View Financial Info

An overview of the company’s main financial indicators and financial statements is provided in the Financial Profile tab.

You can't add or edit the data displayed in the sections below as it is directly retrieved from other systems, such as Core systems, or financial and economics databases, such as Electronic Archive of Real Movable Guarantees (EARMG).

The categories of indicators are defined by the delivery team in implementation.

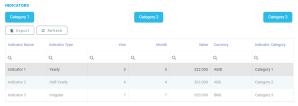

In the Financial Indicators section, you can find the customer's general financial information and financial indicators. Financial indicators are metrics used to determine, track, and analyze the economic health of a business. For example, the following categories of indicators can be defined:

- Financial Statement Indicators: turnover, total assets, net equity, liquidity, solvency, total debt, total liability, number of employees, profit and loss, Earnings Before Interest and Taxes (EBIT), Before Interest, Taxes, Depreciation and Amortization (EBITDA).

- Leverage indicators : Debt to Assets Ratio, Debt to Equity Ratio, Debt to Capital Ratio, Debt to EBITDA Ratio.

- Market value indicators: Price to Earnings Ratio, Price to Book Ratio, Free Cash Flow (CFC).

- Efficiency indicators: Employee Turnover Rate, Employee Absence Rate.

-

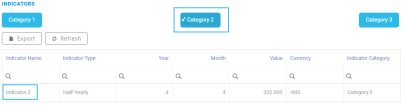

In the Financial Indicators section, you can filter the records by clicking on the category buttons, in this case Category 1, Category 2, or Category 3. The filter buttons can also be defined by the delivery team in implementation.

-

To view additional information about a financial indicator, double-click a record from the list. The following data is displayed:

-

Indicator Name: The name of the financial indicator.

-

Status: The status of the financial indicator: active or inactive.

-

Indicator Category: The category of the financial indicator.

-

Value: The value of the financial indicator.

-

Currency: The currency of the financial indicator.

-

Year: The year of the financial indicator.

-

Month: The month of the financial indicator.

-

Indicator Type: The financial indicator type. Possible values:Monthly, Biannually, Annually, Irregular.

-

Reporting Date: The date the financial indicator was reported.

-

Source: The source of the record.

-

External ID: The external ID.

-

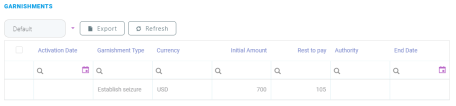

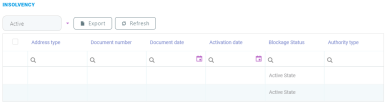

In the Garnishments section, you can find information related to garnishments at the customer's account level. A bank or wage garnishment is a legal process that allows the financial institution to put a hold on the customer's account to settle unpaid debts. Here, you can view the following garnishment types: Default, Active Garnishment, Canceled Garnishment, Suspended Garnishment, Closed Garnishment, Garnishment Paid in Full, Active Seizure, Closed Seizure, Active Insolvency, Closed Insolvency, Expired Insolvency, Expired Seizure or Expired Garnishment.

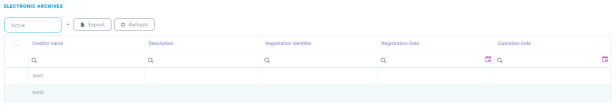

In the Electronic Archives section, you can find information related to Electronic Archive of Real Movable Guarantees (EARMG) at the customer's account level. By default, the active records are displayed but the inactive ones can also be viewed.

Select either Active or Inactive from the drop-down list to filter the records.