Managing Credit Facility Utilization Details

A credit facility utilization is a contract opened for banking products attached to the facility.

You can find the details of the credit facility such as facility utilizations, fee values, accruals and repayment notifications in a credit facility record's Credit Facility Utilizations tab. There is no information here to display for records in Draft status. You can add utilizations only after the record reaches Approved status.

Here are the actions that you can perform on utilizations already added to a credit facility record:

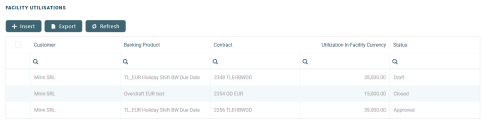

You can view, insert or export contracts based on the banking products added to this credit facility in the Facility Utilizations section within a credit facility record's Credit Facility Utilizations tab. These contracts are known as utilizations.

To add a utilization, perform the steps described on the Adding Utilizations to Credit Facilities page.

The already added utilizations are displayed in a list with the following fields:

-

Customer - The name of the customer who is the owner of this utilization.

-

Banking Product - The banking product which is the object of this credit facility utilization.

-

Contract - The number of the contract holding this credit facility utilization, either selected when adding the utilization, or automatically created by Core Banking.

-

Utilization in Facility Currency - The amount specified in the credit facility utilization, expressed in the credit facility's currency.

-

Status - The status of the credit facility utilization record. The possible values are:

- Draft - The utilization was created, but it needs further approval.

- Approved - The utilization was approved and its amount was disbursed in the customer's designated current account.

- Closed - The utilization reached its final unalterable status either by being rejected during the utilization approval process, or manually by changing the record's status.

To update a utilization in Draft status:

-

Double-click to open the Credit Utilization page.

-

Update the editable fields of the utilization according to your needs.

-

Click the Save and Close button.

Approve credit facility utilizations to instruct Core Banking to disburse the amount of the contract in the customer's account.

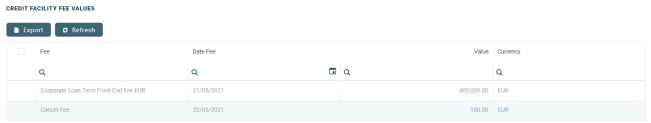

You can see or export the fee values already applied to this credit facility in the Credit Facility Fee Values section within the Credit Facility Utilizations tab.

To view the details of a fee:

-

Double-click the fee to display the Credit Facility Fee Value page.

-

View the following information regarding the fee:

-

Credit Facility - The id of the selected credit facility record.

-

Fee - The fee applied to the credit facility.

-

Date Fee - The date when the fee was applied to the credit facility.

-

Customer - The customer who must pay the fee value.

-

Currency - The currency of the fee.

-

Repayment Notification - The number of the repayment notification automatically generated by Core Banking.

-

Loan Item - The type of the fee.

-

Value - The value of the fee, expressed in the fee's currency.

-

-

Click the Save and Close button.

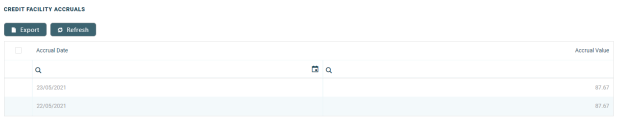

You can see or export the values of the accrual automatically calculated by Core Banking for this credit facility in the Credit Facility Accruals section of the Credit Facility Utilizations tab.

Each accrual lists the following information:

-

Accrual Date and Accrual Value - The date and the value of the accrual calculation, expressed in the credit facility's currency.

-

Fee - The fee or commission based on which the accrual was calculated. This is only displayed on the Credit Facility Accrual page, opened if you double-click an accrual record for viewing purposes.

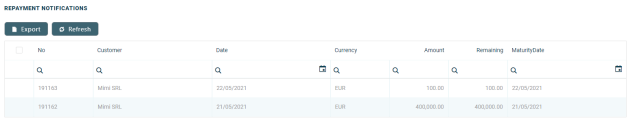

You can see, update or export the repayment notifications automatically issued by Core Banking for this credit facility in the Repayment Notifications section of the Credit Facility Utilizations tab.

Each repayment notification lists the following information: number, issuance date, the customer participant to the credit facility for whom the repayment notification was issued, the amount, the currency, and the due date of the notification, as well as the amount that remains to be paid by the customer for this repayment notification.

To update a repayment notification:

-

Double-click a record to open the Edit Repayment Notification page.

-

If needed, insert corrections by clicking the Insert button next to the Corrections section.

-

On the newly displayed Add Contract Correction Entry page, view in the following details: repayment notification number, contract, currency, the name of the customer, the date when the correction entry is saved, and the sum of values entered for in the correction entry details section.

-

In the Contract Correction Entry Details section, fill in the following details:

-

Repayment Notification Detail - Select the repayment notification detail to be corrected.

-

Operation Item - Select the operation item.

-

Correction Value - Enter the desired value.

-

-

The correction entries must be approved in order to be processed. Change the record's status to Approved.

-

Click the Save and Reload button after performing the desired updates.

The repayment notification is automatically marked as paid (the IsPaid checkbox in the Repayment Notification details section is selected) after the payment is processed, either by a Core Banking process or by adding a manual correction.