FTOS_BP_CalculateRepaymentSchedule

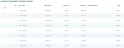

Returns an array of json records representing the calculated installments of a repayment schedule, that must be stored and presented as in the picture bellow, customized for every project:

Syntax

The FTOS_BP_CalculateRepaymentSchedule custom endpoint is called from within the Endpoint API endpoint. Visit the Endpoint API page for more details.

POST <host_address>/ftosapi/automation-processors/actions/FTOS_BP_CalculateRepaymentSchedule

Content-Type: application/json

{

"jsonParam": {

"ScheduleType": "<schedule_type_name>",

"ProductType": "<product_type_name>",

"InterestPercent": <annual_interest_rate_for_calculation>,

"Amount": <financed_amount>,

"AdvanceAmount": <advance_amount>,

"HolidayShift": <true_or_false>,

"HolidayCountry": "<holiday_country_calendar_name>",

"RealInstallmentNo": <actual_number_of_installments>,

"InstallmentsNo": <number_of_installments>,

"GracePeriodInterest": <number_of_installments_with_grace_period_for_interest>,

"GracePeriodPrincipal": <number_of_installments_with_grace_period_for_principal>,

"PeriodicityType": "<schedule_periodicity_type>",

"LastDueDate": "date_of_last_installment_unmodified_for_recalculation",

"BlockInstallmentNo": <number_of_installment_blocked_for_recalculation>,

"IsLocked": <1_or_0>,

"BlockAmount": <value_of_capital_blocked_for_recalculation>,

"BlockInterestAmount": <value_of_interest_for_grace_period>,

"ActivationDate": "contract_actiovation_date",

"InstallmentDay": <day_of_month_for_each_installment>,

"InstallmentMethod": "<installment_calculation_method_ActualMonth_or_NextMonth>",

"StartDateForUnusage": "<starting_date_for_calculating_interest_for_unused_amount yyyy-mm-dd>",

"ExpiryDateForOD": "<last_date_for_overdraft yyyy-mm-dd>",

"MaturityDate": "<contract_end_date>",

"InterestCapitalization": <interest_capitalization_value>,

"UpFrontValue": <up_front_value>,

"Commission": [

{

"SourceValue":<commission_value>,

"SourcePercent":<commission_percent>

"FeePeriodicityType":"<commission_periodicity_type>",

"GracePeriodFee":<commission_grace_period>,

"BlockFeeAmount":<commission_blocked_amount_for_recalculation>,

"FeeDate":"<commission_date>",

"FeeName":"<commission_name>",

"IsUpfront": <whether_first_commission_value_is_paid_at_activation_date_with_values_0_1>}

],

"Insurance": [

{

"SourceValue":<insurance_value>,

"SourcePercent":<insurance_percent>

"InsurancePeriodicityType":"<insurance_periodicity_type>",

"GracePeriodInsurance":<insurance_grace_period>,

"BlockInsuranceAmount":<insurance_blocked_amount_for_recalculation>,

"InsuranceDate":"<insurance_date>",

"InsuranceName":"<insurance_name>",

"InsuranceClassName": "<insurance_class_name>",

"IsUpfront": <whether_first_insurance_value_is_paid_at_activation_date_with_values_0_1>}

],

"DeferDueDate": <defer_due_date_with_values_0_1>,

"FirstDueDate": "<contract_first_due_date>",

"ContractPeriod": <number_of_contract_periods>,

"HolidayMethod": "<holiday_method>",

"MultipleInterestRates": [

{

"InterestRate": <interest_percent>,

"FromInstNo": <from_installment_number>

"ToInstNo": <to_installment_number>

}

],

"BandedInterestRates": [],

"UnusedAmount": <unused_amount>

}Here's a list of the available parameters:

| Parameter | Description |

|---|---|

| host_address | URL of the FintechOS Platform server. |

| access_token | Access token used to connect to the API endpoint. For details, see GetToken. |

| user_name | The username of an existing user account on the FintechOS Platform, previously used to get the access token. |

| Data | Key-value pairs of any input parameters to be passed to the internal endpoint in JSON format. Double quotes that enclose string parameter values must be escaped with backslash characters, eg.: \"string value\". |

| ScheduleType | Mandatory. The name of the Payment Schedule found in the FTOS_BP_PaymentScheduleType entity. |

| ProductType | Mandatory. The periodicity of the schedule. The possible values are the names of the records from the FTOS_CB_PeriodicityType entity. |

| InterestPercent | Mandatory. The interest rate for the calculation, defined at the banking product level. The interest rate must be annual, so if you are using a monthly interest rate, you must transform it into an annual rate, multiplying it with 12. |

| Amount | Mandatory. The financed amount, usually also containing the residual value if present, but not the advance value. |

| InstallmentsNo | Mandatory. The number of installments. |

| PeriodicityType | Mandatory. The periodicity of the schedule. The possible values are the names of the records from the FTOS_CB_PeriodicityType entity. |

| InstallmentDay | Mandatory. The day of month for each installment. |

| AdvanceAmount | Optional. The advance value, where AdvanceAmount + Amount = CreditValue. |

| GracePeriodInterest | Optional. The number of installments having grace period applied on the Interest column. |

| GracePeriodPrincipal | Optional. The number of installments having grace period applied on the Principal column. |

| LastDueDate | Optional. The date of the last installment unmodified for recalculation. |

| BlockInstallmentNo | Optional. The installment number that is blocked for recalculation. |

| BlockAmount | Optional. The value of the capital that is blocked for recalculation. |

| ActivationDate | Optional. The activation date of the contract. This is considered at the adjustment of the first installment for the columns that have Effective Rate as calculation method. |

| FirstDueDate | Optional. The due date of the first installment. |

| BlockInterestAmount | Optional. The value of the interest for the grace period if recalculation includes the grace period. |

| HolidayShift | Optional. The system takes into account not working days/ national holidays, according to the sent value. If true and Sunday or Saturday are defined as nonworking days, then the DueDate excepts these dates. |

| CalculateDAE | Optional. Specifies whether to show the effective annual interest rate: for 0 or null, the DAE is not displayed; for 1, only the DAE percent is displayed, and for 2, the original schedule containing a column wiht DAE percent is displayed. |

| installmentValue | Optional. If there is a locked value for installments, this value should be provided here (equal installments). |

| principalValue | Optional. If there is a locked value for principal, this value should be provided here (equal principal). |

| InstallmentMethod | Optional. The method for calculating the installment (Actual Month or Next Month). |

| MaturityDate | Optional. The date for the end of the contract. |

| InterestCapitalization | Optional. Specifies if the interest is capitalized for deposit calculation. |

| UpFrontValue | Optional. The amount for upfront commissions, taxes, insurances paid once at the beginning of the contract. |

| ResidualValue | Optional. The residual value amount for insurance business. |

| ResidualInInstallment | Optional. The method of display for the residual value: for 0, it is displayed in a new schedule line, for 1, it is displayed in the last schedule line. |

| Commission | Optional. An array [] of commissions with periodicity different than Once |

| SourceValue | Within the Commission object of the request. The value of the commission when the commission is a defined as value. Mandatory if the line is present, and mutually exclusive if the SourcePercent is present. |

| SourcePercent | Within the Commission object of the request. The percent of the commission when the commission is defined as a percentage. Mandatory if the line is present, and mutually exclusive if the SourceValue is present. |

| FeePeriodicityType | Within the Commission object of the request. The periodicity of the commission. Mandatory if the line is present. |

| GracePeriodFee | Optional, within the Commission object of the request. It can have its own grace period for a number of installments |

| BlockFeeAmount | Optional, within the Commission object of the request. The blocked amount is case of recalculation. |

| FeeDate | Within the Commission object of the request. The date of the fee being applied to the contract. Mandatory if the line is present. |

| FeeName | Within the Commission object of the request. The fee name from the FTOS_BP_Commission entity selected from the banking product level. Mandatory if the line is present. |

| IsUpfront | Optional, within the Commission object of the request. For commissions that are included into the payment schedule and the first commission value is paid at the activation date. Possible values: 0,1. The parameter is optional and if it is not included into the JSON request, the value comes from payment schedule detail column setting. |

| Insurance | Optional. An array [] of insurances with periodicity different than Once. |

| SourceValue | Within the Insurance object of the request. The value of the insurance when the insurance is defined as value. Mandatory if the line is present, and mutually exclusive if the SourcePercent is present. |

| SourcePercent | Within the Insurance object of the request. The percent of the insurance when the insurance is defined as a percentage. Mandatory if the line is present, and mutually exclusive if the SourceValue is present. |

| InsurancePeriodicityType | Within the Insurance object of the request. The periodicity of the insurance. Mandatory if the line is present. |

| GracePeriodInsurance | Optional, within the Insurance object of the request. It can have its own grace period for a number of installments. |

| BlockInsuranceAmount | Optional, within the Insurance object of the request. The blocked amount is case of recalculation. |

| InsuranceDate | Within the Insurance object of the request. The date of the insurance applied to the contract. Mandatory if the line is present. |

| InsuranceName | Within the Insurance object of the request. The insurance name from the FTOS_BP_Insurance entity selected from the banking product. Optional if InsuranceClassId is present. |

| InsuranceClassId | Within the Insurance object of the request. The insurance class from the FTOS_BP_ScheduleElementClass entity selected on the FTOS_BP_Insurance entity when defining the insurance. Optional if InsuranceId is present. |

| IsUpfront | Optional, within the Insurance object of the request. For insurances that are included into the payment schedule and the first commission value is paid at the activation date. Possible values: 0,1. The parameter is optional and if it is not included into the JSON request, the value comes from payment schedule detail column setting. |

| MultipleInterestRates | Optional. An array [] of interest rates. |

| InterestRate | Optional, within the MultipleInterestRates object of the request. The interest percent defined as interest type = Collection on the banking product Dimensions > Interest List > Interest level. |

| FromInstNo | Optional, within the MultipleInterestRates object of the request. The From installment number defined as interest type = Collection on the banking product Dimensions > Interest List > Interest level. |

| ToInstNo | Optional, within the MultipleInterestRates object of the request. The To installment number defined as interest type = Collection on the banking product Dimensions > Interest List > Interest level. |

| CapitalPercent | Optional. The percentage field defined at the banking product level (Credit Card) in the Details tab, representing a percentage to be applied as a formula to the schedule detail principal column. |

Response

The response is an array of json records representing the calculated installments of a repayment schedule.

Example

To view the calculated installments of a repayment schedule with multiple interest rates, no commissions, and no insurances ,send the following request, changing the parameters with your needed values.

Request

POST https://your_FintechOS_server/ftosapi/automation-processors/actions/FTOS_BP_CalculateRepaymentSchedule

Content-Type: application/json

{

"jsonParam": {

"ScheduleType": "Equal Installment Monthly 360",

"InterestPercent": null,

"Amount": 20000,

"InstallmentsNo": 24,

"AdvanceAmount": 0,

"GracePeriodInterest": null,

"GracePeriodPrincipal": 0,

"PeriodicityType": "Monthly",

"LastDueDate": "2021-12-17",

"BlockInstallmentNo": 0,

"BlockAmount": 0,

"ActivationDate": "2021-12-17",

"BlockInterestAmount": 0,

"HolidayShift": true,

"HolidayCountry": "Country:Thailand",

"CalculateDAE": 2,

"installmentValue": 862.49,

"principalValue": null,

"InstallmentDay": 24,

"InstallmentMethod": "ActualMonth",

"MaturityDate": "2023-12-24",

"FirstDueDate": "2021-12-24",

"InterestCapitalization": 0,

"UpFrontValue": 0,

"ResidualValue": 0,

"ResidualInInstallment": 0,

"Commission": [],

"Insurance": [],

"MultipleInterestRates": [

{

"InterestRate": 5,

"FromInstNo": 1,

"ToInstNo": 3

},

{

"InterestRate": 2,

"FromInstNo": 4,

"ToInstNo": 12

},

{

"InterestRate": 6,

"FromInstNo": 13,

"ToInstNo": 24

}

],

"CapitalPercent": 6

}

}Response

{

[

{

"InstallmentNo": 1,

"DueDate": "2021-12-24T00:00:00Z",

"NoDays": 7,

"InstallmentTypeId": "de9ebf4e-d541-4742-8979-55182a4ff3ef",

"remainingValue": 20000,

"pMT": 874.64,

"interest": 19.44,

"principal": 855.2,

"managementFee": 0,

"totalInstallment": 874.64,

"dae": 3.28040957,

"ScheduleTypeId": "62351c51-df4e-4bb7-ba62-683ae47a9a05",

"isEarlyRepayment": "false"

},

{

"InstallmentNo": 2,

"DueDate": "2022-01-24T00:00:00Z",

"NoDays": 30,

"InstallmentTypeId": "de9ebf4e-d541-4742-8979-55182a4ff3ef",

"remainingValue": 19144.8,

"pMT": 874.64,

"interest": 79.77,

"principal": 794.87,

"managementFee": 0,

"totalInstallment": 874.64,

"dae": 3.28040957,

"ScheduleTypeId": "62351c51-df4e-4bb7-ba62-683ae47a9a05",

"isEarlyRepayment": "false"

},

{

"InstallmentNo": 3,

"DueDate": "2022-02-24T00:00:00Z",

"NoDays": 30,

"InstallmentTypeId": "de9ebf4e-d541-4742-8979-55182a4ff3ef",

"remainingValue": 18349.93,

"pMT": 874.64,

"interest": 76.46,

"principal": 798.18,

"managementFee": 0,

"totalInstallment": 874.64,

"dae": 3.28040957,

"ScheduleTypeId": "62351c51-df4e-4bb7-ba62-683ae47a9a05",

"isEarlyRepayment": "false"

},

{

"InstallmentNo": 4,

"DueDate": "2022-03-24T00:00:00Z",

"NoDays": 30,

"InstallmentTypeId": "de9ebf4e-d541-4742-8979-55182a4ff3ef",

"remainingValue": 17551.75,

"pMT": 850.12,

"interest": 29.25,

"principal": 820.87,

"managementFee": 0,

"totalInstallment": 850.12,

"dae": 3.28040957,

"ScheduleTypeId": "62351c51-df4e-4bb7-ba62-683ae47a9a05",

"isEarlyRepayment": "false"

},

{

"InstallmentNo": 5,

"DueDate": "2022-04-25T00:00:00Z",

"NoDays": 30,

"InstallmentTypeId": "de9ebf4e-d541-4742-8979-55182a4ff3ef",

"remainingValue": 16730.88,

"pMT": 850.12,

"interest": 27.88,

"principal": 822.24,

"managementFee": 0,

"totalInstallment": 850.12,

"dae": 3.28040957,

"ScheduleTypeId": "62351c51-df4e-4bb7-ba62-683ae47a9a05",

"isEarlyRepayment": "false"

},

{

"InstallmentNo": 6,

"DueDate": "2022-05-24T00:00:00Z",

"NoDays": 30,

"InstallmentTypeId": "de9ebf4e-d541-4742-8979-55182a4ff3ef",

"remainingValue": 15908.64,

"pMT": 850.12,

"interest": 26.51,

"principal": 823.61,

"managementFee": 0,

"totalInstallment": 850.12,

"dae": 3.28040957,

"ScheduleTypeId": "62351c51-df4e-4bb7-ba62-683ae47a9a05",

"isEarlyRepayment": "false"

},

{

"InstallmentNo": 7,

"DueDate": "2022-06-24T00:00:00Z",

"NoDays": 30,

"InstallmentTypeId": "de9ebf4e-d541-4742-8979-55182a4ff3ef",

"remainingValue": 15085.03,

"pMT": 850.12,

"interest": 25.14,

"principal": 824.98,

"managementFee": 0,

"totalInstallment": 850.12,

"dae": 3.28040957,

"ScheduleTypeId": "62351c51-df4e-4bb7-ba62-683ae47a9a05",

"isEarlyRepayment": "false"

},

{

"InstallmentNo": 8,

"DueDate": "2022-07-25T00:00:00Z",

"NoDays": 30,

"InstallmentTypeId": "de9ebf4e-d541-4742-8979-55182a4ff3ef",

"remainingValue": 14260.05,

"pMT": 850.12,

"interest": 23.77,

"principal": 826.35,

"managementFee": 0,

"totalInstallment": 850.12,

"dae": 3.28040957,

"ScheduleTypeId": "62351c51-df4e-4bb7-ba62-683ae47a9a05",

"isEarlyRepayment": "false"

},

{

"InstallmentNo": 9,

"DueDate": "2022-08-24T00:00:00Z",

"NoDays": 30,

"InstallmentTypeId": "de9ebf4e-d541-4742-8979-55182a4ff3ef",

"remainingValue": 13433.7,

"pMT": 850.12,

"interest": 22.39,

"principal": 827.73,

"managementFee": 0,

"totalInstallment": 850.12,

"dae": 3.28040957,

"ScheduleTypeId": "62351c51-df4e-4bb7-ba62-683ae47a9a05",

"isEarlyRepayment": "false"

},

{

"InstallmentNo": 10,

"DueDate": "2022-09-26T00:00:00Z",

"NoDays": 30,

"InstallmentTypeId": "de9ebf4e-d541-4742-8979-55182a4ff3ef",

"remainingValue": 12605.97,

"pMT": 850.12,

"interest": 21.01,

"principal": 829.11,

"managementFee": 0,

"totalInstallment": 850.12,

"dae": 3.28040957,

"ScheduleTypeId": "62351c51-df4e-4bb7-ba62-683ae47a9a05",

"isEarlyRepayment": "false"

},

{

"InstallmentNo": 11,

"DueDate": "2022-10-24T00:00:00Z",

"NoDays": 30,

"InstallmentTypeId": "de9ebf4e-d541-4742-8979-55182a4ff3ef",

"remainingValue": 11776.86,

"pMT": 850.12,

"interest": 19.63,

"principal": 830.49,

"managementFee": 0,

"totalInstallment": 850.12,

"dae": 3.28040957,

"ScheduleTypeId": "62351c51-df4e-4bb7-ba62-683ae47a9a05",

"isEarlyRepayment": "false"

},

{

"InstallmentNo": 12,

"DueDate": "2022-11-24T00:00:00Z",

"NoDays": 30,

"InstallmentTypeId": "de9ebf4e-d541-4742-8979-55182a4ff3ef",

"remainingValue": 10946.37,

"pMT": 850.12,

"interest": 18.24,

"principal": 831.88,

"managementFee": 0,

"totalInstallment": 850.12,

"dae": 3.28040957,

"ScheduleTypeId": "62351c51-df4e-4bb7-ba62-683ae47a9a05",

"isEarlyRepayment": "false"

},

{

"InstallmentNo": 13,

"DueDate": "2022-12-26T00:00:00Z",

"NoDays": 30,

"InstallmentTypeId": "de9ebf4e-d541-4742-8979-55182a4ff3ef",

"remainingValue": 10114.49,

"pMT": 867.2,

"interest": 50.57,

"principal": 816.63,

"managementFee": 0,

"totalInstallment": 867.2,

"dae": 3.28040957,

"ScheduleTypeId": "62351c51-df4e-4bb7-ba62-683ae47a9a05",

"isEarlyRepayment": "false"

},

{

"InstallmentNo": 14,

"DueDate": "2023-01-24T00:00:00Z",

"NoDays": 30,

"InstallmentTypeId": "de9ebf4e-d541-4742-8979-55182a4ff3ef",

"remainingValue": 9297.86,

"pMT": 867.2,

"interest": 46.49,

"principal": 820.71,

"managementFee": 0,

"totalInstallment": 867.2,

"dae": 3.28040957,

"ScheduleTypeId": "62351c51-df4e-4bb7-ba62-683ae47a9a05",

"isEarlyRepayment": "false"

},

{

"InstallmentNo": 15,

"DueDate": "2023-02-24T00:00:00Z",

"NoDays": 30,

"InstallmentTypeId": "de9ebf4e-d541-4742-8979-55182a4ff3ef",

"remainingValue": 8477.15,

"pMT": 867.2,

"interest": 42.39,

"principal": 824.81,

"managementFee": 0,

"totalInstallment": 867.2,

"dae": 3.28040957,

"ScheduleTypeId": "62351c51-df4e-4bb7-ba62-683ae47a9a05",

"isEarlyRepayment": "false"

},

{

"InstallmentNo": 16,

"DueDate": "2023-03-24T00:00:00Z",

"NoDays": 30,

"InstallmentTypeId": "de9ebf4e-d541-4742-8979-55182a4ff3ef",

"remainingValue": 7652.34,

"pMT": 867.2,

"interest": 38.26,

"principal": 828.94,

"managementFee": 0,

"totalInstallment": 867.2,

"dae": 3.28040957,

"ScheduleTypeId": "62351c51-df4e-4bb7-ba62-683ae47a9a05",

"isEarlyRepayment": "false"

},

{

"InstallmentNo": 17,

"DueDate": "2023-04-24T00:00:00Z",

"NoDays": 30,

"InstallmentTypeId": "de9ebf4e-d541-4742-8979-55182a4ff3ef",

"remainingValue": 6823.4,

"pMT": 867.2,

"interest": 34.12,

"principal": 833.08,

"managementFee": 0,

"totalInstallment": 867.2,

"dae": 3.28040957,

"ScheduleTypeId": "62351c51-df4e-4bb7-ba62-683ae47a9a05",

"isEarlyRepayment": "false"

},

{

"InstallmentNo": 18,

"DueDate": "2023-05-24T00:00:00Z",

"NoDays": 30,

"InstallmentTypeId": "de9ebf4e-d541-4742-8979-55182a4ff3ef",

"remainingValue": 5990.32,

"pMT": 867.2,

"interest": 29.95,

"principal": 837.25,

"managementFee": 0,

"totalInstallment": 867.2,

"dae": 3.28040957,

"ScheduleTypeId": "62351c51-df4e-4bb7-ba62-683ae47a9a05",

"isEarlyRepayment": "false"

},

{

"InstallmentNo": 19,

"DueDate": "2023-06-26T00:00:00Z",

"NoDays": 30,

"InstallmentTypeId": "de9ebf4e-d541-4742-8979-55182a4ff3ef",

"remainingValue": 5153.07,

"pMT": 867.2,

"interest": 25.77,

"principal": 841.43,

"managementFee": 0,

"totalInstallment": 867.2,

"dae": 3.28040957,

"ScheduleTypeId": "62351c51-df4e-4bb7-ba62-683ae47a9a05",

"isEarlyRepayment": "false"

},

{

"InstallmentNo": 20,

"DueDate": "2023-07-24T00:00:00Z",

"NoDays": 30,

"InstallmentTypeId": "de9ebf4e-d541-4742-8979-55182a4ff3ef",

"remainingValue": 4311.64,

"pMT": 867.2,

"interest": 21.56,

"principal": 845.64,

"managementFee": 0,

"totalInstallment": 867.2,

"dae": 3.28040957,

"ScheduleTypeId": "62351c51-df4e-4bb7-ba62-683ae47a9a05",

"isEarlyRepayment": "false"

},

{

"InstallmentNo": 21,

"DueDate": "2023-08-24T00:00:00Z",

"NoDays": 30,

"InstallmentTypeId": "de9ebf4e-d541-4742-8979-55182a4ff3ef",

"remainingValue": 3466,

"pMT": 867.2,

"interest": 17.33,

"principal": 849.87,

"managementFee": 0,

"totalInstallment": 867.2,

"dae": 3.28040957,

"ScheduleTypeId": "62351c51-df4e-4bb7-ba62-683ae47a9a05",

"isEarlyRepayment": "false"

},

{

"InstallmentNo": 22,

"DueDate": "2023-09-25T00:00:00Z",

"NoDays": 30,

"InstallmentTypeId": "de9ebf4e-d541-4742-8979-55182a4ff3ef",

"remainingValue": 2616.13,

"pMT": 867.2,

"interest": 13.08,

"principal": 854.12,

"managementFee": 0,

"totalInstallment": 867.2,

"dae": 3.28040957,

"ScheduleTypeId": "62351c51-df4e-4bb7-ba62-683ae47a9a05",

"isEarlyRepayment": "false"

},

{

"InstallmentNo": 23,

"DueDate": "2023-10-24T00:00:00Z",

"NoDays": 30,

"InstallmentTypeId": "de9ebf4e-d541-4742-8979-55182a4ff3ef",

"remainingValue": 1762.01,

"pMT": 867.2,

"interest": 8.81,

"principal": 858.39,

"managementFee": 0,

"totalInstallment": 867.2,

"dae": 3.28040957,

"ScheduleTypeId": "62351c51-df4e-4bb7-ba62-683ae47a9a05",

"isEarlyRepayment": "false"

},

{

"InstallmentNo": 24,

"DueDate": "2023-11-24T00:00:00Z",

"NoDays": 30,

"InstallmentTypeId": "de9ebf4e-d541-4742-8979-55182a4ff3ef",

"remainingValue": 903.62,

"pMT": 867.2,

"interest": 4.52,

"principal": 862.68,

"managementFee": 0,

"totalInstallment": 867.2,

"dae": 3.28040957,

"ScheduleTypeId": "62351c51-df4e-4bb7-ba62-683ae47a9a05",

"isEarlyRepayment": "false"

}

]

}To view the calculated installments of a repayment schedule with fixed single interest rate, multiple commission, and single insurance, send the following request, changing the parameters with your needed values.

Request

POST https://your_FintechOS_server/ftosapi/automation-processors/actions/FTOS_BP_CalculateRepaymentSchedule

Content-Type: application/json

{

"jsonParam": {

"ScheduleType": "Equal Installment Monthly 360",

"ProductType": "TL",

"InterestPercent": 4,

"Amount": 20000,

"AdvanceAmount": 0,

"HolidayShift": false,

"HolidayCountry": "Country:Thailand",

"RealInstallmentNo": 26,

"InstallmentsNo": 24,

"GracePeriodInterest": 0,

"GracePeriodPrincipal": 0,

"PeriodicityType": "Monthly",

"LastDueDate": "2022-6-10",

"BlockInstallmentNo": 0,

"IsLocked": 1,

"BlockAmount": 0,

"BlockInterestAmount": 0,

"ActivationDate": "2022-6-10",

"InstallmentDay": 12,

"InstallmentMethod": "ActualMonth",

"StartDateForUnusage": "2022-7-10",

"ExpiryDateForOD": "1970-1-1",

"MaturityDate": "2024-5-12",

"InterestCapitalization": 0,

"UpFrontValue": 840,

"Commission": [

{

"SourceValue": 0,

"SourcePercent": 10,

"FeePeriodicityType": "Monthly",

"FeeDate": "2022-6-10",

"FeeId": "d9df08b6-0291-46e9-a333-e0fc971ac49a"

},

{

"SourceValue": 4,

"FeePeriodicityType": "Monthly",

"FeeDate": "2022-6-10",

"FeeId": "76a2dc25-2e30-4f14-a4cf-1e91e35b0669"

},

{

"SourceValue": 10,

"FeePeriodicityType": "Monthly",

"FeeDate": "2022-6-10",

"FeeId": "09e86821-b6be-41ac-ae89-2a89ffb91aad"

}

],

"DeferDueDate": 1,

"FirstDueDate": "2022-6-12",

"ContractPeriod": 23,

"HolidayMethod": "Forward",

"MultipleInterestRates": [],

"BandedInterestRates": [],

"UnusedAmount": 0

}

}Response

[

{

"InstallmentNo": 1.0,

"DueDate": "2022-06-12T00:00:00",

"NoDays": 2.0,

"InstallmentTypeId": "de9ebf4e-d541-4742-8979-55182a4ff3ef",

"RemainingValue": 20000.0,

"PMT": 865.81,

"Interest": 4.44,

"Principal": 861.37,

"ManagementFee": 10.0,

"TotalInstallment": 875.81,

"EIR": 0.0,

"ScheduleTypeId": "62351c51-df4e-4bb7-ba62-683ae47a9a05",

"IsEarlyRepayment": "false"

},

{

"InstallmentNo": 2.0,

"DueDate": "2022-07-12T00:00:00",

"NoDays": 30.0,

"InstallmentTypeId": "de9ebf4e-d541-4742-8979-55182a4ff3ef",

"RemainingValue": 19138.63,

"PMT": 865.81,

"Interest": 63.8,

"Principal": 802.01,

"ManagementFee": 10.0,

"TotalInstallment": 875.81,

"EIR": 0.0,

"ScheduleTypeId": "62351c51-df4e-4bb7-ba62-683ae47a9a05",

"IsEarlyRepayment": "false"

},

{

"InstallmentNo": 3.0,

"DueDate": "2022-08-12T00:00:00",

"NoDays": 30.0,

"InstallmentTypeId": "de9ebf4e-d541-4742-8979-55182a4ff3ef",

"RemainingValue": 18336.62,

"PMT": 865.81,

"Interest": 61.12,

"Principal": 804.69,

"ManagementFee": 10.0,

"TotalInstallment": 875.81,

"EIR": 0.0,

"ScheduleTypeId": "62351c51-df4e-4bb7-ba62-683ae47a9a05",

"IsEarlyRepayment": "false"

},

{

"InstallmentNo": 4.0,

"DueDate": "2022-09-12T00:00:00",

"NoDays": 30.0,

"InstallmentTypeId": "de9ebf4e-d541-4742-8979-55182a4ff3ef",

"RemainingValue": 17531.93,

"PMT": 865.81,

"Interest": 58.44,

"Principal": 807.37,

"ManagementFee": 10.0,

"TotalInstallment": 875.81,

"EIR": 0.0,

"ScheduleTypeId": "62351c51-df4e-4bb7-ba62-683ae47a9a05",

"IsEarlyRepayment": "false"

},

{

"InstallmentNo": 5.0,

"DueDate": "2022-10-12T00:00:00",

"NoDays": 30.0,

"InstallmentTypeId": "de9ebf4e-d541-4742-8979-55182a4ff3ef",

"RemainingValue": 16724.56,

"PMT": 865.81,

"Interest": 55.75,

"Principal": 810.06,

"ManagementFee": 10.0,

"TotalInstallment": 875.81,

"EIR": 0.0,

"ScheduleTypeId": "62351c51-df4e-4bb7-ba62-683ae47a9a05",

"IsEarlyRepayment": "false"

},

{

"InstallmentNo": 6.0,

"DueDate": "2022-11-12T00:00:00",

"NoDays": 30.0,

"InstallmentTypeId": "de9ebf4e-d541-4742-8979-55182a4ff3ef",

"RemainingValue": 15914.5,

"PMT": 865.81,

"Interest": 53.05,

"Principal": 812.76,

"ManagementFee": 10.0,

"TotalInstallment": 875.81,

"EIR": 0.0,

"ScheduleTypeId": "62351c51-df4e-4bb7-ba62-683ae47a9a05",

"IsEarlyRepayment": "false"

},

{

"InstallmentNo": 7.0,

"DueDate": "2022-12-12T00:00:00",

"NoDays": 30.0,

"InstallmentTypeId": "de9ebf4e-d541-4742-8979-55182a4ff3ef",

"RemainingValue": 15101.74,

"PMT": 865.81,

"Interest": 50.34,

"Principal": 815.47,

"ManagementFee": 10.0,

"TotalInstallment": 875.81,

"EIR": 0.0,

"ScheduleTypeId": "62351c51-df4e-4bb7-ba62-683ae47a9a05",

"IsEarlyRepayment": "false"

},

{

"InstallmentNo": 8.0,

"DueDate": "2023-01-12T00:00:00",

"NoDays": 30.0,

"InstallmentTypeId": "de9ebf4e-d541-4742-8979-55182a4ff3ef",

"RemainingValue": 14286.27,

"PMT": 865.81,

"Interest": 47.62,

"Principal": 818.19,

"ManagementFee": 10.0,

"TotalInstallment": 875.81,

"EIR": 0.0,

"ScheduleTypeId": "62351c51-df4e-4bb7-ba62-683ae47a9a05",

"IsEarlyRepayment": "false"

},

{

"InstallmentNo": 9.0,

"DueDate": "2023-02-12T00:00:00",

"NoDays": 30.0,

"InstallmentTypeId": "de9ebf4e-d541-4742-8979-55182a4ff3ef",

"RemainingValue": 13468.08,

"PMT": 865.81,

"Interest": 44.89,

"Principal": 820.92,

"ManagementFee": 10.0,

"TotalInstallment": 875.81,

"EIR": 0.0,

"ScheduleTypeId": "62351c51-df4e-4bb7-ba62-683ae47a9a05",

"IsEarlyRepayment": "false"

},

{

"InstallmentNo": 10.0,

"DueDate": "2023-03-12T00:00:00",

"NoDays": 30.0,

"InstallmentTypeId": "de9ebf4e-d541-4742-8979-55182a4ff3ef",

"RemainingValue": 12647.16,

"PMT": 865.81,

"Interest": 42.16,

"Principal": 823.65,

"ManagementFee": 10.0,

"TotalInstallment": 875.81,

"EIR": 0.0,

"ScheduleTypeId": "62351c51-df4e-4bb7-ba62-683ae47a9a05",

"IsEarlyRepayment": "false"

},

{

"InstallmentNo": 11.0,

"DueDate": "2023-04-12T00:00:00",

"NoDays": 30.0,

"InstallmentTypeId": "de9ebf4e-d541-4742-8979-55182a4ff3ef",

"RemainingValue": 11823.51,

"PMT": 865.81,

"Interest": 39.41,

"Principal": 826.4,

"ManagementFee": 10.0,

"TotalInstallment": 875.81,

"EIR": 0.0,

"ScheduleTypeId": "62351c51-df4e-4bb7-ba62-683ae47a9a05",

"IsEarlyRepayment": "false"

},

{

"InstallmentNo": 12.0,

"DueDate": "2023-05-12T00:00:00",

"NoDays": 30.0,

"InstallmentTypeId": "de9ebf4e-d541-4742-8979-55182a4ff3ef",

"RemainingValue": 10997.11,

"PMT": 865.81,

"Interest": 36.66,

"Principal": 829.15,

"ManagementFee": 10.0,

"TotalInstallment": 875.81,

"EIR": 0.0,

"ScheduleTypeId": "62351c51-df4e-4bb7-ba62-683ae47a9a05",

"IsEarlyRepayment": "false"

},

{

"InstallmentNo": 13.0,

"DueDate": "2023-06-12T00:00:00",

"NoDays": 30.0,

"InstallmentTypeId": "de9ebf4e-d541-4742-8979-55182a4ff3ef",

"RemainingValue": 10167.96,

"PMT": 865.81,

"Interest": 33.89,

"Principal": 831.92,

"ManagementFee": 10.0,

"TotalInstallment": 875.81,

"EIR": 0.0,

"ScheduleTypeId": "62351c51-df4e-4bb7-ba62-683ae47a9a05",

"IsEarlyRepayment": "false"

},

{

"InstallmentNo": 14.0,

"DueDate": "2023-07-12T00:00:00",

"NoDays": 30.0,

"InstallmentTypeId": "de9ebf4e-d541-4742-8979-55182a4ff3ef",

"RemainingValue": 9336.04,

"PMT": 865.81,

"Interest": 31.12,

"Principal": 834.69,

"ManagementFee": 10.0,

"TotalInstallment": 875.81,

"EIR": 0.0,

"ScheduleTypeId": "62351c51-df4e-4bb7-ba62-683ae47a9a05",

"IsEarlyRepayment": "false"

},

{

"InstallmentNo": 15.0,

"DueDate": "2023-08-12T00:00:00",

"NoDays": 30.0,

"InstallmentTypeId": "de9ebf4e-d541-4742-8979-55182a4ff3ef",

"RemainingValue": 8501.35,

"PMT": 865.81,

"Interest": 28.34,

"Principal": 837.47,

"ManagementFee": 10.0,

"TotalInstallment": 875.81,

"EIR": 0.0,

"ScheduleTypeId": "62351c51-df4e-4bb7-ba62-683ae47a9a05",

"IsEarlyRepayment": "false"

},

{

"InstallmentNo": 16.0,

"DueDate": "2023-09-12T00:00:00",

"NoDays": 30.0,

"InstallmentTypeId": "de9ebf4e-d541-4742-8979-55182a4ff3ef",

"RemainingValue": 7663.88,

"PMT": 865.81,

"Interest": 25.55,

"Principal": 840.26,

"ManagementFee": 10.0,

"TotalInstallment": 875.81,

"EIR": 0.0,

"ScheduleTypeId": "62351c51-df4e-4bb7-ba62-683ae47a9a05",

"IsEarlyRepayment": "false"

},

{

"InstallmentNo": 17.0,

"DueDate": "2023-10-12T00:00:00",

"NoDays": 30.0,

"InstallmentTypeId": "de9ebf4e-d541-4742-8979-55182a4ff3ef",

"RemainingValue": 6823.62,

"PMT": 865.81,

"Interest": 22.75,

"Principal": 843.06,

"ManagementFee": 10.0,

"TotalInstallment": 875.81,

"EIR": 0.0,

"ScheduleTypeId": "62351c51-df4e-4bb7-ba62-683ae47a9a05",

"IsEarlyRepayment": "false"

},

{

"InstallmentNo": 18.0,

"DueDate": "2023-11-12T00:00:00",

"NoDays": 30.0,

"InstallmentTypeId": "de9ebf4e-d541-4742-8979-55182a4ff3ef",

"RemainingValue": 5980.56,

"PMT": 865.81,

"Interest": 19.94,

"Principal": 845.87,

"ManagementFee": 10.0,

"TotalInstallment": 875.81,

"EIR": 0.0,

"ScheduleTypeId": "62351c51-df4e-4bb7-ba62-683ae47a9a05",

"IsEarlyRepayment": "false"

},

{

"InstallmentNo": 19.0,

"DueDate": "2023-12-12T00:00:00",

"NoDays": 30.0,

"InstallmentTypeId": "de9ebf4e-d541-4742-8979-55182a4ff3ef",

"RemainingValue": 5134.69,

"PMT": 865.81,

"Interest": 17.12,

"Principal": 848.69,

"ManagementFee": 10.0,

"TotalInstallment": 875.81,

"EIR": 0.0,

"ScheduleTypeId": "62351c51-df4e-4bb7-ba62-683ae47a9a05",

"IsEarlyRepayment": "false"

},

{

"InstallmentNo": 20.0,

"DueDate": "2024-01-12T00:00:00",

"NoDays": 30.0,

"InstallmentTypeId": "de9ebf4e-d541-4742-8979-55182a4ff3ef",

"RemainingValue": 4286.0,

"PMT": 865.81,

"Interest": 14.29,

"Principal": 851.52,

"ManagementFee": 10.0,

"TotalInstallment": 875.81,

"EIR": 0.0,

"ScheduleTypeId": "62351c51-df4e-4bb7-ba62-683ae47a9a05",

"IsEarlyRepayment": "false"

},

{

"InstallmentNo": 21.0,

"DueDate": "2024-02-12T00:00:00",

"NoDays": 30.0,

"InstallmentTypeId": "de9ebf4e-d541-4742-8979-55182a4ff3ef",

"RemainingValue": 3434.48,

"PMT": 865.81,

"Interest": 11.45,

"Principal": 854.36,

"ManagementFee": 10.0,

"TotalInstallment": 875.81,

"EIR": 0.0,

"ScheduleTypeId": "62351c51-df4e-4bb7-ba62-683ae47a9a05",

"IsEarlyRepayment": "false"

},

{

"InstallmentNo": 22.0,

"DueDate": "2024-03-12T00:00:00",

"NoDays": 30.0,

"InstallmentTypeId": "de9ebf4e-d541-4742-8979-55182a4ff3ef",

"RemainingValue": 2580.12,

"PMT": 865.81,

"Interest": 8.6,

"Principal": 857.21,

"ManagementFee": 10.0,

"TotalInstallment": 875.81,

"EIR": 0.0,

"ScheduleTypeId": "62351c51-df4e-4bb7-ba62-683ae47a9a05",

"IsEarlyRepayment": "false"

},

{

"InstallmentNo": 23.0,

"DueDate": "2024-04-12T00:00:00",

"NoDays": 30.0,

"InstallmentTypeId": "de9ebf4e-d541-4742-8979-55182a4ff3ef",

"RemainingValue": 1722.91,

"PMT": 865.81,

"Interest": 5.74,

"Principal": 860.07,

"ManagementFee": 10.0,

"TotalInstallment": 875.81,

"EIR": 0.0,

"ScheduleTypeId": "62351c51-df4e-4bb7-ba62-683ae47a9a05",

"IsEarlyRepayment": "false"

},

{

"InstallmentNo": 24.0,

"DueDate": "2024-05-12T00:00:00",

"NoDays": 30.0,

"InstallmentTypeId": "de9ebf4e-d541-4742-8979-55182a4ff3ef",

"RemainingValue": 862.84,

"PMT": 865.81,

"Interest": 2.88,

"Principal": 862.84,

"ManagementFee": 10.0,

"TotalInstallment": 875.72,

"EIR": 0.0,

"ScheduleTypeId": "62351c51-df4e-4bb7-ba62-683ae47a9a05",

"IsEarlyRepayment": "false"

}

]