Current Account with Overdraft

A current account with an attached overdraft functionality allows customers to withdraw funds from the account even if the available balance goes below zero. If there is a prior agreement with the account provider for an overdraft, and the amount overdrawn is within the authorized overdraft limit, then interest is normally charged at the agreed rate. If the negative balance exceeds the agreed terms, then additional fees may be charged and higher interest rates may apply. The customer may use the account beyond their available balance (credit balance) and may have a debit balance as low as the approved overdraft/ limit. The overdraft can be added on top of existing current accounts.

The overdraft feature of the current account may expire, in which case the contract continues to function as a current account. If needed, the overdraft feature can be reactivated in the future within the same contract by editing the contract and creating a new version. If the overdraft feature is extended by creating a new version of the contract, the repayment schedule is also updated. In cases when the feature is extended after a period of expiry, than repayment schedule has a missing period equivalent with the period when overdraft was expired. All overdue amounts from previous overdraft notifications generated for the same current account contract are covered automatically, decreasing the balance and available limit amount of the new overdraft.

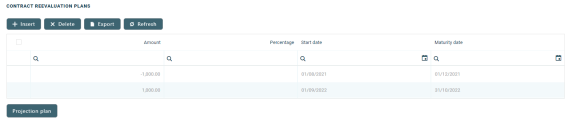

The overdraft amount can fluctuate seasonally or be reduced or increased according to a schedule, defined in the Contract Reevaluation Plans section of the contract.

When such a contract is closed, first the costs linked to the overdraft need to be settled, the account balance transferred and only then the account can be closed. To close such a contract before its maturity date, create a new contract version where the expiration date is changed to an agreed upon date and the repayment schedule is recalculated to have the last installment due on that date, with all the accrued amount added into the designated columns. At the end of that day, the installment is notified. After settling the last installment, the current account can be closed. Read more about closing contracts based on Current Account with Overdraft banking products in this page's dedicated chapter.

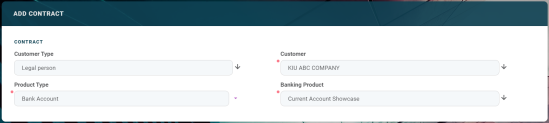

Creating Current Account with Overdraft Contracts

To create a contract based on a Current Account with Overdraft banking product, follow the steps described in the Creating Contracts page, making sure that you select Bank Account in the Product Type field and a Current Account with Overdraft banking product in the Banking Product field. After saving the contract, go through each tab and fill in the general and the specific information for this type of contract:

The Overview tab requires the basic elements for the creation of a contract such as customer, banking product, account, interest rate, participants, tranches, fees, and contract covenants.

The following information in the Overview tab is common to all contract types:

| Field | Mandatory | Data Type | Details |

|---|---|---|---|

| Contract ID | No | Text | A contract ID can be filled in, other than the contract number generated automatically by Core Banking when you saved the contract. |

| Customer | Yes | Lookup | The customer who owns the contract, selected previously, in the initial contract creation page. You cannot modify this information. |

| Banking Product | Yes | Lookup | The banking product selected previously, in the initial contract creation page. You cannot modify this information. |

| Currency | Yes | Lookup | The currency of the banking product selected previously, in the initial contract creation page. For the moment the product is defined currency wise, thus each product has an underlying currency. You cannot modify this information. |

| Activation Date | Yes | Invariant date | This is the date when the contract is activated. It is automatically completed with the system date. |

| Main Bank Account | Yes | Lookup | When the contract is approved, this account it is created automatically for the bank defined as Main in Core Banking,within the Core Banking Operational > Bank menu. In order to generate an account number, a rule must be defined during the Core Banking implementation phase (example: branch code + incremental sequence number). |

| Managing Branch | Yes | Option set | This represents the branch of the organization where the contract was created. It is automatically completed at contract saving time, but you can select another branch from the list. |

Click the Save and Reload button at the top right corner of the page.

The following information specific to Current Account with Overdraft contracts should be completed in the Overview tab:

| Field | Mandatory | Data Type | Details |

|---|---|---|---|

| General Data section | |||

| Start Calculation Date For Amount Unused | Yes | Date | Select the date when the amount not drawn from the overdraft limit amount starts to be calculated with commissions with Commission Undrawn Amount (overdraft) type. This field is displayed and required to be filled in only when the Overdraft Limit Amount value is >0. |

| Product Interest Rate section | |||

| Product Interest | No | Lookup | Select from the list the interest to be applied for this contract. Only the interests associated to the selected banking product are displayed within the list. Depending on the selected interest, a series of other fields are displayed to be filled in: Margin, Reference Rate Date and Reference Rate. |

| Margin | No | Numeric | This field is automatically completed with the margin of the previously selected product interest. If the product interest was not selected, you can manually enter the margin. |

| Reference Rate Date | Yes | Date | Select the date for the reference rate that is part of the previously selected product interest. |

| Reference Rate | Yes | Numeric | This field is automatically completed with the reference rate valid at the previously selected date. |

| Total Interest Rate | Yes | Numeric | This field is automatically completed with the calculated total interest rate of the previously selected product interest and any values entered for margin and reference rate. If the product interest was not selected or if the interest at the banking product level was marked as Is Negociable, you can manually enter the interest rate. |

| Overdraft section | |||

| Overdraft Limit Amount | Yes | Numeric | Enter the limit for the overdraft amount applicable for this contract. If the overdraft limit amount is greater than 0, then all the fields related to the overdraft interest rate are mandatory to be completed. |

| Expire Date for Overdraft | Yes | Date | Enter the date until when the overdraft functionality is active for this contract. On the expiry of the overdraft limit, any used amount and the underlying interest becomes due. A repayment notification is generated in case the current account does not hold enough balance to cover the interest. NOTE The due dates of all installments within the repayment schedule of current account with overdraft contracts fall before the expire date for overdraft. |

| Date for Review Overdraft Interest Rate | No | Date | Enter the date for reviewing the interest rate applicable for the overdraft. |

| Overdraft Interest | Yes | Lookup | Select from the list the interest to be applied for the overdraft amount of this contract. Only the interests marked as Is For Overdraft are displayed within the list. |

| Overdraft Margin | No | Numeric | This field is automatically completed with the margin of the previously selected overdraft interest. If the overdraft interest was not selected, you can manually enter the margin applicable for overdraft amounts. |

| Overdraft Reference Rate Date | Yes | Date | Select the date for the overdraft reference rate that is part of the previously selected overdraft interest. |

| Overdraft Reference Rate | Yes | Numeric | This field is automatically completed with the overdraft reference rate valid at the previously selected date. |

| Overdraft Total Interest Rate | No | Numeric | This field is automatically completed with the calculated total overdraft interest rate of the previously selected overdraft interest and any values entered for overdraft margin and overdraft reference rate. If the overdraft interest was not selected, you can manually enter the interest rate. |

| Minimum Overdraft Interest Rate | No | Numeric | Enter the minimum interest rate applicable for overdraft amounts for this contract. |

| Overdraft Interest Type | No | Option set | This field is automatically completed with the interest type of the overdraft. Possible values: Fixed, Variable, Base Type, Collection, Banking Formula and Banded. Read more about interests in the Interests page. |

| Repayment Overview section | |||

| Contract Period | No | Whole Number | This field is automatically completed with the contract period as it was defined at banking product level. You can edit this value. |

| Contract Period Type | No | Option Set | This field is automatically completed with the contract period type as it was defined at banking product level. You cannot edit this value. |

| Maturity Date | No | Date | This field is automatically completed with the contract maturity date, in this case the maturity date of the current account and not of the overdraft functionality attached to the account, calculated based on the values of the Contract Period, Contract Period Type and Activation Date. You cannot edit this value. |

| Repayment at end of month | No | Boolean | If you select this checkbox, then the due day of the contract is automatically set to the last day of the month, and the repayment schedule is calculated with an installment in the last day of month. |

Versioning Reason Section

The Versioning Reason section is displayed only when you create a new version of an already approved contract by clicking the New Version button in the top right side of the Contract page. Thus, this section is editable for contracts in Contract Version Draft status, and the information within this section is read-only for contracts in Contract Version Closed status.

To add a reason for manually creating the new version of the contract, you can select an option from the Versioning reason drop-down. The Closure of current account reason must be selected when the current account with overdraft contract is closed, as it signals Core Banking to perform the procedures needed in order to settle all the costs of the overdraft and of the current account.

To close the contract, first the costs linked to the overdraft need to be settled, the account balance transferred and only then the account can be closed. In the new contract version, the expiration date should be changed to the agreed upon date and the repayment schedule recalculated to have the last installment due on that date, with all the accrued amount added into the designated columns. At the end of that day, the installment is notified. After settling the last installment, the current account can be closed. Read more about closing contracts based on Current Account with Overdraft banking products in this page's dedicated chapter.

Depending on the banking product used for creating the contract, the following reasons may be available:

-

Closure of current account

-

Disbursement

-

Early Repayment

-

Payment Holiday

-

Reschedule Overdues

Click the Save and Close button at the top right corner of the page.

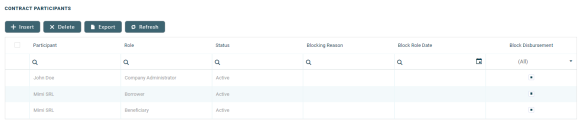

Contract Participants Section

In the Contract Participants section, you can insert, delete or export customers who participate in this contract or who can be blocked from participation. After the first save operation, the customer is added as beneficiary of the contract. If the customer is a legal entity, all the company’s already entered legal representatives such as administrators, affiliates, owners, or other key contact persons are displayed in this list.

To add a participant, click Insert and fill in the following fields:

| Field | Required | Data Type | Details |

|---|---|---|---|

| Participant | No | Lookup | Select from the list the name of the customer who can access the contract. |

| Role | No | Option Set | Select from the list the role of the previously selected customer in the contract beneficiary's company. |

| Blocking Reason | No | Option Set | Select the reason for blocking this participant from accessing the contract, if needed. |

For legal entity customers, the participant with the

Company Administrator role must be added, otherwise the loan contracts cannot be approved. This is not the case for current account contracts. For individual customers, the borrower and beneficiary of the contract are not mandatory to be added in order for the contract to be approved and disbursed.

Click the Save and Close button at the top right corner of the page.

Contract Tranches Section

In the Contract Tranches section, you can view the disbursement tranches configured at the product level. Usually used for corporate loans, such dividend payments or cash outflows are not done in equal amounts and usually trigger a recalculation in terms of interest. In this section you can also insert, delete or export disbursement tranches for the contract.

To add a tranche in a contract based on a product that has a disbursement matrix set up, click Insert and fill in the following fields:

| Field | Required | Data Type | Details |

|---|---|---|---|

| Tranche Date | Yes | Date | Select the date of the disbursement tranche. |

| Tranche Percent | Yes | Numeric | Enter the percentage from the contract value that has to be disbursed with this tranche. |

| Amount | Yes | Numeric | Enter the amount from the contract value that has to be disbursed with this tranche. |

| Interest Percent | No | Numeric | Enter the interest percent applicable for this tranche, if it must be different from the interest rate applicable for the entire contract. |

| Unusage Commission Percent | No | Numeric | Enter the commission percent applicable for the unused loan amount from this tranche. |

| Submitted Document | No | File | Upload the documents related to the tranche disbursement. |

Click the Save and Close button at the top right corner of the page.

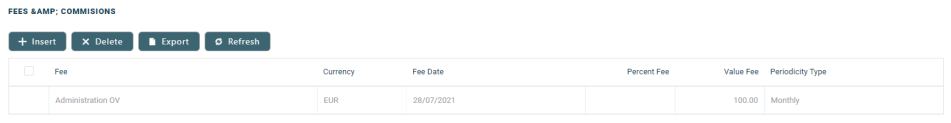

Fees & Commissions Section

In the Fees & Commissions section, you can view all the fees and commissions configured at the product level that have the Automatic Load on Contract checkbox set to True. After the first saving operation, all fees that are defined as values are displayed. The fees that are defined as percentages are displayed after completing all the values of the contract. Read more about the commissions automatically inserted and calculated in the below section. You can also insert, delete or export fees and commissions for the contract.

To add a fee for this contract, click Insert and fill in the following fields:

| Field | Required | Data Type | Details |

|---|---|---|---|

| Contract | Yes | Lookup | This field displays the contract number generated automatically by Core Banking when you saved the contract. You cannot modify this information. |

| Currency | Yes | Lookup | The currency of the contract. You cannot modify this information. |

| Fee | Yes | Lookup | Select a commission from the list of commissions defined for the banking product used when creating the contract. |

| Periodicity Type | No | Option Set | This fields is automatically completed with the periodicity type of the selected fee. |

| Fee Date | Yes | Date | Specify which value of the commission is to be used by selecting the date of the commission. |

| Percent Fee | No | Numeric | This field displays the commission percentage applicable for the selected date, if the commission was defined as a percentage. |

| Value Fee | No | Numeric | This field displays the commission value applicable for the selected date, if the commission was defined as a value. |

Click the Save and Close button at the top right corner of the page.

Automatic Insertion and Calculation of Commissions

Commissions are automatically inserted / updated in the Fees & Commissions section depending on the life cycle and status of the contract:

-

Creating a new contract: Core Banking automatically inserts active commissions associated to the banking product, within their defined validity period, with

Automatically load on contract = True, withIs For Unusage = False, andCommission value is percentage = False.

IfCommission value is percentage = True, then the commission is only inserted if the amount value was previously inserted. -

Updating a contract in

Draftstatus: Core Banking automatically inserts active commissions associated to the banking product, within their defined validity period, withAutomatically load on contract = True, withIs For Unusage = False. If a commission withCommission value is percentage = Truewas already inserted, then the commission's value is updated according to the contract's financed amount. If the value of a commission withCommission value is percentage = Truewas manually modified (for negotiable commissions), then the new value is calculated based on the modified percentage. -

Creating a new version for a contract: Core Banking automatically inserts all the commissions already present in the contract. Additionally, all commissions specifically created for contract version (

Is For Contract Version = True) are added as well.NOTE

If a version for a contract is created more than once on the same day, then all commissions withIs For Contract Version = Truethat were not notified yet for each previous version are deleted. At the end of the day, there is only one commission for the latest version. -

Updating a contract in

Contract Version Draftstatus: Core Banking only updates the percentage commissions that are not already notified.

For percentage commissions (with Commission value is percentage = True), the financed amount of the contract is used to calculate the commission value based on the percentage. The calculation method differs depending on the contract type:

-

For contracts based on Term Loan, Mortgage or Overdraft banking products:

-

If the commission is applied to amount, then the financed amount = amount due;

-

If the commission is applied to financed amount, then the financed amount = amount due - advance amount;

-

If the commission is applied to remaining value and the contract is in

Contract Version Draftstatus, then financed amount = (-1) * main bank account balance. If the result is a negative value, then financed amount = null. In all the other cases, financed amount = null, which is the default value.

-

-

For contracts based on Bank Account with Overdraft banking products:

-

If the commission is applied to overdraft limit amount, then the financed amount = overdraft limit amount;

-

If the commission is applied to used amount and the commission's period type is

Once, then the financed amount = overdraft limit amount - available amount for overdraft. In all the other cases, financed amount = null, which is the default value.

-

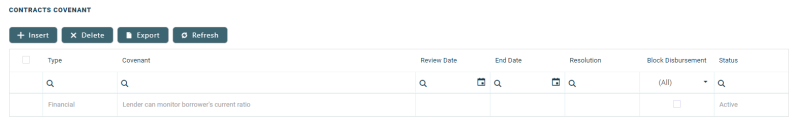

Contract Covenant Section

In the Contract Covenant section, you can view the covenants that applicants must abide by after getting the loan, configured at the product level. Such conventions are usually applicable for corporate clients that must meet certain requirements in order to continue to receive disbursements and not only: submit balance sheet every x months, have account turnover of at least x percent from average monthly turnover, provide other relevant documents from authorities. In this section you can also insert, delete or export covenants for the contract.

To add a covenant to a contract, click Insert and fill in the following fields:

| Field | Required | Data Type | Details |

|---|---|---|---|

| Covenant | No | Option Set |

Select the desired covenant from the list of possible values:

|

| Value | No | Numeric | Enter the value of the covenant. |

| Covenant Type | No | Option Set | This field is automatically completed with the type of the selected covenant. |

| Review Frequency (Months) | No | Whole Number | Enter the number of months after which the covenant has to be reviewed. |

| Review Date | No | Date | Enter the date when the covenant has to be reviewed. |

Click the Save and Reload button at the top right corner of the page.

Activate the covenant record by changing its status to Active.

Click the Save and Close button at the top right corner of the page.

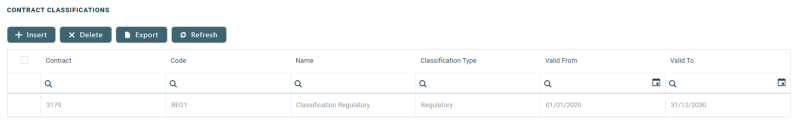

Contract Classifications Section

In the Contract Classifications section, you can insert, delete or export classifications for the contract. You can choose to add the classifications defined at banking product level.

To add a classification to a contract, click Insert and fill in the following fields:

| Field | Required | Data Type | Details |

|---|---|---|---|

| Classification | No | Lookup | Select the desired classification for the contract from the list of classifications associated with the banking product. |

| Contract | Yes | Lookup | This field is automatically completed with the number of the current contract. |

| Description | No | Text Area | Enter a description for the contract classification. |

Click the Save and Close button at the top right corner of the page.

Contract Reevaluation Plans Section

In the Contract Reevaluation Plans section, you can define the increase or decrease of the overdraft limit amount and of the customer limit attached to the contract, according to the customer's seasonal needs. For example, for an approved overdraft limit for 12 months, after 6 months the limit has to be decreased because the customer does not need the entire limit and wants to reduce the costs of the overdraft functionality. Similarly, the overdraft limit can be increased, for example for a working capital requirement, the bank can grant the limit in January, but the company works in tourism and the cash flow needs are higher in summer, thus the bank needs to increase the overdraft.

To add a reevaluation plan to a contract based on a current account with overview, click Insert and fill in the following fields:

| Field | Required | Data Type | Details |

|---|---|---|---|

| Amount | Yes | Numeric | Enter the amount with which the overdraft limit has to increase or decrease. Use negative values for decrease and positive values for increase. This field cannot be filled in if the Percentage field was completed. |

| Percentage | Yes | Numeric | Enter the percentage with which the overdraft limit has to increase or decrease. Use negative values for decrease and positive values for increase. This field cannot be filled in if the Amount field was completed. |

| Start date | Yes | Date | Enter the start date when the overdraft limit increase or decrease should be performed. |

| Periodicity type | Yes | Option Set | Select the periodicity type for applying the overdraft limit increase or decrease. The possible values are: Once, Weekly, Monthly, Bimonthly, 4 Weeks, Trimestrial, Semestrial and Annual. |

| Number of times | No | Numeric | Enter how many times the overdraft limit increase or decrease should be performed. |

| Holiday shift method | No | Option Set | Select the desired holiday shift method from the possible values: Forward or Backward. |

Click the Save and Close button at the top right corner of the page.

When the utilized amount is greater that the resulted available limit, a new repayment schedule detail is added to the repayment notification, displaying the difference between utilized amounts – available limit amount on the Principal column of the notification. The repayment notification notifies the principal amount and tries to collect it.

To view the projection of the overdraft limit reevaluation plan, click the Projection Plan button. A .pdf file containing a detailed overview of the overdraft limit fluctuations in time is automatically downloaded by your browser.

The Payments tab contains all the transactions, payments, penalties, bank account operations, repayment schedules, schedule versions, repayment notifications for a contract. Depending on the contact's chosen banking product, only some of these may be displayed. The tab has no information to display in Draft status. Approve the contract to perform any contract event. Meaningful payment information is displayed in this tab only after performing transactions on the contract.

Contract Repayment Schedule Section

The Contract Repayment Schedule section displays the repayment schedule automatically generated by Core Banking for the approved contract, after performing a disbursement.

The section displays only basic information about the generated schedule, such as contract number, schedule date and last modification date and time. For detailed information and the actual list of the installments, double-click on the schedule. The Edit Contract Repayment Schedule page is displayed with the selected schedule and a list with every schedule detail:

You cannot edit the information displayed in this page.

Following an early repayment event, for contracts based on banking products with the Is Revolving field set to

False, when the installments number recalculated after such an event is lower than the previous installments number, the maturity date and the contract period are updated along with the number of installments.The following information is displayed about each schedule detail (installment):

| Column | Details |

| No. | The number of the repayment schedule detail. |

| Due Date | The date when the installment must be paid. |

| Interest | The value of the interest calculated for this installment. |

| Principal | The value of the principal calculated for this installment. |

| Commission For Undrawn Amount/ or other commissions, depending on the selected contract type | The value of the commission with the specified type calculated for this installment. |

| Total Repayment | The number of the repayment notification generated for this schedule detail. |

| Notification No. | The number of the notification where the installment is included, if it was already generated. |

Within the list, the schedule details are color coded as follows:

-

Schedule details highlighted in blue are already paid, allocated or closed to payment.

-

Schedule details not highlighted (displayed on a white background) remain to be paid.

To export the schedule in a .pdf file, click the Print Schedule button. Your browser automatically downloads the PaymentScheduleFile.pfd file, with all the information displayed within the Contract Repayment Schedule page.

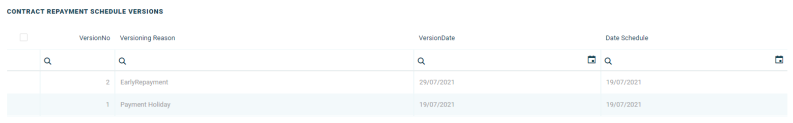

Contract Repayment Schedule Versions Section

The Contract Repayment Schedule Versions section displays the versions of the repayment schedules automatically generated by Core Banking each time when a contract event that changed either the maturity date or the amount of a repayment was performed on the contract. The section is displayed only if such versions exist for the contract.

The section displays only basic information about the generated versions, such as version number, versioning reason, version creation date and the date of the previously active schedule.

The most recent repayment schedule version is considered active by Core Banking, while the previous schedule records are kept for historical purposes.

For detailed information about the repayment schedule version, double-click on the desired record. The Edit Contract Repayment Schedule Version page is displayed with the selected schedule and a list with every schedule detail:

You cannot edit the information displayed in this page.

The following information is displayed about each schedule version:

| Column | Details |

| Version No. | The number of the repayment schedule version. |

| Version Date | The date when the version was created. |

| Versioning Reason | The type of contract event that triggered the generation of the version. |

| Customer | The customer for whom the contract was created. |

| Contract | The number of the contract for which the repayment schedule version was generated. |

| Contract Event | The id of the contract event that triggered the generation of the version. |

| Date Schedule | The date of the previous repayment schedule. |

| Schedule Type | The type of schedule selected in the contract and used to generate the repayment schedule. |

| Version's Details List | |

| No. | The number of the repayment schedule version detail. |

| Due Date | The date when the installment must be paid. |

| Remaining Value | The value remaining to be repaid from the contract value at the moment of this installment. |

| Interest | The value of the interest calculated for this installment. |

| Principal | The value of the principal calculated for this installment. |

| Total Installment | The total value of the installment to be paid. |

| Notification No. | The number of the notification where the installment is included, if it was already generated. |

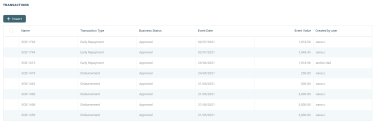

Transactions Section

The Transactions section displays all the transactions performed at the contract level, in any status. This section only has information if the contract is in Approved status and transactions were already created. Read detailed information about contract events and how to add an event in the dedicated Contract Events page.

The section displays only basic information about the transaction, such as event number, status, date, transaction type, value and the user who created it. For detailed information about the transaction and the repayment schedule generated for the approved event, double-click on the schedule. The Event page is displayed with the selected event and the generated repayment schedule for the event:

You cannot edit the information displayed in this page.

The following information is displayed about each event, with some variations depending on the event type:

| Column | Details |

| Contract | The number of the contract for which the transaction is performed. |

| Customer | The customer for whom the contract was created. |

| Transaction Type | The type of the transaction that is performed on the contract. |

| Currency | The currency of the contract. |

| Financed Amount | The amount financed by the contract. |

| Available Value | The amount still available in the contract. |

| Event Date | The date when the event was created. |

| Event Value | The amount of the transaction. |

| Repayment Due Day | The day of the month when the repayment is due. |

| Installment Method | The method of calculating the installment value. |

| Tenor | The tenor of the contract in months. |

| Principal Value | The amount of the principal of the contract. |

| Installment Value | The amount of the installment. |

| Contract Repayment Schedule section | |

| No. | The number of the repayment schedule version detail. |

| Due Date | The date when the installment must be paid. |

| Remaining Value | The value remaining to be repaid from the contract value at the moment of this installment. |

| Interest | The value of the interest calculated for this installment. |

| Principal | The value of the principal calculated for this installment. |

| Total Installment | The total value of the installment to be paid. |

In order to add transactions to an approved contract, the transactions must be previously defined and associated with the banking product in the Banking Product page > Associated Transactions tab.

All existing versions of the contract in Contract Version Draft status are automatically changed to Contract Version Closed when a payment event is approved for that contract.

Repayment Notifications Section

The Repayment Notifications section displays all the repayment notifications generated for the contract. This section only has information if the contract is in Approved status and disbursements were already performed.

Within the list, the repayment notifications are color coded as follows:

-

Repayment notifications highlighted in blue are already paid, allocated or closed to payment.

-

Repayment notifications not highlighted (displayed on a white background) remain to be paid.

The following information is displayed about each notification:

| Field | Description |

|---|---|

| No. | The number of the repayment notification record. |

| Customer | The customer for whom the contract was created. |

| Date | The date when the notification was generated. |

| Currency | The currency of the contract. |

| Amount | The amount of the installment for which the notification was generated. |

| Remaining | The amount from the installment that remains to be paid. |

| Maturity Date | The maturity date of the notification. This is calculated adding the value of the Grace period for repayment field at the banking product level to the notification date. |

For detailed information about a repayment notification, double-click on the desired record. The Repayment Notification page is displayed with the selected notification:

You cannot edit the information displayed in this page. Read detailed information about repayment notifications in the dedicated Repayment Notifications page.

All the

Front-End Fee commission types with Once periodicity type applied to a contract are notified and must be paid when the contract is approved. The Core Banking system parameter FrontEndFee defines the type of commission that is automatically notified at the contract approval.Penalties Section

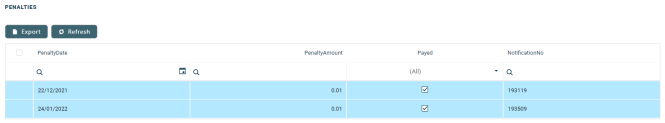

The Penalties section displays the penalty interest applicable to the contract, automatically calculated by Core Banking for an approved contract, based on all the interests with selected Is Penalty checkbox that are applied to this contract, configured in the Overview tab.

The section displays only basic information about the penalties, such as penalty date, amount, notification number and whether it was paid or not. For detailed information, double-click on the desired penalty record. The Contract Penalty page is displayed with the selected penalty's details:

You cannot edit the information displayed in this page.

The following information is displayed about each penalty record:

| Column | Details |

| Contract | The number of the contract for which the transaction is performed. |

| Customer | The customer for whom the contract was created. |

| Is Paid | A checkbox indicating whether the penalty was already paid through a payment allocation or not. |

| Name | The name of the penalty. |

| Notification | The number of the notification where the penalty is included. |

| Penalty Amount | The amount of the penalty expressed in the contract's currency. |

| Penalty Date | The date when the penalty was calculated. |

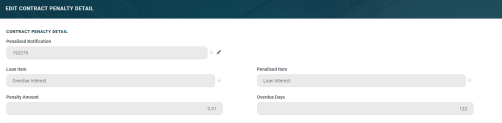

| Contract Penalty Details section | |

| Penalized Notification | The notification which was not paid in time and for which the penalty is calculated. |

| Penalized Item | The item to which the penalty interest was applied. |

| Overdue Days | The number of days since the notification was overdue for payment. |

| Penalty Amount | The calculated amount of the penalty. |

| Loan Item | The loan item which is used to calculate the penalty interest. |

You can view the details of the penalty in a separate page, named Edit Contract Penalty Detail, if you double-click the detail record:

You cannot edit the information displayed in this page.

This section holds documents related to the contract. It is meant to be the electronic folder of the contract.

To insert a document to the contract, click the Insert button in the Contract Document section. The Add Contract Document page is displayed.

Fill in the following fields:

| Field | Mandatory | Data Type | Details |

|---|---|---|---|

| Name | No | Text | Enter the name of the document. |

| Number | No | Text | Enter the number of the document. |

| Contract | Yes | Lookup | This field is automatically completed with the number of the current contract. |

Click the Save and Close button at the top right corner of the page.

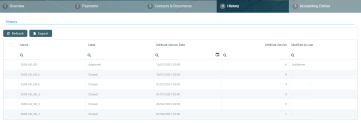

The History tab displays the versions of the contract, along with workflow status and the user who modified the record. A contract can have only one Draft version, one Current version, but it may have multiple History versions, which are displayed in this section. In this tab you can track the contract's life cycle and review older versions that are no longer active (for details, see Contract Versioning).

The Accounting Entries tab holds all the accounting entries, accounting totals, and accruals and provisions recorded for a contract. These records are automatically generated by the system, after performing transactions for an approved contract.

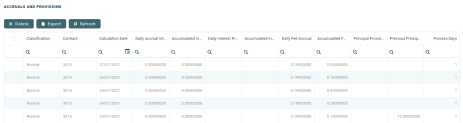

Accruals and Provisions Section

The records containing daily accrual and provisions are displayed in the Accruals and Provisions section. Generated automatically by the system respecting the definition of the contract, product dimensions, system parameters and jobs.

The following information is displayed for each accrual and provision entry:

| Column | Details |

| Classification | The classification of the accrual and provision entry. The classification is determined based on the records created in the Loan Classification menu. These records classify transactions based on the number of days since a repayment notification is overdue. |

| Contract | The number of the current contract. |

| Calculation Date | The date when the accrual and provision calculation was performed. |

| Daily Accrual Interest | The amount of interest accrued on that day. |

| Accumulated Interest Accrual | The total amount of interest accrued until that day. |

| Daily Interest Provision | The amount of interest provisioned on that day. |

| Accumulated Interest Provision | The total amount of interest provisioned until that day. |

| Daily Fee Accrual | The amount of fees and commissions accrued on that day. |

| Accumulated Fee Accrual | The total amount of fees and commissions accrued until that day. |

| Principal Provision | The amount of principal provisioned. |

| Previous Principal Provision | The previous amount of principal provisioned. |

| Process Days | The number of days processed. |

Accounting Totals on Contract Section

The Accounting Totals on Contract section provides an overview of the total amounts specified in accounting records. The accounting entries are generated by the Generate Accounting Entries service in the Core Banking END OF DAY (CB) daily job . The job runs automatically at the end of day.

The following information is displayed for each total amount:

| Column | Details |

| Account | The account where the operation was performed. |

| Total Debit | The amount which was debited from the account. |

| Total Credit | The amount which was credited to the account. |

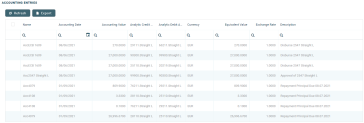

Accounting Entries Section

The Accounting Entries section reflects the accounting for the transactions related to the loan contract. The accounting entries are generated by the Generate Accounting Entries service in the Core Banking END OF DAY (CB) daily job . The job runs automatically at the end of day.

The following information is displayed for each accounting entry:

| Column | Details |

| Name | The id of the accounting entry. |

| Accounting Date | The date when the entry was generated. |

| Accounting Value | The value of the accounting entry. |

| Analytic Credit Account Code | The code of the analytic credit account. |

| Analytic Debit Account Code | The code of the analytic debit account. |

| Currency | The currency of the accounting entry. |

| Equivalent Value | The equivalent value of the accounting entry expressed in the contract's currency. |

| Exchange Rate | The exchange rate between the accounting entry currency and the contract currency. |

| Description | The description of the accounting operation. |

Closing Current Account with Overdraft Contracts

The automatic closure of contract is triggered whenever the maturity date of the contract is reached and there are no overdue amounts on the contract.

You can trigger the closure of the contract before its initial maturity date by creating a new version of the Approved contract and filling in a Versioning Reason. Remember to change the Maturity Date of the contract to an agreed upon date. If the Expire Date for Overdraft was not reached yet, then you must also change it to the same date. The repayment schedule must be recalculated to have the last installment due on that date, with all the accrued amount added into the designated columns.

At the end of that day, the installment is notified. After settling the last installment, the current account can be closed.

Whenever a due amount is notified before the expiration date of the overdraft, the balance of the current account is credited with the notification amount when running the Core Banking End Of Day scheduled job. When the expiration date of the overdraft is reached, any due amounts are moved to the last, expiration installment of the repayment schedule, on the principal, and the balance, the overdraft limit amount and the overdraft available amount are zeroed. The expiration installment amount can be covered with a top-up or a new overdraft on the same current account.