Simulation

The page Quick quote calculator refreshes to display sliders for the amount and period. To configure their desired loan amount and tenor and offer them some product choices bases on the filters from the previous step.

The page displays the message Please enter your desired loan amount and length and we'll find the best options for you. followed by the sliders:

- Loan amount

- Loan tenure.

Slide the values in the two fields labeled Amount and Period. The amount is the value borrowed from the bank and the period is the interval of time when the person is expected to pay off the amount borrowed with an interest. The period is measured in months. By default, the period slider is set at maximum and the amount slider is set in the middle of the road between the max and min amount values. The Continue button is disabled until you click Calculate.

The min and max values for the sliders for amount and tenor are calculated as:

- the minimum amount: the minimum amount from all the remaining available products after the destination filter is applied

- the maximum amount: the maximum amount from all the products after the filter is applied

- the minimum tenor: the minimum tenor from all the remaining available products after the destination filter is applied

- the maximum amount: the maximum tenor from all the products after the filter is applied.

The system now calculates the input values to return a suggestion to the customer. In Fintech OS Studio, the values inputted by the customer are registered, the system introduces in pricing all the products that respect: the destination, the class, the category, and more. Finally, based on the banking product code, the top two products are displayed.

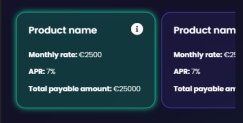

Click Calculate to return a selection of products for the SME. A list of products, maximum two, is displayed with the details:

The system registers the input, and using the endpoint FTOS_BASME_GetAmountAndTenure it determines the products for offering.

- APR

Annual percentage rate. APR is an annualized representation of your interest rate.

Annual percentage rate. APR is an annualized representation of your interest rate.

- Monthly instalment

- Payable amount.

To navigate between products swipe left and right. The first product is pre-selected by default by the system.

For details on how the products were created, see

To view the details of each product, select a card by tapping on it, then tap the information symbol to display a pop-up with the details. The information symbol is only displayed on the selected card. It opens the details:

- Monthly instalment: Small sums of money paid at regular intervals over a period of time, rather than paying the whole amount at once.

- Interest percent: The interest rate is defined as the proportion of an amount loaned which a lender charges as interest to the borrower.

- APR

Annual percentage rate. APR is an annualized representation of your interest rate.

Annual percentage rate. APR is an annualized representation of your interest rate.

- Monthly insurance cost (only for products with insurance): The payment for the insurance.

- Monthly administration fee: The payment charged by the bank for administration.

- Total insurance cost (only for products with insurance): The price of the insurance.

- Total fees: The entire cost.

- Total repayment: The sum of all scheduled or projected payments of funds that the borrower agrees to pay to the bank.

Click the X symbol to close the pop-up and return to the initial screen. To navigate between the two products displayed, click and hold one of the products and drag left or right. A scroll bar is displayed.

Based on the results of the calculations, the system displays the first product that can satisfy your needs. Choose a product, then click Continue. The system registers the product selected and after the next steps begins to determine whether you qualify for it. You can go back to this step and choose a different product using the back arrow.