Limits

The exposure is the risk a bank is taking on for writing the loan. Every time a bank grants any type of credit facility to a customer (a loan), they incur exposure to something or a number of somethings. Simply put the bank monitors its exposure to various things, which can negatively affect the customer. The bank uses various algorithms to calculate their exposure to any of the above risks, but this calculation simply adds up to their exposure.

When referring to a loan, this page refers to all types of loans: unsecured loan, secured loan, overdraft, promissory note, working capital loan, and so on.

In FintechOSCore Banking an exposure can be related to a group or to a customer.

The approval of limits is subject to validation, depending on the type of customer. These validations are detailed below.

Group Exposure Types

- Total Exposure - the sum of the aggregate principal amount of the Loans of a Lender.

- Country Exposure - the limit placed by a bank on the number of loans that can be given to borrowers in a particular country. They are used to control the banks' risk exposure to particular regions.

- Company Exposure - the banks' exposure to a single non-banking financial company (NBFC).

- Product Type Exposure - the maximum amount of credit an institution extends to the group for a specific type of product.

- Product Exposure - the maximum amount of credit an institution extends to the group for a specific product.

- Exchange Exposure - the risk a company undertakes when making financial transactions in foreign currencies. All currencies can experience periods of high volatility which can adversely affect profit margins, if suitable strategies are not in place to protect cash flow from sudden currency fluctuations.

Customer Exposure Types

- Total Exposure - the sum of the aggregate principal amount of the Loans of a Lender.

- Product Type Exposure - the maximum amount of credit an institution extends to the customer for a specific type of product.

- Product Exposure - the maximum amount of credit an institution extends to the customer for a specific product.

- Exchange Exposure - the risk a company undertakes when making financial transactions in foreign currencies. All currencies can experience periods of high volatility which can adversely affect profit margins, if suitable strategies are not in place to protect cash flow from sudden currency fluctuations.

Validations

Total Exposure is validated to be unique.

Product Type Exposure is validated against the approved and active total exposure set on the customer.

Product Exposure is validated against the Product Type Exposure if exists. If a Product Type Exposure does not exist, it is validated against the Total Exposure.

Exchange Exposure is validated against Total Exposure.

Total Exposure is validated to be unique and it is validated against the Total Exposure set on the group.

When a group defines a Company Exposure, a Total Exposure is automatically created for that company.

All the other limits are validated against their correspondent set on the customer’s group, if exists. If the correspondent does not exist, there are validated against Total Exposure from the group.

The account limit currency is automatically filled in with the group limit currency.

Total Exposure is validated to be unique.

Product Type Exposure is validated against the approved and active Total Exposure set on the group.

Product Exposure is validated against the Product Type Exposure if it exists. If a Product Type exposure does not exist, it is validated against the Total Exposure.

Company Exposure is validated against the approved and active total exposure set on the group.

Country Exposure is validated against the approved and active total exposure set on that group.

Exchange Exposure is validated against Total Exposure.

It is possible to define as many limits with the same Type (on Group or on Customer) as long as only one Limit (Type) is in Approved status.

After setting the limits, the loan approval is validated against those limits, as detailed below:

- If there is not at least one limit set at the customer or group level, the approval of the loan is not possible and an explicit error is displayed.

- Contract maturity date cannot exceed the limit’s expiry date and an explicit error is displayed.

- The loan amount cannot exceed the corresponding limit amount. If not, an explicit error is displayed.

Calculation of Available Limit Amount

After loan approval, the available amount for each corresponding limit is recalculated by substracting the loan amount from the limit amount. When calculating the group limit available amount, the application takes into account all group members. If the limit currency and loan currency are different, the application automatically converts the loan amount using the current exchange rate.

All group and customer limits are updated daily in accordance with the exchange rate. This is done via a job called Daily Limit Recalculation. After a loan is closed, the available limit amount increases with that loan amount.

If a customer that already has approved contracts becomes member of a group, all it’s active limits are suspended. The same applies when excluding a customer from a group.

If a customer is a child company for more than one company which are part of different groups, it should have impact in the available limit amount on the group to which it was first added, unless if it was already part of a group.

Limit Statuses

A limit has the following statuses:

- Draft - the limit record is created but not yet approved for use.

- Approved - the limit record is approved for use and is applied throughout Core Banking.

- Closed - the limit record is closed and cannot be used anymore.

- Suspended - the limit record cannot be used for the moment.

For the limit to be applied, it must be in Approved status.

As a best practice, new records or new versions of existing records created on a specific day should be approved on the same day.

Adding Limits for Legal Entities in the FintechOS Portal

You can add limits and groups while defining customers using the Single Customer View -> Legal entity menu. The limit is taken into consideration when a contract is approved, and the limit is reset when the contract is closed.

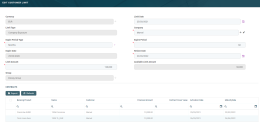

To add a limit, follow these steps:

- Log into FintechOS Portal. In the main menu, navigate to Single Customer View -> Legal entity menu option.

From the newly opened page you can add a new company or modify an existing one. To access the limits and groups, once the legal entity has been created and saved in the database, you can access the Group & Limits tab. - Navigate to the Group & Limits tab.

- Two fields are displayed: the checkbox is Group and Account Limit Currency. If true, the checkbox marks the legal entity as being a group. The Account Limit Currency opens a drop-down to select the currency that is used later on when creating limits. This currency acts as a reference for the limits added further on. Two sections are displayed below, Limits and Members. Members is relevant if the company is a group, because this is where the members of the group are added.

- In the Limits section, the list of existing limits is displayed. To add a customer limit, click the Insert button.

- Fill in the following fields (valid for a legal entity and for a group):

Field Data Type

Description Currency Lookup Select the currency for the limit in particular. Limit Type Option set Select the type from the list as explained above: - Total Exposure

- Product Type Exposure

- Product Exposure

- Exchange Exposure

- Exchange Exposure

- Country Exposure

- Company Exposure.

IMPORTANT!

The correlation between the limits and group is important as the limits on the parent entity affect the child entities. If the legal entity is a group, two additional types of exposures are available country and company exposure.Expire Period Type Option set

Select from the list the period type: - Days

- Weeks

- Months

- Years

- Once.

Expire Period Whole number Insert the number for the period, e.g. 4., i.e. 4 months. Expire Date Date Select a date when the limit expires. Review Date Date Select a date when the limit is reviewed. Limit Amount Numeric Select the sum of money to be the limit for the credit. Available Limit Amount Numeric This field is automatically completed by the system with the remaining sum of money, e.g. if the total exposure was $5 million, a credit was given for $3 million, $2 million will be available. Group Lookup If the legal entity is not a group, this field is read-only. If the legal entity is a group, the name of the group will be automatically filled in. Depending on the type of exposure selected, each type may display additional fields:

Additional Fields Data Type

Description Exchange exposure Exchange currency limit Lookup Select the currency from the list. Product Exposure Product Lookup Select the product from the list. From the total exposure amount, a user can set a limited amount to be given on a certain product. For example, for a corporate term loan to give only $2 million dollars while the total exposure is $3 million. Product Type Exposure Product type Option set Select the product type from the list: - bank account

- term loan

- card

- overdraft

- leasing

- mortgage

- credit card

- deposit.

Product type is secured Boolean If true, then the type is secured by an asset. Country Exposure Country Lookup Select from the list the country where the limit is available. Company Limit Company Lookup Select from the list of members the company for which the limit applies. For details on Groups, see Groups. - Click the Save and reload button. Repeat to add as many limits as needed.

For the same customer, only one limit exposure can be added.

In the Contracts section, the existing contracts for the banking products are displayed. To export the list, click the Export button.