Third-Party Agreements Life Cycle and States

Third-party agreements are complex agreements between a financial institution and third-party entities such as agents or brokers, who intermediate the creation of contracts with customers, in exchange of a payment previously negotiated with the financial institution. Therefore the four-eyes principle is applicable here, meaning that a record should be approved by a second financial institution employee, with higher authorization rights. This is enabled via approval task FintechOS Platform capabilities and thus it is also a financial institution's responsibility to set proper security roles and access rights to its users, in order to make sure that the same user can't insert and also authorize the same record.

A third-party agreement record has the following business workflow statuses:

-

Draft - the status of a newly created third-party agreement record that was not yet sent for approval. While in this status, you can edit the fields from the record's Agreement tab, but Core Banking doesn't attach any invoices to it. Send the record to approval after editing all the necessary details and adding at least one agreement pricing record.

-

Pending - this is a system status applied to records sent for approval, but not yet approved (when the four-eyes approval process is implemented). You can't perform any updates in this system status.

-

Approved - the status of a third-party agreement record after being authorized by a user with approval competencies. While in this status, you can't edit the record's details, but the invoice details are automatically added through the Core Banking invoicing processes. If you need to alter the record's details, create a new version based on the current agreement.

-

Closed - the last status of a third-party agreement, after manually closing it or after creating a new version based on the current version. You can't perform any updates on the record.

-

Canceled - the status of a record after manually canceling it straight from the Draft status. You can't perform any updates on the record.

Third-Party Agreements Versioning

Core Banking allows you to create new versions for an existing agreement if you need to modify an existing approved record.

A third-party agreement version can have the following statuses:

-

Version Draft - the status of a newly created agreement version record that was not yet sent for approval. While in this status, you can edit some fields. Send the record to approval after editing all the necessary details.

-

Approved - the status of an agreement version record after being authorized by a user with approval competencies. While in this status, you can't edit the record's details.

-

Version Closed - the last status of an agreement version, after manually closing it or after creating another new version based on the current version. You can't perform any updates on the record.

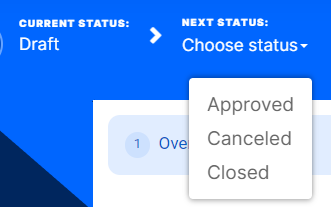

Changing Third-Party Agreement Statuses

You can manage a third-party agreement's life-cycle by changing its status from the top right corner of the screen.

The third-party agreement status transitions are illustrated below:

Note that:

- Once a record is live, its settings can no longer be modified.

- If you want to update the details of a live agreement, you must create a new agreement version.

- When you create a new agreement version, the current version is retired; no updates are allowed on the retired version.

- Every agreement version starts in a Draft state and must go through an approval process before going live.

- Only one version of an agreement can be live at one time.

As a best practice, new records or new versions of existing records created on a specific day should be approved on the same day.