Payment Schedule Types

A payment schedule represents the complete table of periodic loan payments, showing the amount of principal and interest that comprise each level payment until the loan is paid off at the end of its term.

The payment schedules are a quintessential part of a loan. You can create them using the Banking Schedule Types. Below you can see how to configure the installments, dates and calculations.

In Banking Product Factory, payment schedules come with a business workflow attached in order to block changes to schedule types that are actively used on banking products. Read more about Business Workflows. The following statuses are available:

-

Draft - first, default, every field is editable;

-

Active - manually selected, fields are no longer editable. The Duplicate button is visible. By pressing this button the current schedule type gets duplicated in a draft new schedule type that can be further edited. Only active schedule types can be added to a banking product;

-

Draft - not manually selected. It is available when a New Version button is visible;

-

Closed - manually selected.

When transitioning a schedule type from Draft to Active, the following server-side validations are being performed:

-

The

Interestcolumn needs to be calculated after the calculation of theRemainingValuecolumn. Please change the order in the grid. -

The column

{0-ex.TotalInstallment}with formula {1-ex.Principal+Interest} has column{2-ex.Principal}calculated after formula. Change the order in the grid.

A set of out-of-the-box schedule type templates are available with the Active status in Innovation Studio. The templates contain only the mandatory fields, no commissions or interests are defined.

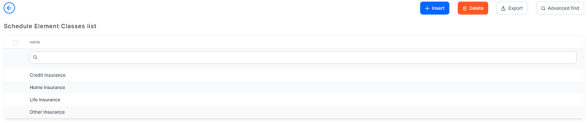

- In the main menu, click Product Factory > Schedule Element Class, and the Schedule Element Classes list page opens.

- Click the Insert button to add a new class.

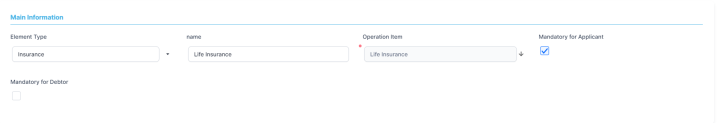

- In the newly opened Add Scheduled Element Class, select an Element Type: Insurance or Commission.

- Add a name for the element class.

- Select an Operation Item.

- Click the Save and close button. Repeat as many times as needed.

In Innovation Studio, payment schedule types come with a business workflow attached in order to block changes to schedule types that are actively used on banking products. Read more about Business Workflows.

Follow the steps below to create a new payment schedule type:

-

In the main menu, click Product Factory > Payment Schedule Types, and the Payment Schedule Types List page opens, showing all the already created schedule types.

-

Click the Insert button to add a new type.

-

In the newly opened Add Payment Schedule Type page, fill in the following fields:

-

Name: Insert a suggestive name for the type.

-

Payment schedule code: Insert a code for the type to keep track of them.

-

Banking Product Type: Select a product type to associate with the payment schedule type. Depending on the Product Type, different calculation rules are triggered. For example, the product type

Overdrafthas only the payment at maturity. -

Interest Calculation Type: Select from the list a type of calculation for the interest.

When an annual interest rate is specified, in order to calculate the Installment for an interval of days, first the annual interest rate should be transformed into a daily base. To make this transformation, there are some accepted conventions. Innovation Studio implemented the following conventions: 30/360, 30/365, Actual/ Actual, where Actual for years can be either 365 or 366. Other schedule interest calculation types can also be defined, as needed. In practice may be also encountered the Actual/ 360 or Actual/ 365. Here are some of the implemented schedule interest calculation types:-

Equal Installment Monthly 30/360 - this generates a payment schedule of equal installments where every period is a month of 30 days, and every year has 360 days;

-

Equal Installment Monthly 30/365 - this generates a payment schedule of equal installments where every period is a month of 30 days, and every year has 365 days;

-

Equal Installment Monthly 30/366 (30/Actual) - this generates a payment schedule of equal installments where every period is a month of 30 days, and every year has 366 days;

-

Equal Installment Monthly Actual/365 - this generates a payment schedule of equal installments where every period is a month with actual days (28,29, 30, or 31 days), and every year has 365 days;

-

Equal Installment Monthly Actual/366 (Actual/Actual) - this generates a payment schedule of equal installments where every period is a month with actual days (28,29, 30, or 31 days), and every year has 366 days;

-

Equal Principal Monthly 30/360 - this generates a payment schedule of equal principal where every period is a month of 30 days, and every year has 360 days;

-

Equal Principal Monthly 30/365 - this generates a payment schedule of equal principal where every period is a month of 30 days, and every year has 365 days;

-

Equal Principal Monthly 30/366 (30/Actual) - this generates a payment schedule of equal principal where every period is a month of 30 days, and every year has 366 days;

-

Equal Principal Monthly Actual/365 - this generates a payment schedule of equal principal where every period is a month with actual days (28,29, 30, or 31 days), and every year has 365 days;

-

Equal Principal Monthly Actual/366 (Actual/Actual) - this generates a payment schedule of equal principal where every period is a month with actual days (28,29, 30, or 31 days), and every year has 366 days.

NOTE

The payment schedule projection takes into consideration both the payment schedule type defined at the banking product level, and whether to collect the interest accrued on the contract until the date of an early repayment event, thus repaying the accrued interest, or not, thus adding the accrued interest to the repayment amount. Set theCollect accrued interestfield in the Event page at the contract level toFalseto add the accrued interest to the repayment amount. -

-

Measurement Unit: Select from the list the type of measurement unit applicable for the payment schedule type: Days, Weeks, Months, Years, Once. The default value: Months.

-

Is With Equal Installments: Select the checkbox if the installments are equal, so the annuity (also known as PMT) value calculation is needed, and the Principal is calculated with formula

Annuity minus Interest. If there are Commissions that appear on the Payment Schedule, these Commissions are not included in annuity calculation. -

Installment Value Custom: If you select the checkbox, with multiple disbursements, the Principal component of the installments is the one calculated for the entire Financed Amount, even if it was not entirely disbursed.

For example, if Financed Amount is 10.000 EURO and the value calculated for Principal component of the Installments is 800 EURO, and the customer disburses only 5.000 EURO, the Principal component remains 800, but the Interest is calculated for 5.000 EURO that were disbursed.

IfInstallment Value Custom = False, then theIs Manual ValueandRoyalty/ Initial Principal Valuefields at the contract level are read only.

IfInstallment Value Custom = True, then theIs Manual Valuefield at the contract level is editable, withFalsedefault value. -

Use Fix Maturity Date (from Activation Date): If you select the checkbox, then the Maturity Date equals to Activation Date plus the Contractual Period in Months, i.e. the number of installments depends on the Activation Date.

If the checkbox remains unselected, the number of installments are fixed, the Maturity Date is equal to the First Installment plus the Contractual Period in Months, e.g. Installment date is on the first day of the month, this results in the Maturity day to be the first day of the month.

NOTE

This is only valid forPeriod Type = Months.

-

-

Click the Save and reload button.

-

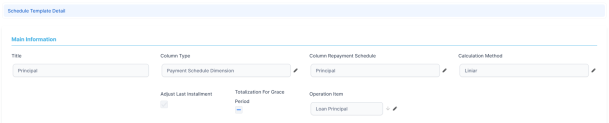

In the newly displayed Payment Schedule Type Details section, fill in the fields below. Note that the fields change according to the selection of Column Type and Calculation Method.

-

Title: Insert a suitable title for the detail.

-

Column type: Select one of the following types: Payment Schedule Dimension, Fee Dimension or Insurance Dimension. Note that the selected type triggers changes in the displayed fields.

-

Column Repayment Schedule: Select one of the columns that is assigned in the Payment Schedule.

-

Calculation Method: Select a method. It triggers changes in the fields. There are the predefined values that are taken into consideration when calculating the Interest:

-

Linear: calculated as Amount / Number of Installments.

-

Effective Rate: percent applied to the Source field (see below), usually to the Remaining Value.

-

Fixed Value: a constant value that is completed in the Payment Schedule.

-

Column Formula: formulas having other columns as parameters. Formula used is specified in the field Formula that is displayed when this option is set.

-

Remaining Formula: specific to a column of Remaining.

-

Once: the value is paid once.

-

Once: the value is paid once.

-

LinearOnYear: a value calculated based on the Remaining Value at the beginning of the credit year and a given percentage, divided in installments with the specified periodicity.

-

FeeOnce: takes into account a fee that is paid once.

-

ProductLevelFixedValue: method that calculates the capital percent defined for cards and credit cards type of products.

-

-

Operation Item: It is the item allocated to a column in the Payment Schedule on which the amount calculated at this step is allocated. Select an item from the list.

-

Fee: Select a fee configured in the Product Dimensions.

-

Fee Type: Select a fee type configured in the Product Dimensions. This is helpful when, for different banking products, there are different values applicable for the same type of fee.

-

Source: It is the source element from the JSON file returned by the Payment Schedule calculation from where to take the value.

-

Insurance type: Select an insurance type.

-

Is Calculated In Advance?: Select the checkbox if the calculation is done in advance.

-

Is calculated Upfront: Option available for Insurance Dimension and Fee Dimension. Select the checkbox for insurance or commissions that need to be paid at the activation of the lending contract.

NOTE

This is only valid for products with Period Type = Months. -

Totalization For Grace Period: This checkbox is available when the Calculation method is set to Effective Rate or Fixed Value. If you select it, then the values that are not applied during Grace period are added to the first non-grace installment.

-

Adjust Last Installment: This checkbox should be checked most of the time, as rounding loses of precision can exist, and the sum of Principal paid monthly should be the same as the Financed Amount.

-

Operation Item: Select the operation item from the list for which this schedule type details should apply.

-

Formula: This checkbox is available when the Calculation method is set to Column Formula or Remaining Formula or Once or LiniarOnYear. The formula can use other Schedule Details Names. For example, for a total installment calculated as Principal+Interest+ManagementFee that were added to Payment Schedule Type Details earlier.

-

-

If you selected Fee Dimension, then fill in the following fields: Fee, Fee Type or Source.

-

If you selected Insurance Dimension, then fill in the following fields: Insurance class or Source.

-

Click the Save and close button. Repeat to add more details.

The first installment can be adjusted in situations when the algorithm forces an equal installment, by adjusting the Principal paid in the first interval.

For a Payment Schedule with equal installments, the first installment interest is calculated for the number of days between Activation Date and First Installment Date.

Normally, for this first installment, the number of days can be lower or higher than the normal interval, so the Interest calculated makes the first installment to be different than the others.

The following picture illustrates the payment schedule type and the details defined for Credit Card Installments calculation:

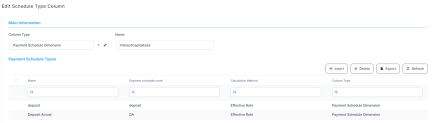

To configure the calculation steps, use the Payment Schedule Type Column menu. The order of the steps is determined by the Calculation column.

- In the main menu, click Product Factory > Payment Schedule Type Columns, and the Schedule Type Column List page opens, showing all the already created schedule type columns.

- Click the Insert button to add a new column type.

- In the newly opened Add Schedule Type Column page, select a Column Type from the list: Payment Schedule Dimension, Fee Dimension or Insurance Dimension.

- Enter a Name for the column.

- Click the Save and reload button.

- The Payment Schedule Types section is displayed after saving, showing all the payment schedule types using this column, with the following information:

Name: The name of the Payment Schedule element.

Column Type: The column type: Payment Schedule Dimension, Fee Dimension or Insurance Dimension.

Payment Schedule Code: The code of the payment schedule.

Calculation: The calculation method.

Operation Item: Select an operation item for this schedule type.