Bank Account Transaction Configurations

Transactions between bank accounts generate debit operations on a source bank account and credit operations on a destination bank account. The bank accounts can be reconciliation accounts (accounts defined at the product admin configuration level serving as source for disbursements or accounts defined at the transaction fee level for collecting fees), user bank accounts (current, deposit or credit accounts), or external bank accounts (accounts from other banks).

In Loan Management, the transactions between bank accounts are created in Draft status. When you change a transaction's status changes to Approved, Loan Management automatically generates bank account operations: Debit Operations for the Source Account, and Credit Operations for the Destination Account. It also updates the balance for the source or the destination accounts if they are bank accounts defined within Loan Management.

You can define fees to be added to bank account transactions. Using fee lists, you can attach fees with specified values to each bank account transaction type. The lists can further be filtered. When you select a transaction operation type on a bank account transaction, Loan Management identifies the fee list and fee values and applies them considering the data of the transaction. Loan Management creates operations of debit and credit for both transaction value and fees. The number of credit and debit operations created by Loan Management is managed through the BankAccountTransactionFeeMarkDown system parameter.

You can configure the bank account transaction operations and fees by managing the records within FintechOS Portal's dedicated menu, Admin Configurations > Bank Account Transactions.

This page contains a series of topics that assist you in configuring how Loan Management manages transactions between bank accounts:

Transaction Types Covered Through Bank Account Transaction Operation Types in Loan Management

Loan Management currently covers within its automated processes the following transaction types through the bank account transaction operation types:

| Transaction | Code | Usage | Generates Accounting Entry | Is Return Transaction | Is System Transaction | Is Automatic | New Contract Version | Source Entity | Bank Account Transaction Operation Type |

| Disbursement | DSB | Loan Account | yes | no | no | no | no | Contract Event

|

Disbursement |

| Revert Disbursement | RDSB | Loan Account | yes | no | no | yes | no | Contract Event

|

Disbursement |

| Repayment | RP | Loan Account | yes | no | no | yes | no | Payment

|

PaymentIn |

| Top-Up Account | TPCA | Current Account | yes | no | no | no | no | Contract Event

|

PaymentIn |

| Payment Deposit | PD | Deposit Account | yes | no | no | yes | no | Payment Notification

|

PaymentIn |

| Withdraw | W | Current/ Deposit Account | yes | no | no | no | no | Contract Event

|

PaymentOut |

| Transfer between my bank accounts | TR | Current Account | no | no | no | no | no | PaymentOut | |

| Early Termination Deposit | RPD | Deposit Account | yes | no | no | yes | no | Payment Notification

|

PaymentOut |

| Revert Transfer between my bank accounts | RTR | Current Account | yes | no | no | yes | no | Contract Event

|

PaymentOut |

| Deposit Liquidation | DLQ | Deposit Account | yes | no | no | no | no | Contract Event

|

PaymentOut |

| Reschedule Overdues | RO | Loan Account | no | no | no | no | yes | RecoverDebt | |

| Repayment Notification | RN | Loan Account | yes | no | no | yes | no | Repayment Notification

|

RepaymentContract |

| Early Repayment | ER | Loan Account | yes | no | no | no | yes | Contract Event

|

RepaymentContract |

| Overdraft Payment | ODP | Loan Account | yes | no | no | no | no | Contract Event

|

RepaymentContract |

| Returned Amount or Goods | RG | Loan Account | yes | yes | no | no | yes | Contract Event

|

RepaymentContract |

| WriteOff | WO | Loan Account | no | no | no | no | no | Contract Event

|

WriteOff |

Usually, these transactions are operated behind the scenes, on the server-side, on a higher-order entity like Contract (once a credit contract changes its state to Approved for auto disbursement) or ContractEvent (when the initiated event of transferring money from a current bank account to a deposit bank account of the same user is approved and the selected Transaction Type = Transfer between my bank accounts).

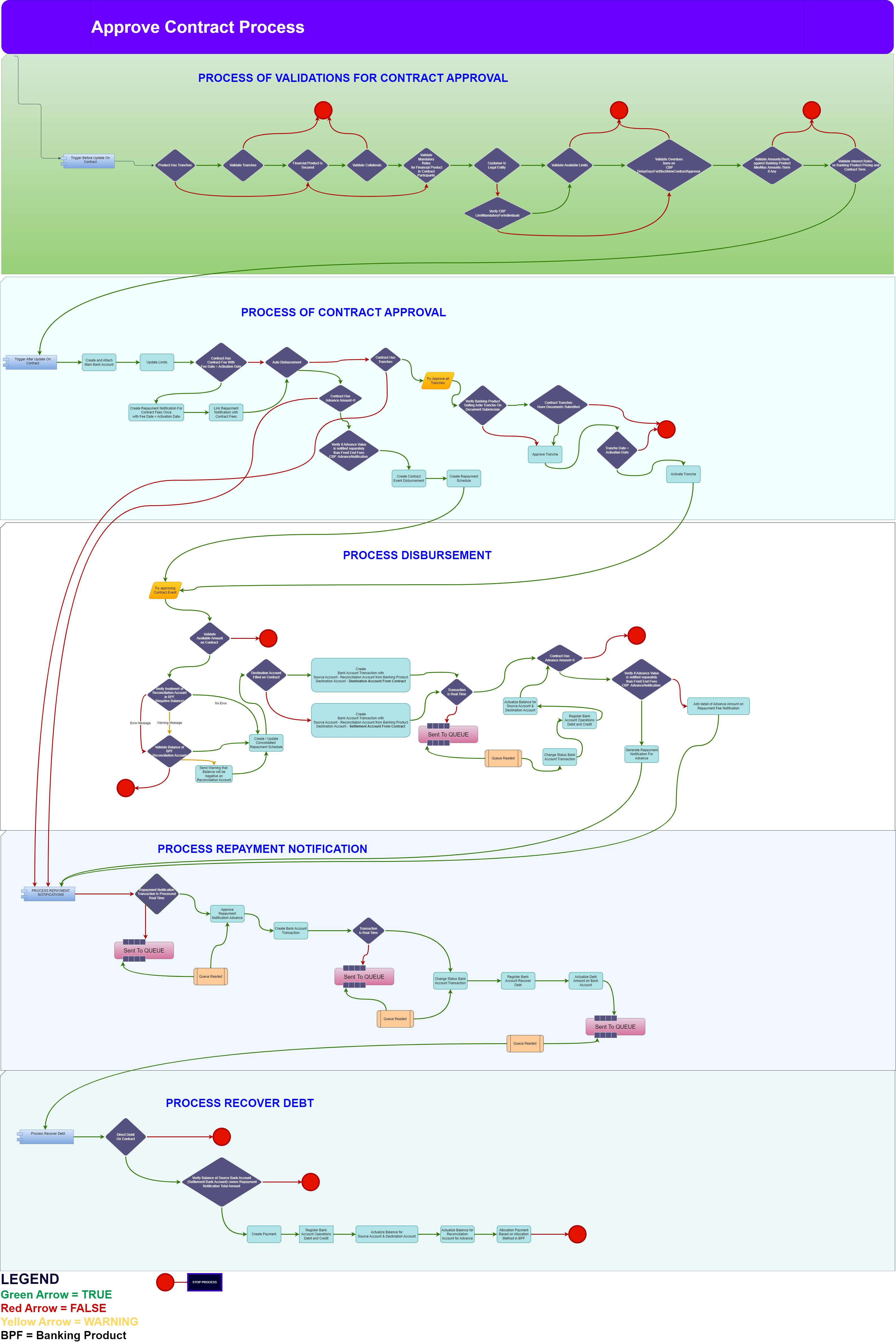

Loan Contract Approval Process Flow

Loan contracts in Loan Management go through a series of processes during their life time, from contract approval to full recovery of debts. The following transaction types are illustrated in the below diagram:

-

Loan Contract - This is the transaction performed when the contract is being validated for approval and actually approved;

-

Disbursement - This is the transaction performed when the funds are actually delivered from a bank account to the customer;

-

Repayment Notification - This is the transaction performed when a repayment is generated.

-

Repayment - This is the transaction performed when the funds are actually collected from the customer and the notification is recovered.

If no external triggers are put in place (such as an early repayment or a return of goods event), then this is the flow applicable for each loan contract in Loan Management. The orchestration of the processes is performed either internally, through Job Server (see Jobs page) or through external request processing.