Custom Product Templates

In addition to the Built-In Product Templates, you can create custom templates tailored to your business requirements. This can be done by duplicating an existing template (either a built-in template or a previously created custom template), then adding or removing sections and items according to your needs.

Create a Custom Product Template

- In FintechOS Studio, go to Main Menu > Products.

- From the Settings drop-down, select Product Types.

- Double click an existing product type to open it.

- From the ellipsis menu (...), select Duplicate.

- Provide a name for the new template and click Duplicate.

- The template is created and opened in a Draft state. As long as the template stays in this state you can edit it.

Edit a Product Template

Any product template that is in a Draft state can be customized:

- Click the title and edit the text field to rename the template title.

- Click the icon at the top left corner of the screen and select one of the available options to change the template icon.

- Use the drop-down at the top right corner of the screen to switch the template class between Personal, Business, and Corporate.

- Select Show the class name as part of the product type name to prepend the class name to the template name when editing a product in the Product Designer. E.g.: A product in the Personal class that uses the Holiday Loan template will be displayed as Personal Holiday Loan in the designer.

Customize Product Template Sections

Insurance product template sections cannot be customized. Insurance product templates always inherit their sections from the duplicated template. You are only allowed to reorder insurance product sections (with the exception of the Main Info section which is always the first).

For banking product templates, you can customize the displayed sections.

Customize the Main Info Section

The Main Info section is always displayed at the top of the template. Unlike the other sections, it cannot be removed or repositioned further down the page.

Customize the fields and default values you wish to display in the Main Info section.

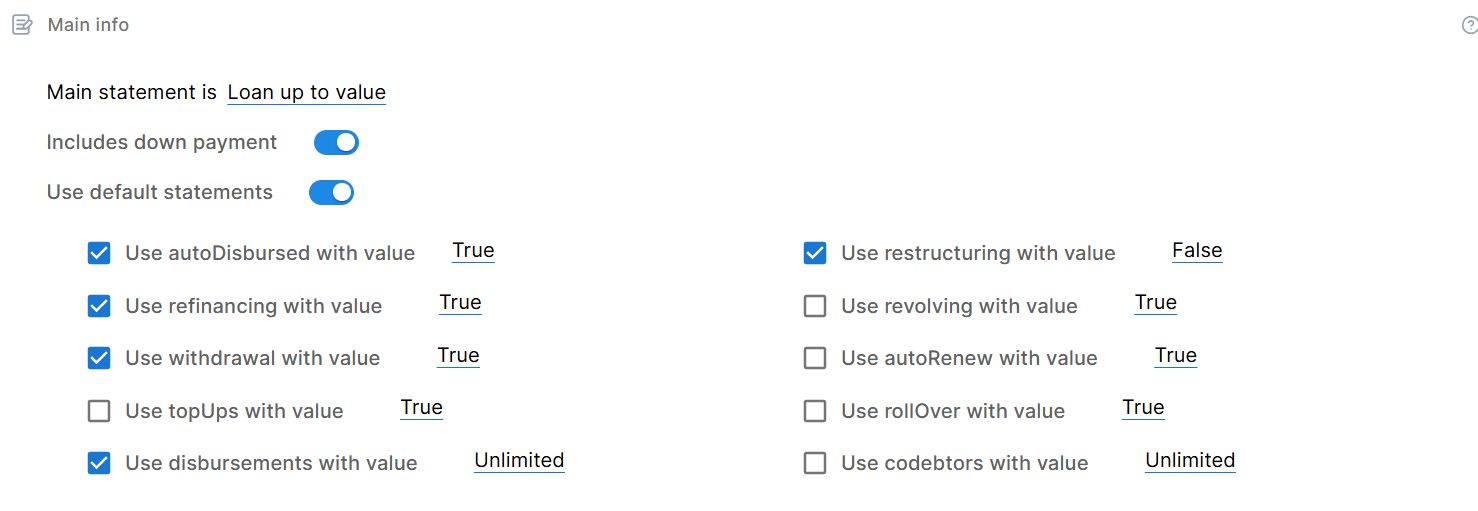

- Main statement is - This option allows you to configure the currency, amount limits, and time ranges for loan repayments or deposit terms.

- Amount and Term Interval - For loan products, sets limits for the amount that can be loaned in a specified currency and the repayment time range. E.g.: Loan amount from 1,000 to 10,000 Euro with a term of 1 to 5 years.

- Deposit Amount and Term Interval - For deposits, sets limits for the amount that can be deposited in a specified currency and the time range for the deposit's term. E.g.: Deposit amount up to 100000 $ with a term of 1 to 5 years.

- Only Currency - For products where you only specify the currency with no limits on amounts or time ranges.

- Loan up to value - For loan products where you only set limits for the amount that can be loaned in a specific currency, but don't set limits for the repayment time range.

- Includes down payment - Adds a field to configure an up-front partial payment (e.g.: for loan products such as mortgages).

- Use default statements - Additional options you wish to include in the main section. Tick the checkmark on the left of the option to include the option in the template and configure the setting on the right of the option to set up a default value for it.

Customize Regular Sections

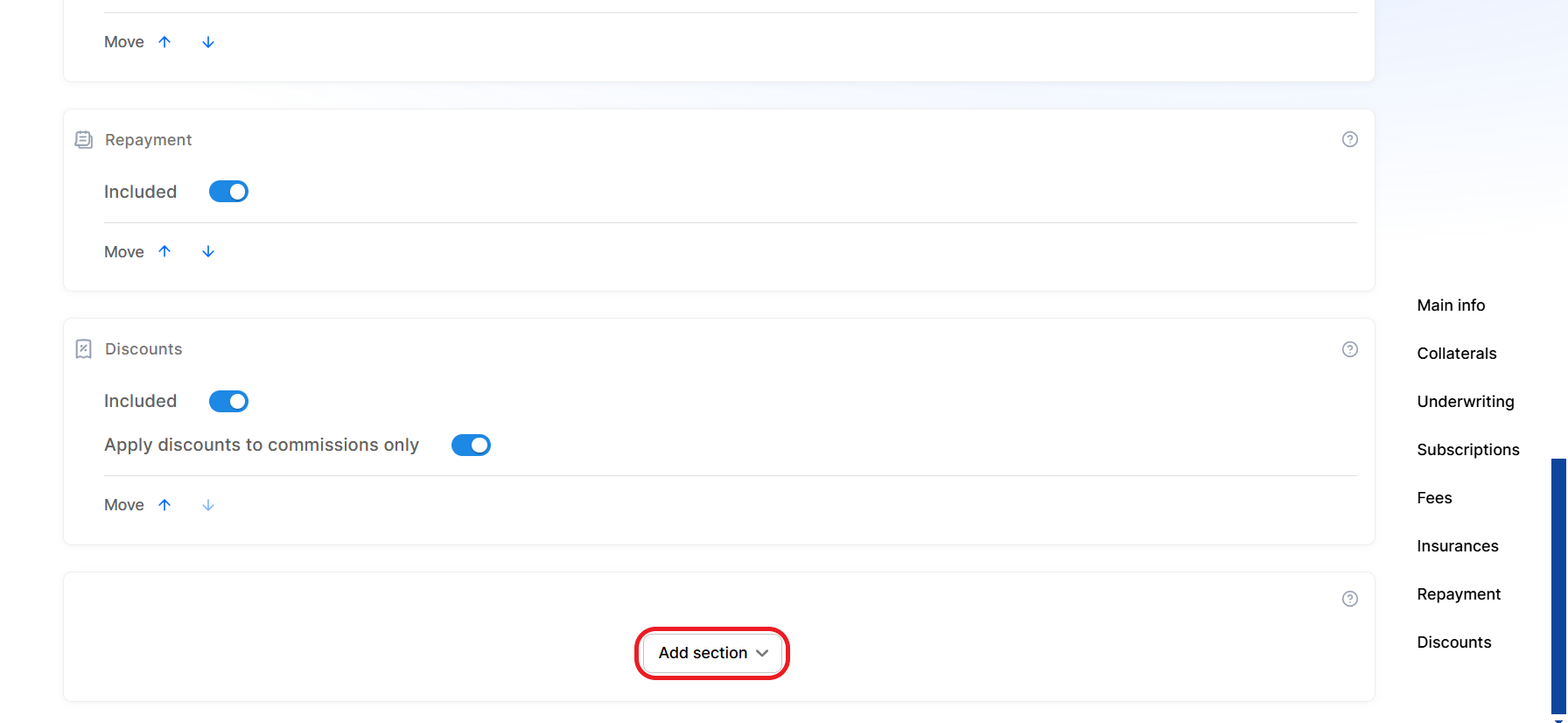

To add a section to the template, scroll down to the bottom of the page and select it from the Add section drop-down.

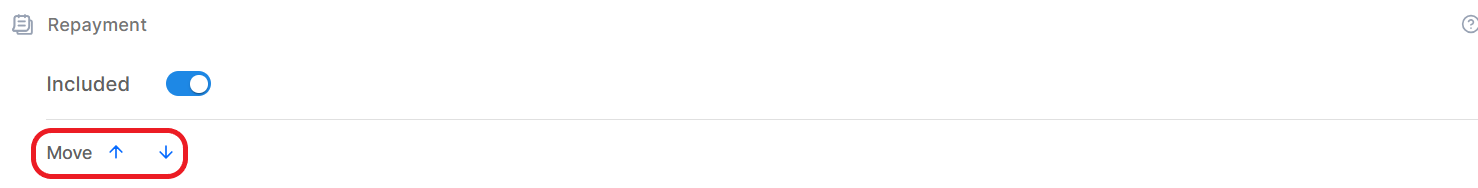

To reorder sections on the product template, use the move arrows on each section.

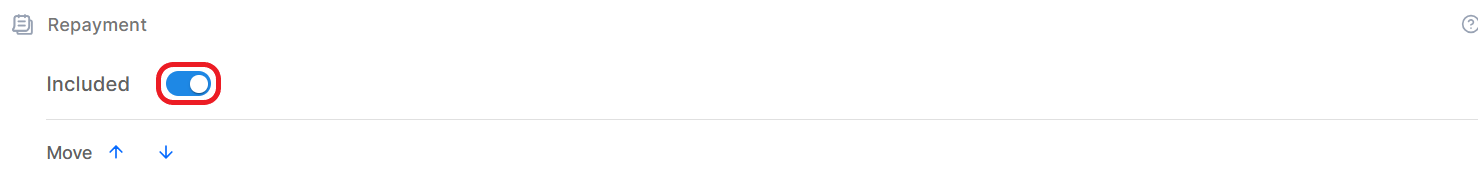

To delete sections from the product template, disable the Included toggle button. This removes the section from the template editor and adds it to the Add section drop-down (from where you can enable it again).

You cannot remove Interest, Fees, and Underwriting sections from banking product templates.

Product Template Life Cycle

Draft

When you create a new product template (by duplicating an existing template), it begins in the Draft state. This is the only state where the template can be edited and customized.

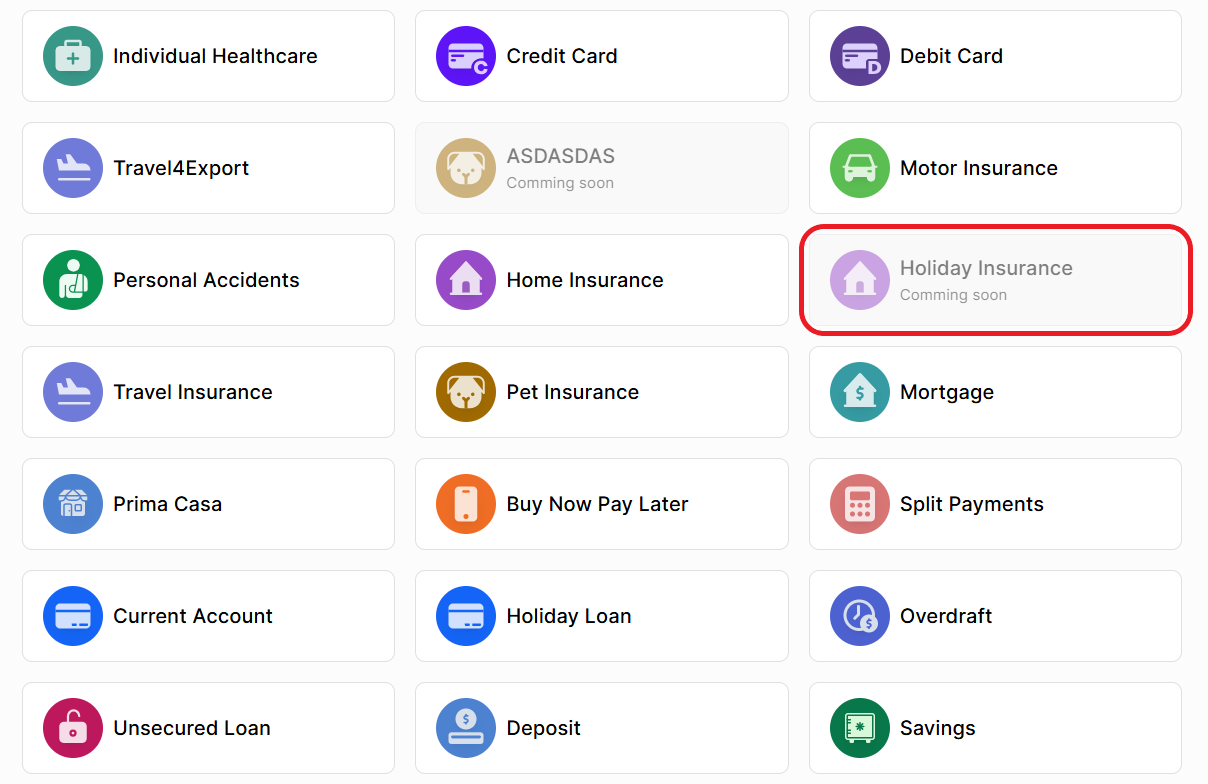

When selecting the template for a new product, draft templates are displayed in the selection window as grayed out, inactive buttons tagged as Coming soon.

Active

A product template in the Active state is available in the Product Designer, allowing the creation of products based on it. To activate a template, click the ellipsis button (...) and select Active.

Once a product template is activated, it cannot revert to the Draft state. Ensure all edits are complete before activation. To make further changes after activation, you will need to create a duplicate and work on a new template.

Inactive

If you want to disable a product template (prevent its use in the Product Designer to create new products), you can deactivate it by clicking the ellipsis button (...) and selecting Inactive. Templates in the Inactive state can be reactivated by selecting the Active option again from the ellipsis menu.