Overview

The Banking Product Factory allows you to create and maintain banking products. A banking product can further be used in FintechOS digital journeys for processes such as loan origination or a hybrid journey for applying for more products. The banking products are configured from a graphical user interface while Banking Product Factory automatically populates and maintains the underlying data in a consistent data model. Consequently, you have a reliable data model for your product portfolio that you can reference when building digital journeys. Thus you can manage your product portfolio at will, without having to re-code your digital journeys every time a banking product is added, updated, or retired.

For instance, you can use Banking Product Factory to create a loan type with a specific amount interval, availability period, interest rate, commission, credit scoring criteria, etc. You can then use this type of loan as one of the options that are available to the applicant in a loan application digital journey. As your product portfolio evolves and you add new types of loans, modify some of the conditions for your products, or retire products, the options that show up (or no longer show up) in the loan application digital journey change automatically.

Banking Products Features

Banking Product Factory allows you to customize the product features. Here are some of the customizable features:

- Adjustable interest rates and commissions depending on commercial conditions or participation in campaigns;

- Full versioning functionality;

- Clone a banking product to create a new product based on an existing one;

- Product classification;

- Payment schedules;

- Guarantees;

- Availability periods;

- Scoring rules.

Integration with Formula Engine

Banking Product Factory leverages the capabilities of the Formula Engine to implement complex decision modeling for product availability, risk scoring, or insurance rules.

Applications

The Banking Product Factory can facilitate business processes, such as:

- Digital onboarding;

- Loan origination;

- Product portfolio management;

- Approval flows.

Configurations

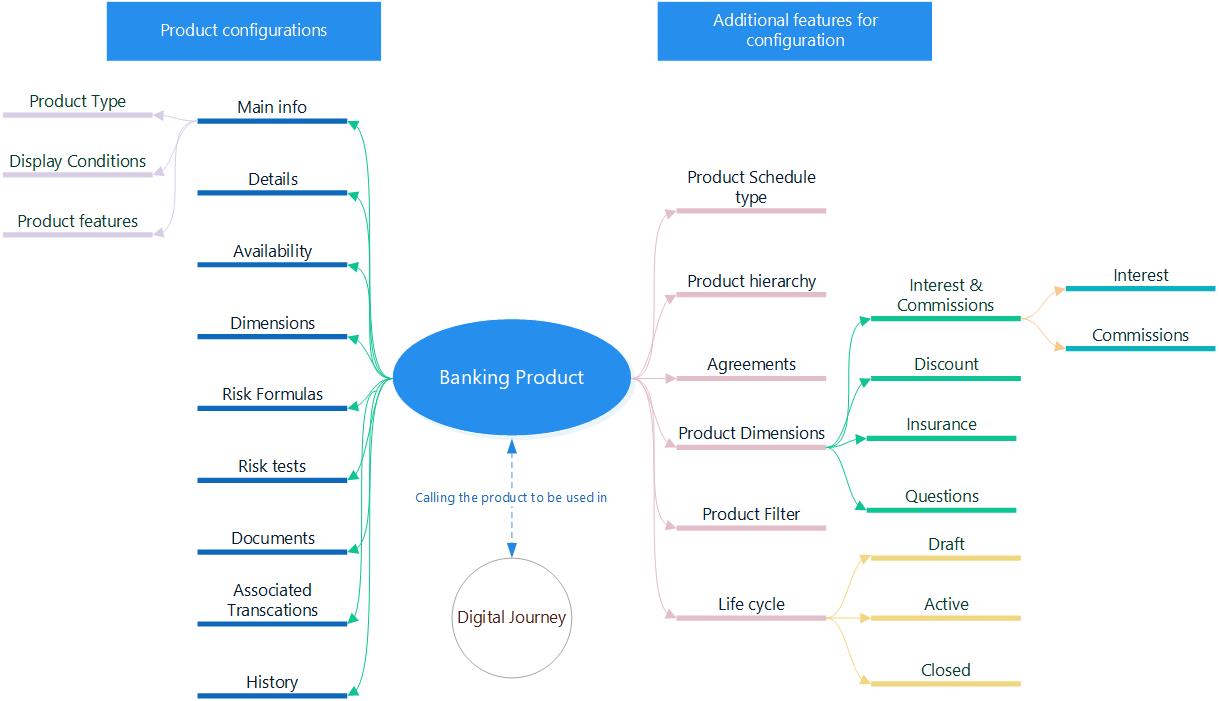

The diagram below exhibits the extensive configurations applicable when creating a complete and esthetically pleasing banking product. The documentation explains the ramifications drawn below. You can start by establishing the product configurations for an individual product or by setting up the additional features and attaching them to a product.