Overview

Term Life Quote & Apply helps insurers to organize their life and health operations along two dimensions: agent registry and quotation activity.

Based on the solution, insurers can translate the complexities of life quotation activity, its volume, and progress, into more simple business terms, and steps. For example, by using the solution, insurers can accurately track a quote to the agent that offered it. A selling history of every agent also makes it easier to understand their individual performance, a skill building cycle, or persisting blockages.

Term Life Quote & Apply also enables insurance agents to streamline their activity, gather customer information according to industry best practices and focus on getting the right life insurance for their customers. The Quote and Apply flow, upon successful completion, establishes a term life policy, and generates all its accompanying documents. The policy can be issued in FintechOS Portal or in a third-party system.

Additionally, the solution radically reduce the completion time for the calculations of different types of quotes - by linking with the FintechOS Formula Engine, during the quotation flow. It is thus advantageous to use it for when the agents need to calculate more alternatives to the initial quotation, in an easy and rapid manner. By presenting different quotations to a customer seeking to get life cover, an agent can increase the probability to identify the right quotation for the customer, then establish a term insurance policy, and convert a potential lead into a satisfied customer, probably for life.

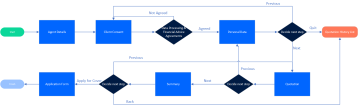

The quotation flow is presented in the diagram below.

The premium is automatically calculated based on the customer's age and the selected term.

The following insurance Lines of Business are included:

-

Term life with multiple riders;

-

Permanent health insurance;

-

Health insurance, including core and ancillary benefits.

The Term Life Quote & Apply accelerator offers the user the ability to apply for a new life quote and view the existing life quote records.

Industry Business Processes

Illustration / Quotation: This process is initiated on receipt of a request for a product quotation. Either a direct request or driven from the FNA/DNT process, typically this involves just the minimum information from the individual or group of individuals, necessary to enable the relevant calculations to be performed and the results returned for formatting into the quotation to be produced. The ability to enable the collection of a broader set of the prospective insureds information is supported, such as:

-

Height/weight;

-

Occupation (Class);

-

Nicotine usage;

-

Alcohol use.

These requirements may vary from insurer to insurer.

The quotation results are stored until such time as they are selected for progression to an application, or can be deleted or otherwise archived in accordance with the offices business practice and applicable regulation, e.g. GDPR.

Apply (New Business Process): The application flow is triggered only manually. The application form is editable and the agent can make adjustments. Sometimes, the responses to the health questions may indicate the need for medical underwriting. When so, the applicant data can be referred to an external system, indicated by the insurer. The flow continues up to the underwriting step. If no underwriting is needed, the flow continues to the issuing of the policy cover.

After underwriting, no adjustments can be made on the quote.

Not Proceed With: The NPW process deals with the cancellation of the application before issuing the policy. This can be initiated automatically or manually. The automatic process is triggered from the New Business or Underwriting when the requests for underwriting evidence or additional application details have not been responded to within the agreed time lines. Users, including authorized representatives can manually initiate the NPW processes.

Not Taken Up: The NTU process deals with the cancellation of an application after policy issue but while the application is active during the cooling off period.

Port Issue Monitoring: This process runs in the background, checking for the completion of the cooling off period. The contract then changes in order to confirm the completion. In the duration of this period, the requests for an NTU can be processed.