Working with Overdue Loans

Financial institutions classify their existing loan contracts based upon the days past due (DPD), the number of days passed since repayment due date without fully repaying the due amount for the oldest unpaid repayment notification. In order to comply with the risk method calculation, the DPD (days past due) value is calculated as the number of days between the contract's due date and the current system date of Core Banking. The financial institutions can apply different provision percentages for principal or for interest for each contract, based on this classification: the higher the delay period, the higher the provision percentage applicable and the risk classification.

In Core Banking, the loan classification works by risk contamination at the customer and the group levels. This means that if a loan contract belonging to a customer is classified as one of a higher risk due to delays in the repayment process, all the other loans of the customer and of the group where the customer is a member are further classified into that high-risk classification. The risk classification of loan contracts is automatically performed by the Update Loan Classification (CB) scheduled job based on the loan classification records' definition. Read about managing loan classification records in the Loan Classification topic.

Core Banking uses two system parameters that help you manage contracts with DPD:

-

UseContaminationForDPDCategory- this parameter specifies whether Core Banking should use the risk contamination for loan classification or not; -

DelayDaysForBlockNewContractApproval- this parameter controls the default number of delay days for blocking the approval of new loan contracts for customers who have overdue payments.

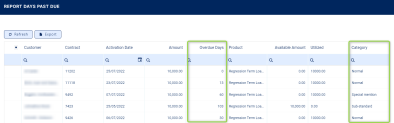

You can view the contracts with DPD in the dedicated Days Past Due report, accessible through Core Banking's Reports menu. Double-click any of the contracts from the report to open it for editing. The report displays the contracts with overdue repayment notifications, along with information about the number of overdue days and the contract's classification based on the DPD:

You can also extract the information about overdue repayment notifications through API integration, using the GetDataSourcePastDueInstallmentsReport endpoint.

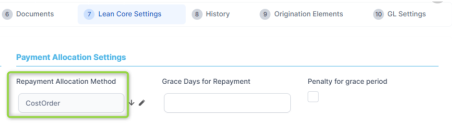

The allocation of funds for repayment notification is performed according to the cost allocation method defined at the banking product definition level, in the product's Lean Core Settings tab -> Payment Allocation Settings section, as described in the Banking Product Factory user guide:

In order to avoid having to deal with overdues, you can perform payment holiday transactions. If you already have overdues, then perform reschedule overdues transactions on the contracts. Both transactions are usually part of the risk management/ collection departments' policies and can be proactively implemented by the bank, or on the customer's demand.