Working with Returns

To manage merchandise return in a contract based on a BNPL-type banking product or even a return of funds in a different kind of loan, no matter if the return is partial or full, Core Banking allows you to perform an early repayment and decide if the repayment amount is excluded from interest calculation, as well as decide how to treat potentially claimed interest at the moment of performing the early repayment. This feature was created in context of BNPL where you can return goods but can also apply for mortgages when the deal drops and the solicitor returns the funds.

The Returned Amounts or Goods transaction triggers an early repay and reconciles/ gives back any interest if collected for that specific amount so far, as well as all or part of the upfront fee. The recalculation of the repayment schedule covers the recalculation of interest and the mitigation of potentially already charged/ notified interest amounts. Core Banking can capture the return for any amount no matter if the disbursement of the loan was done in one or multiple transactions. Even if there are overdue payments on the contract, the principal can be decreased and also the overdue notifications overdue are adjusted to reflect the early repayment, if the date of processing is before the notification date. The transaction only accepts Return Fee commission types. Upon transaction approval, a new contract version is automatically created.

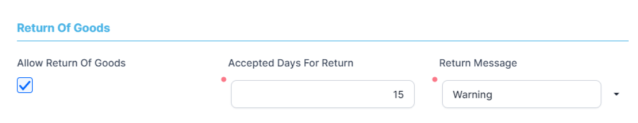

Whether a contract allows or not Returned Amounts or Goods transactions must be defined at the banking product level, within the Lean Core Settings' tab Return of Goods section, as described in the Banking Product Factory user guide.

You can add Returned Amounts or Goods transactions to an approved and disbursed contract via Core Banking's user interface or through API calls, using the Core Banking endpoints. Read more about these endpoints in the Core Banking Developer Guide.

In order to add a Returned Amounts or Goods transaction to a loan contract through the menus available in Core Banking, follow these steps:

-

In FintechOS Portal, select a contract with Approved status and double-click to open it.

-

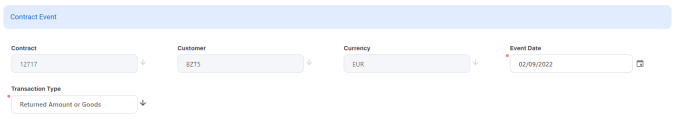

Navigate to the contract's Payments tab and click the Insert button above the Transactions section. The Event page is displayed.

-

Fill in the following fields:

-

Event Date - This is pre-filled with current date.

-

Transaction Type - Select from the list the Returned Amounts or Goods transaction type. If you can't find it, then the transaction type is not associated with the banking product which is at the base of the contract.

Other values are automatically completed: contract, customer, and currency.

-

-

Click the Save and Reload button.

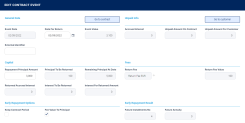

The event is saved in Draft status and a transaction number is automatically generated for it. The Edit Contract Event page corresponding to the selected transaction type is displayed. A series of value fields are automatically calculated, their values are displayed, and you can't edit them: the contract's financed and available amounts, the selected installment calculation method, the repayment day ant the contract's tenor. -

In the General Data section, fill in the external identifier of the transaction, if available.

The date for return is pre-filled and it can't be beforeActivation Dateand afterCurrent Date.

The event value represents value of the transaction, calculated and displayed after saving the record, based on the information filled in a series of other fields:Event Value = Repayment Principal Amount + Commission Value + Interest To Be Returned. -

In the Unpaid Info section, you can only view the information about:

-

Accrued Interest - The interest accrued up until the event date for an early repayment contract event.

-

Unpaid Amount On Contract - The value of the unpaid amount still on the contract.

-

Unpaid Amount For Customer - The value of the unpaid amount for the customer.

-

-

In the General Data section, fill in the Repayment Principal Amount with the amount from the Principal that the customer wishes to return. You can only view the following information:

-

Remaining Principal At Date - The remaining value of the principal at the current date.

-

Returned Accrued Interest - The returned accrued interest.

-

Interest For Returned Amount - The interest for the returned amount.

-

Interest To Be Returned - The interest to be returned with this event.

-

-

In the Fees section, you can only view the information about:

-

Return Fee - The transaction fee applicable for a Returned Amount or Goods transaction on this contract. See Transaction Fees for more details.

-

Return Fee Percent - The return fee percentage applicable for the contract, if the return fee is set up as a percentage.

-

Return Fee Value - The return fee value applicable for the contract.

-

-

In the Early Repayment Options section, select the Keep Contract Period checkbox if Core Banking should keep the period of the contract.

-

Select the Fee Value To Principal checkbox to indicate that the value of the return fee should be applied to the principal, using its value to include it in the repayment amount and diminishing the outstanding principal.

-

In the Early Repayment Result section, you can only view the information about:

-

Future Installments No - the number of installments to be paid in the future. This depends on whether you opted to keep the contract period as it was or not.

-

Future Annuity - the future value of the installment as recalculated after this payment.

-

Future Principal For Installment - the future value of the principal as recalculated after this payment.

-

-

Decide whether you want to use the repayment schedule calculated by Core Banking through automatic processes, or you want to import a custom schedule. For custom schedule, select the Import Schedule checkbox. Read more about importing a custom schedule file in the Manually Upload Repayment Schedules section of the user guide.

-

Click the Save and Reload button.

If the event value meets the business requirements defined within Core Banking, the event is saved. Otherwise, an error message appears. Change the values as instructed in the message and try saving the event again.

While the event is in Draft status, you can modify all the event's fields except Transaction Type. The event value is not applied to the contract while the event is still in this status. -

Click the Simulate Returned Amounts or Goods button to view the details of each installment of the calculated repayment schedule.

-

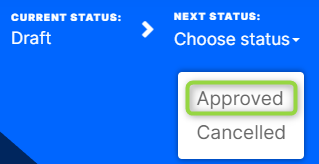

Approve the event by changing its status to Approved in the upper left corner of the Event page.

-

Confirm the change of status in the Confirmation window, clicking Yes. The event is now in Approved status and Core Banking applies the recalculated repayment schedule to the contract, displaying the previous schedule version in the Contract Repayment Schedule Versions section of the contract's Payments tab.

The transaction is visible in the Transactions section.

All existing versions of the contract in Contract Version Draft status are automatically changed to Contract Version Closed when a payment event is approved for that contract.

Legend:

-

RA = Returned amount/ Returned value of the goods

-

IFRV = Interest for remaining value after returning the amount/ returning the value of the goods

-

IFRA = Interest for returned amount starting from return date

-

RVA = Remaining value after returned amount/ returned value of the good

-

RVBA = Remaining value before returned amount/ return value of the good

Principal To Be Returned = if RA > RVBA => RA - RVBA, else 0.

Interest To Be Returned = if IFRA > IFRV=>IFRA -IFRV, else 0.

Interest on the first installment generated by the transaction: if IFRV > IFRA => IFRV - IFRA, else 0.

On event approval, Core Banking verifies if Event Date respects the formula: Activation Date + Accepted Days For Return >= Current Date. If the formula is not respected, Core Banking returns:

-

an error message, if

Return Message = Erroron the banking product definition; -

a warning message, if

Return Message = Warningon the banking product definition; -

nothing, if

Return Message = NoMessageon the banking product definition.

Core Banking also checks on event approval if the Return Fee is not greater that the sum of commissions with type Front-End Fee with Is Returnable = True on the contract level.

There is no validation of the event amount on this transaction related to balance of current account.

After event validation, Core Banking creates a new version of the contract. The contract's current account (customer casa account) is topped-up TOP Up with the Event Value = Amount + Return Fee. The return fee is added to the contract's Fees & Commissions section with a negative value that can't be modified.

In the Contract Repayment Schedule, Core Banking creates an installment with all columns = 0, except Principal, Remaining Value and Total Installment, with Is Early Repayment = True and Is Return = True. The Principal amount is:

-

the principal amount saved on the transaction if

Fee Value To Principal = False; -

the event amount saved on transaction if

Fee Value To Principal = True.

Core Banking generates a notification for this installment and performs the allocation. The allocation process affects the main bank account balance as it is now, all the limits with Is Revolving = True and On Repayment = True affected by this contract, and the available amount on the contract if Is Revolving = True at the product level.