Partners' Flow

Each partner has to achieve some tasks before signing the documents:

1 Greetings!

This is a landing page for the business partners to be informed about the situation: Your business partner <main applicant name> applied for a loan in the name of the <the applicant company> company from us, <Bank name>. He provided us with all the necessary steps, including your email address.

Your approved loan characteristics:

- The name of the product,

- The loan amount

- The value of the monthly repayment

- APR

- The period of the loan

- The value for the total repayable amount.

For compliance reasons, all the stakeholders of the company <company name> must sign the loan contract. As a security measure, your identity must be certified in the next 72h through three easy steps:

- Identity Proof

- Take a selfie

- Sign the Documents

Click the button Let’s start!.

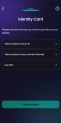

2 Verify Your Identity

The Verify Your Identity screen allows you to provide personal identification documents to prove your identity. A card or any bank product cannot be issued without verifying the identity of the applicant. The following ways of providing identification proof are available:

- Take a photo of your ID: requires you to take a photo of your ID

or

- Take a photo of your driver's license: requires you to take a photo of your driver's license

or

- Use NFC

Near-field communication is a set of communication protocols for communication between two electronic devices over a distance of 4 cm or less. if you have a compatible ID card - to be used if you have a compatible ID card.

Near-field communication is a set of communication protocols for communication between two electronic devices over a distance of 4 cm or less. if you have a compatible ID card - to be used if you have a compatible ID card.

It is mandatory to choose at least one way of providing identification information.

Take a photo of my ID

This option allows you to open the camera and take a photo of the front of the ID card. The photo is taken by our automation processor Computer Vision, which gathers the data from the document and saved the photo of the customer's face. This photo is later compared with the selfie to match the appearance of the customer.

If the first attempt to take the photo is unsuccessful, then you have five more tries. Once the final attempt has failed, the flow ends. This number of retries can be modified within Digital Flow Settings.

Click Take a photo to continue the flow.

Near Field Communication

If you choose the NFC![]() Near-field communication is a set of communication protocols for communication between two electronic devices over a distance of 4 cm or less. option, you must tap your NFC compatible ID card to the back of the phone. This alternative is a proposal to scan the ID card, however, it was not developed within this solution.

Near-field communication is a set of communication protocols for communication between two electronic devices over a distance of 4 cm or less. option, you must tap your NFC compatible ID card to the back of the phone. This alternative is a proposal to scan the ID card, however, it was not developed within this solution.

3 Time to take a selfie

The Time to take a selfie screen allows you to confirm your identity by taking a selfie. However, you need to follow a few conditions:

-

Keep a straight face;

-

Consider good lighting conditions;

-

Make sure the face is clearly visible.

This option allows you to open the camera and take a photo. The photo is taken by our automation processor Face Recognition with Liveness. This photo of the ID is later compared with this selfie, to match the appearance of the customer. If the first attempt to take the selfie is unsuccessful, then you have five more tries. Once the final attempt has failed, the flow ends.

4 Sign the Documents

For the amount to be disbursed and the loan to be contracted, you need to sign both documents You’re almost done! Below you can preview and sign your loan documents. A copy of the contracts was also sent to your email address.

- SME Loan contract

- Repayment schedule.

The process can continue only if the two documents are signed. These documents are sent to your email address as well. If you choose to sign them at a later date, the email contains the link from where to resume the journey.

This page allows you to preview the documents and download them on your local drive.

For details on how the documents are generated, see .

Insert the One-Time-Password

The signing process is done by sending a One-Time-Password (OTP) code in a text message to your phone number or email and you are required to input the code in another screen. All documents are mandatory to be signed, but this can be configured by the bank.

Insert the six digits in the designated field, and click Continue.

5 Thank you for your trust

The Thank You screen allows you to provide feedback on your experience with the SME Mobile Lending.

This feedback is provided using a rating system of 1 to 5 stars. This step is not mandatory. In addition, you can type in your opinion in the text box. Moreover, this screen also recommends complementary products and services, including loans, savings accounts, cards.

Additionally, there is a list of products as a recommendation. A bank can accommodate the popular products here.

Other customers also looked at:

- Office loans with a 2% interest rate

- 0,5% Interest rate on Savings Accounts

- Credit card with 0% interest rate for the first 3 months.

Click Home to return to the first screen.