Quote Admin

The main purpose of the Quote Admin solution is efficiently managing quotes coming from internal or external Quote & Bind flows exposed to a final client, all within a comprehensive back-office environment. The management and actions taken within the Quote Admin solution is carried out within the framework of a back-office setting, executed by users equipped with specific roles.

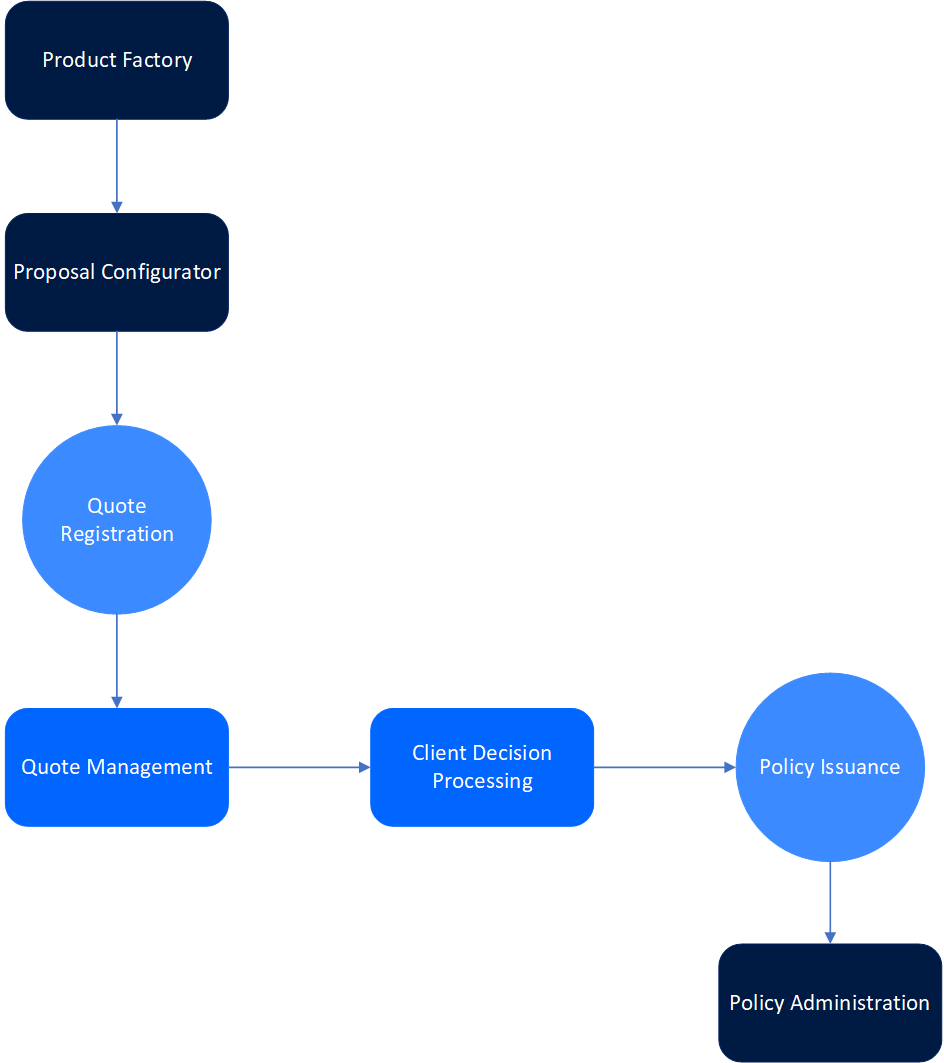

Quote Admin acts as a black box in terms of orchestrating pricing and underwriting APIs (Proposal Configurator), policy and master policy related APIs. It ensures that what was initially offered and accepted by the end customer through a quote is also remains consistent within the policy that is issued for that quote. In short, once a custom quote and bind journey is linked with Quote Admin, it has seamless automatic links with the Product Factory, Proposal Configurator and Policy Administration solutions.

The steps of the Quote Admin workflow are described below.

Quote Registration

Quote registration is the process of registering in a back-office framework (in a single point of records) all the quotes which have been initiated in a client Quote & Bind journey. All the quotes will be generated in Draft status through a specific API, having a distinctive back-office approach in terms of user interface. This step enriches the back-office user portfolio with relevant details from Quote & Bind flows, enabling further management actions and policy issuance within the system.

Quote Management

Through quote management feature, back-office users can perform different actions in order to generate a final offer and subsequently an insurance policy. Functions like viewing, editing, or initiating the underwriting process for a specific quote are easily done through the quote management tool.

Client Decision Processing

Clients are presented with insurance offers, and they hold the option to either Accept or Decline the presented offers. This feature allows back-office users to formally record the client's decision post-offer submission. Through this process, user inputs can be accurately aligned with the client's response, facilitating the subsequent policy issuance step.

Policy Issuance

After the client has accepted the submitted offer, a back-office user can trigger the issuance of a new policy within the FintechOS systems via the generatePolicy API. This freshly generated policy incorporates information originating from the current quote, starting from insured details and insured object specifications to policy coverages and premium calculations.