Policy Claim Data

Claim data is used in decision process when writing a new risk or when modifying existing risks during underwriting, adjusting indemnity limits if no automatic reinstatements are in place, or renewing a policy. It can determine a set of KPIs at policy level that can be further aggregated at portfolio levels.

The system is able to get claims data from an external source in order to be used in the views for Policy Claims data and other processes (e.g. Update Sum Insured after a claim is settled).

The Policy Claim Data API is used to log the policy claim data. The API is called each time an update is made at reserve level and/or payment level. Find out more about the API by accessing the Policy Claim Data API page.

View the Loss Ratio

The loss ratio (LR) is calculated at coverage level, and takes into account the gross written premium (GWP).

In order to view the loss ratio, access a policy and click on the second tab, named Claims Data.

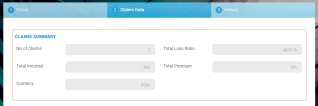

The tab displays three sections:

-

Claims Summary: This section contains a grid with the following fields:

-

No of Claims: All claim files opened on the coverage;

-

Total Loss Ratio: Calculated as Incurred Total/Premium Amount Total * 100. It is displayed in percentages.

-

Total Incurred: Calculated as the sum of all incurred values for all coverages. The incurred is calculated as: SUM (all resevres on the coverage) + SUM (all indemnities paid on that coverage).

-

Total Premium: Calculated as the sum of all the premium values for all coverages.

-

Currency.

-

-

Affected Coverage: Keeps and reflects the tabular view for claims recorded at coverage level.

-

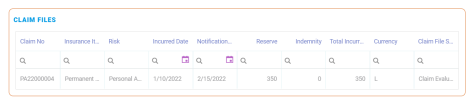

Claim Files: This section displays a list with all the claim files recorded to that policy. The claim file data is updated after each API call for said claim file with the latest data. The values are updated each time the API is received.