after the save operation, containing the calculated fee values for the saved fee. The list displays the fee name, date, value and currency.

After filling in all the mandatory details in the Credit Facility tab, the record is still in Draft status. Change its status to Send to Approved to send it for approval. You can add utilizations only for credit facility records with Approved status.

A credit facility utilization is a contract opened for banking products attached to the facility.

The Credit Facility Utilizations tab contains details of the credit facility such as facility utilizations, fee values, accruals and repayment notifications. There are no information here to display for records in Draft status. You can add utilizations only after the record reaches Approved status.

The following sections are available for completion when adding utilizations to a credit facility record in Approved status:

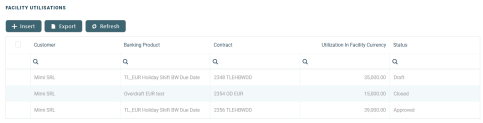

Facility Utilizations Section

In the Facility Utilizations section, you can view, insert or export contracts based on the banking products added to this credit facility. These contracts are known as utilizations.

To add a utilization, perform the steps described on the Adding Utilizations to Credit Facilities page.

The already added utilizations are displayed in a list with the following fields:

| Field | Details |

|---|---|

| Customer | The name of the customer who is the owner of this utilization. |

| Banking Product | The banking product which is the object of this credit facility utilization. |

| Contract | The number of the contract holding this credit facility utilization, either selected when adding the utiization, or automatically created by Core Banking. |

| Utilization in Facility Currency | The amount specified in the credit facility utilization, expressed in the credit facility's currency. |

| Status | The status of the credit facility utilization record. Possible values are:

|

You can update utilizations in Draft status by double-clicking them and updating their editable fields on the newly displayed Credit Utilization page.

Credit facility utilizations must be approved so that the amount of the contract can be disbursed in the customer's account. At any given time, the available amount of the credit facility = the facility amount - (the sum of all approved utilizations expressed in the facility's currency).

Remember to send the utilizations to approval after creating them by changing their statuses to Send for Approved!

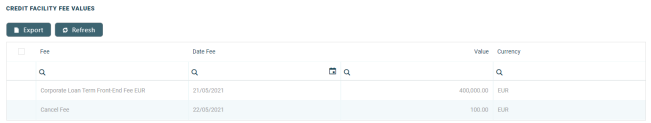

Credit Facility Fee Values Section

In the Credit Facility Fee Values section, you can see or export the fee values already applied to this credit facility.

To view the details of a fee, double-click it to display the Credit Facility Fee Value page. For each fee, the following fields are displayed:

| Field | Details |

|---|---|

| Credit Facility | The id of the selected credit facility record. This field is displayed on the Credit Facility Fee Value page. |

| Fee | The fee applied to the credit facility. |

| Date Fee | The date when the fee was applied to the credit facility. |

| Customer | The customer who must pay the fee value. This field is displayed on the Credit Facility Fee Value page. |

| Currency | The currency of the fee. |

| Repayment Notification | The number of the repayment notification automatically generated by Core Banking. This field is displayed on the Credit Facility Fee Value page. |

| Loan Item | The type of the fee. This field is displayed on the Credit Facility Fee Value page. |

| Value | The value of the fee, expressed in the fee's currency. |

Click the Save and Close button at the top right corner of the page.

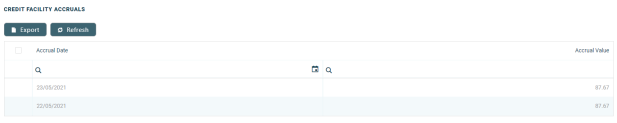

Credit Facility Accruals Section

In the Credit Facility Accruals section, you can see or export the values of the accrual automatically calculated by Core Banking for this credit facility.

For each accrual, the following fields are displayed:

| Field | Details |

|---|---|

| Accrual Date | The date of the accrual calculation. |

| Accrual Value | The value of the accrual calculation, expressed in the credit facility's currency. |

| Fee | The fee or commission based on which the accrual was calculated. This is only displayed on the Credit Facility Accrual page, opened if you double-click an accrual record for viewing purposes. |

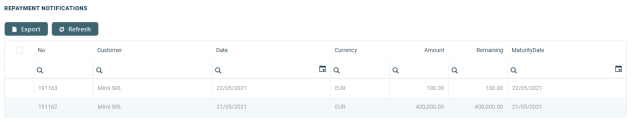

Repayment Notifications Section

In the Repayment Notifications section, you can see, update or export the repayment notifications automatically issued by Core Banking for this credit facility.

For each repayment notification, the following information is displayed:

| Field | Details |

|---|---|

| No | The number of the repayment notification issued by Core Banking. |

| Customer | The name of the customer participant to the credit facility for whom the repayment notification was issued. |

| Date | The date when the repayment notification was issued. |

| Currency | The currency of the issued repayment notification. |

| Amount | The amount of the issued repayment notification. |

| Remaining | The amount that remains to be paid by the customer for this repayment notification. |

| Maturity Date | The due date of the repayment notification. |

To update a repayment notification, double-click it to open the Edit Repayment Notification page.

Here you can view the details of the repayment notification and you can insert corrections. Add a correction to the repayment notification by clicking the Insert button next to the Corrections section and filling in the details on the newly displayed Add Contract Correction Entry page.

| Field | Required | Data Type | Details |

|---|---|---|---|

| Repayment Notification | No | Lookup | Read-only field. It displays the id of the selected repayment notification record. |

| Contract | No | Lookup | Read-only field. It displays the id of the contract attached to the selected credit facility. |

| Currency | No | Lookup | Read-only field. It displays the currency of the selected repayment notification record. |

| Customer | No | Lookup | Read-only field. It displays the name of the customer. |

| Correction Date | No | Invariant Date | Read-only field. It displays the date when the correction entry is saved. |

| Total Correction | No | Numeric | Read-only field. It displays the sum of values entered for in the correction entry details section. |

| Contract Correction Entry Details Section | |||

| Repayment Notification Detail | No | Lookup | Select the repayment notification detail to be corrected. |

| Operation Item | No | Option set | Select the operation item for the correction entry detail. |

| Correction Value | No | Numeric | Enter the desired value for the contract correction entry detail. |

The correction entries must be approved in order to be processed. Change the record's status to Approved.

Click the Save and Reload button at the top right corner of the page after performing the desired updates.

The repayment notification is automatically marked as paid (the IsPaid checkbox in the Repayment Notification details section is selected) after the payment is processed, either by a Core Banking process or by adding a manual correction.

The History tab displays the versions of the credit facility, their workflow status and the user who modified the record.

Here you can track the record's life cycle and review older versions that are no longer active (for details, see Credit Facility Statuses).

There are no edits allowed in this tab.