Contact Information and Consent

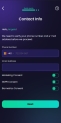

The purpose of the Contact Info screen is for you to provide an email address and phone number. This is part of the process for validating contact details. This screen uses the name selected by you in the previous screen, from the list of results pulled up by the Companies House Connector, and displays the message: Hello, firstName! We need to verify your phone number and e-mail address before we proceed.

You, as the applicant, must provide a valid phone number and email address. A validation is enforced on the email address field, meaning that the address must follow the standard pattern. Click Next to trigger the OTP verification codes generation. They are sent to the phone number and email address. These codes must be introduced on the next screen.

Within Fintech OS Studio, there are configurations for the OTP codes using the processor settings FTOS_DFP_ContactOTP. You can modify the settings there (e.g., the number of digits, the number of retries, etc.).

Consent

GDPR![]() The General Data Protection Regulation is a regulation in EU law on data protection and privacy in the European Union and the European Economic Area. consent is mandatory in many operations when dealing with personal information. Therefore, in order to proceed with the SME Mobile Lending digital journey, you must consent to GDPR and Biometric consents. The list contains:

The General Data Protection Regulation is a regulation in EU law on data protection and privacy in the European Union and the European Economic Area. consent is mandatory in many operations when dealing with personal information. Therefore, in order to proceed with the SME Mobile Lending digital journey, you must consent to GDPR and Biometric consents. The list contains:

- GDPR Consent: mandatory consent that must be provided in order to proceed. The time stamp of when the consent was given is saved.

- Marketing Consent: optional consent that refers to whether or not the applicant would like to receive marketing materials.

- Biometric Consent

Certain laws require banks to provide you a notice to agree that the bank can collect, use and disclose your biometric data, e.g. biometric identifiers are fingerprints, facial patterns, voice or typing cadence.: mandatory consent that must be provided in order to proceed.

Certain laws require banks to provide you a notice to agree that the bank can collect, use and disclose your biometric data, e.g. biometric identifiers are fingerprints, facial patterns, voice or typing cadence.: mandatory consent that must be provided in order to proceed.

Toggle on and off on each consent.

To proceed to the next screen, click the Next button. Upon clicking this button, a number of actions are triggered:

- the timestamp for the action is recorded in case the bank might later need information on when the GDPR consent was given (GDPRTimestamp);

- the digital journey progresses to the next step, the Contact Validation screen;

- One-Time-Password (OTP)

It is a password generated by the system to validate a piece of information or sign a document. codes are automatically sent to your email address and phone number.

It is a password generated by the system to validate a piece of information or sign a document. codes are automatically sent to your email address and phone number.