Closing a Current Account

Current account contracts with all their financial obligations met can be closed. Loan Management enables you to close these contracts automatically through scheduled jobs or manually, according to a series of settings defined at the banking product and at the contract level. The automatic closure of contract is triggered whenever the maturity date of the contract is reached and there are no overdue amounts on the contract, or according to the closure settings.

There are cases when you might expect the account to get closed once all amounts recovered, maturity date reached, or you might want such contracts to be closed after a certain number of days, allowing for possible reconciliations, or even leave them to be manually closed or with a localized job. All this is enabled from product level and, if set as negotiable, you can also change the default at contract level. You might need such settings if you work with direct debit and need to allow for the number of days the direct debit can bounce to pass before you really close the deal.

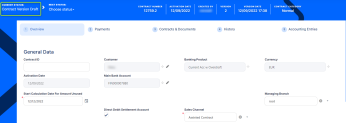

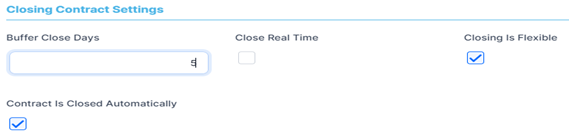

You can configure the closure settings during product definition, in the Lean Contract Settings' tab -> Closing Contract Settings section, as described in the Banking Product Factory user guide:

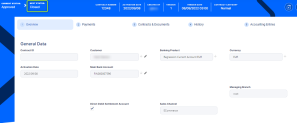

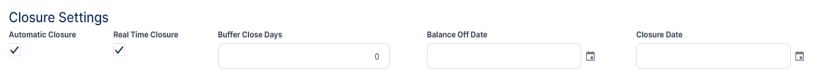

If allowed from the product definition, you can amend the closure settings of the contract, the way Loan Management should behave once there are no more due amounts and the contract can be closed. Perform these configurations in the Closure Settings section of the Overview tab, during contract creation, for contracts based on banking products having the Closing Is Flexible = True setting:

Depending on the real time closure setting, Loan Management uses the one following scheduled jobs to close the contracts automatically:

-

Close Contracts (CB) Job- this job closes automatically all contracts withAutomatic Closure = TrueandReal Time Closure = False, with zero available amount and with no further amounts to be recovered, that haveBalance Off Datefilled in andClosure Date = Current Date. -

Close Contracts RealTime(CB) JobAutomatic Closure = TrueandReal Time Closure = True, with zero available amount and with no further amounts to be recovered.

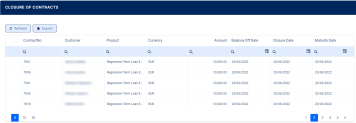

You can see the list of contracts that are ready to be closed in the Closure of Contracts report:

You can also use the GetClosureOfContracts endpoint to fetch the same information within your own API integration.

If you opted to close a contract with all the obligations met manually, and not automatically, before its maturity date, then follow these steps:

-

Double-click an approved contract with zero amounts to be recovered and zero available balance, opening it for editing.

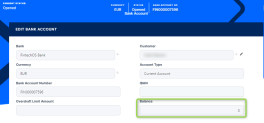

This example shows you a current account with its balance = 0 and no overdraft:

-

Change the contract's Next Status into Closed.

If Loan Management performs all the validations and finds that the financial obligations are met and there are no more amounts to be recovered or to be transferred out, then the contract's status becomes Closed. You can't perform any other operations on this contract.

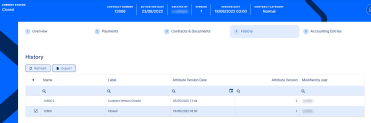

Any existing versions of the contract are also automatically closed, as you can see in the History tab.

When you plan to close a current account with an attached overdraft functionality, first you have to settle the costs linked to the overdraft, transfer any remaining balance to another account, and only then you can proceed to close the account.

If you opted to close a current account with overdraft contract with all the obligations met manually, and not automatically, before its maturity date, then follow these steps:

-

Create a new version of the Approved contract.

-

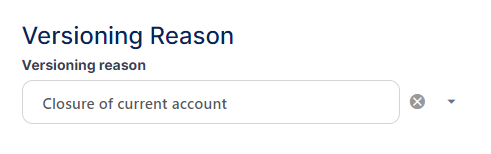

Scroll down in the new version's Overview tab and fill in a

Versioning Reason.

-

Change the

Maturity Dateof the contract to an agreed upon date. -

If the

Expire Date for Overdraftwas not reached yet, then you must also change it to the same date as you did forMaturity Date. -

Go to the contract's Payments tab and double-click the repayment schedule to open it. Click Recalculate for Loan Management to perform a recalculation of the repayment plan, to have the last installment due on the new maturity date, with all the accrued amount added into the designated columns.

-

Approve the contract version.

-

At the end of that day, Loan Management notifies the installment.

Whenever a due amount is notified before the expiration date of the overdraft, the balance of the current account is credited with the notification amount when running theLoan Management End Of Dayscheduled job. When the expiration date of the overdraft is reached, any due amounts are moved to the last, expiration installment of the repayment schedule, on the principal, and the balance, the overdraft limit amount and the overdraft available amount are zeroed. The expiration installment amount can be covered with a top-up or a new overdraft on the same current account. -

The next day, settle the last installment, performing a top-up.

-

Close the current account manually, performing the same steps described in the Manually Closing Current Account without Overdraft Contracts section.